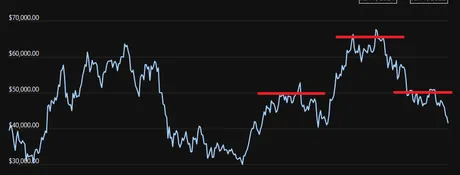

Bitcoin at extreme make or break levels.

- And if I'm being honest, there will be no bounce.

- Getting extreme bull-trap vibes.

- Market is floating on air.

- Only thing keeping it up is decent volume.

- But that volume seems to dwindle by the hour.

- We are already trading below the critical level.

I'll say it again:

Best to give this market another week before making any bullish moves. I've done a good job of hedging in both directions during this time of extreme uncertainty.

It is nice to see that the fear/greed index in our favor.

People are afraid, so they are less likely to be caught off guard by a dip. However, they could be caught by surprise by a pump that FOMOs them into leveraging long. A bull trap like that could easily get liquidated. I maintain that we are very temporarily bearish for the next week unless we start trading above $45k again. In that case I was wrong and buying this dip would have been a good idea. I'm hedged either way.

The macro head-and-shoulders pattern still fully in play, but it's unclear if it will bounce off the $40k line, the $35k line, or the $30k line. My guess is the $35k-$38k range has massive support. We paid our dues and are still in a bullish trend into the summertime. Obviously bouncing from here would be even more bullish.

Regardless, I still think there's going to be a boring crab-walk at the bottom as we often see. There's no reason to FOMO into this market or leverage long until we've become bored. Trying to catch the falling knife is too risky at this point in time. Again, I think we only need to wait a week for the full moon to perhaps flip this sentiment a tad.

Hopefully January 17th is strong.

If the bullish moon cycle happens to be the crab-walk sideways, I will heavily bet on the market crashing to $35k or below. Unfortunately I've lost access to Binance margin trading, which is annoying. Mandala doesn't have margin yet, and may never have it because they are trying to fly under the regulatory radar. QQ.

HIVE!

Hive did exactly what I said it was going to do (for once). We see a crash and bounce off the 100 day moving average. As long as we trade above this level it's impossible to experience a death-cross, which would be great, but personally unexpected. We've been trading in a golden-cross mega bull run since August. The death-cross is coming sooner or later, and it's going to hit hard. At best I think the $1 unit-bias level holds, and at worse 80 cents is still the ultimate floor to buy back in.

Hive is becoming much easier to predict for some reason, so I'll continue doing analysis on it. If we don't death-cross within the next month or two, we are in some kind of crazy super-cycle, and it's unclear just how high we can go. I think the next obvious target is the $4-$8 range. This is the critical level that this community remembers quite well. How many whales held in 2017 only to get absolutely wrecked in 2018? Many will take gains here, guaranteed. Time will tell.

My LEO and CUB hedges are doing amazing, as predicted.

I also bought a tiny bit of RUNE and MATIC, which obviously got wrecked like everything else (oops!). Luckily most of it went into LEO and CUB, which are great because everyone is chasing those airdrops and other fundamental developments like the bridge, RUNE listing, project blank, new liquidity pools, new defi protocols, and whatever else (so much to keep up with). This will continue to be a good hedge until these products launch.

Hopefully LEO gets a nice spike to all time highs and I can trade it back 1:1 for Hive after trading Hive into LEO at 10:1 in my favor. Wouldn't that be wild? #dreambig!

Conclusion

Again, it just feels like this market is dead in the water. The Federal Reserve is in control. If they continue tightening (and more importantly claim further tightening) and the stock market crashes another 5%, there's nothing Bitcoin can do but bleed.

That being said, I'm pretty impressed that BTC only crashed 6.5% in the face of the stock market's 4.5%. That's a pretty good ratio for such an incredibly risk-on asset like Bitcoin. As we all know, Bitcoin traders can outlast stock market traders any day of the week. These losses in the stock market hit legacy finance ten times harder than they do Bitcoin. We are just grizzled and used to it by now: they are not.

Stay hedged!

Don't make any sudden moves until you get bored. This falling knife doesn't need catching. No bounce here: boring crabwalk incoming.

Posted Using LeoFinance Beta

Return from Imminent dead-cat-bounce indicator: to edicted's Web3 Blog