So many things to discuss...

I guess it's best to start at the beginning, and that's Bitcoin.

So recently everyone has been making a fuss over Blackrock CEO Larry Fink wanting to "democratize" Bitcoin and bring about mainstream adoption. Obviously this is a hilarious choice of words considering the meaning of "democratic". Oh yes very cool we should centralize more power into the hands of a known corrupt institution for more inclusion and fairness. lol. Nice one. But of course in situations like these when people talk the thing coming out of their mouth normally has the exact opposite meaning, so this is all par for the course.

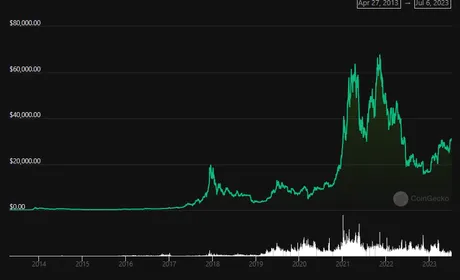

It's worth mentioning that now that Larry is publicly praising Bitcoin that perhaps the first wave of institutional buying is already over? The price action would certainly seem to suggest such a thing, as it was only this morning that everyone was celebrating a local high of $31500 only for it to dump hours later back to $30k almost in response to the hype.

Another reason why this choice of language is so noteworthy is that it's technically not wrong. It's a very impressive half-truth riddled with problematic implications. Yes, Blackrock jumping into Bitcoin head first would certainly expand the liquidity pool to reservoirs that previously did not have access to it. It would be made accessible to more people... but which types of people would it be made accessible to? Obviously the ones who already have money and banking access making the entire endeavor a bit of a greed-play. I mean Blackrock is a hedge fund so none of this should be surprising to anyone. Like all incorporated entities they're in the business of making money. This is very standard stuff. The only difference being that they wield a lot more power than the average incorporated entity.

You know I really hate peppering in information like this that's guaranteed to expire over time but I guess I just can't help myself. Every time I zoom out and look at the Bitcoin chart and think about people thinking to themselves "I don't know it still looks pretty bearish"... lol I just can't get over it. Such tunnel vision. Again BTC could hit $100k at the end of the year, be at all time highs, and I still wouldn't even call that a bull market... I'd just call it the inevitable return to the doubling trendline. Nothing to see here.

FEDnow?

Also crypto people are still talking about the whole FEDnow situation and "how it's basically just a CBDC" which again is comical. All these well respected crypto influencers are like "here's how FEDnow is like a CBDC" but then all they're doing is begging the question and describing FEDnow as if it was a CBDC. lol... what? "Here's why FEDnow is a CBDC and I'll prove it to you by describing FEDnow as if it was a CBDC." So stupid. I watched this entire 22 minute video on it and learned literally nothing. Thanks Guy. Perhaps @taskmaster4450 can stich in his take on this video.

At the end of the day it's just silly to assume that every banking institution in the world is going to let the fox into the henhouse, become hopelessly dependent on it, and then the FED is going to pull the old switcheroo, rugpull all of it, and control everything while every private bank in the world just sits there and takes it with no Vaseline. That is literally the argument being presented for fast-tracking any kind of CBDC. These people do not understand how bankers operate on any level whatsoever. I would like to see some takes that are actually based in reality. Thanks.

But enough of that and onto the evergreen content.

There are huge differences between Hive and Bitcoin that most people don't think about and more likely don't even realize exists. In this post I'd like to point out the obvious accounting differences.

The security of both chains is completely different.

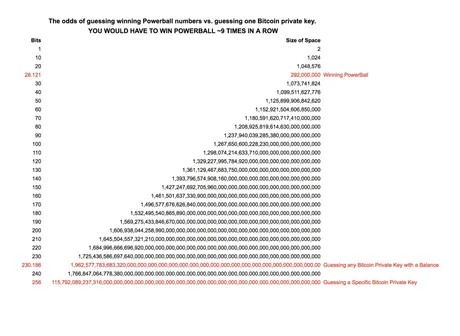

When looking at something like Bitcoin we can see 256 bits of encrypted security... which is a very tough nut to crack (impossible to brute-force with modern computing). This spoon-feeds us the concept of implicit accounting vs explicit accounting.

Implicit Accounting.

Most blockchains (especially the older ones) use implicit accounting. It is implied by every node in the network that all accounts exist and are valid, but the only ones we keep track of are the ones that actually have a balance in them (and perhaps even ones that used to have a balance but have been subsequently drained). Any one of those 256 bit addresses can be used to create a Bitcoin public/private key pair.

Explicit Accounting.

This is how Hive does business, which is an interesting choice for a chain that claims to be more scalable than the others. Every account on Hive has to be explicitly created by another account on Hive (which then becomes the recovery account for the new account by default). Again this is an interesting choice for a network that wants to scale up because every single account created has quite a bit of meta-data attached to it that networks like Bitcoin simply do not keep track of.

Hive has to save a username, posting-key, active-key, memo-key, and owner-key (all public keys) for each account. On top of this frontends have to keep track of profile pictures, following lists, upvotes and downvotes issued by everyone and their associated weights, witness votes, proposal votes, custom jsons, and blog posts for every single user. Compare that to Bitcoin and it's quite clear that even if Hive was 10x more scalable we are bogging down the network by keeping track of more than x10 the data.

Luckily the incentives of Hive are completely different than Bitcoin and we monetize our nodes directly. Bitcoin nodes have zero monetization. The only way to make money off of Bitcoin is to be a miner, which technically does not require one to run a node because there are perfectly good mining pools that do a much better job than someone operating alone. This will lead to a constantly centralizing node-pool, no matter how small a Bitcoin block is. With Hive we have a guarantee that at least 20 nodes will be massively incentivized to continue operations and scale up to levels that Bitcoin nodes could never dream of (unless of course those Bitcoin nodes are harvesting and monetizing the data they process... but that's a failing WEB2 strategy).

Interestingly enough I was reading this post on how quantum computing poses no threat to crypto. Probably the best Forbes article I ever read on crypto... which is actually kind of enraging because when you think about it they should all be at least this quality but never are. One of the arguments presented is that it's impossible to be targeted by a quantum attack if the public key in question has never been revealed. Hive doesn't have this luxury, but I'll save that conversation for another time.

So what does Hive gain?

Explicit accounting seems like a big liability, but there are also several advantages to it as well. Accounts on Hive are so abstracted and have so much metadata attached to them that I often refer to them as NFTs. This abstraction and extra commitment to on-chain resources allows us to do things that other networks just can't. For example if your Bitcoin private key gets hacked you're shit outta luck. You lose everything. However if your Hive account gets hacked the process of decentralized account recovery (incurring zero extra attack vectors) is so ingenious that for years I assumed there must be associated attack vectors that stem from the process. That is incorrect. It's 100% gain and zero loss of security across the board.

Another nice thing about explicit accounting is that it has allowed our network to operate in very unique ways. Our account names are readable just like an email address would be or any other WEB2 account. A random string of 32 characters can't compete with that. The readable nature of Hive accounts allows us to build reputation systems on top of the network which would otherwise be impossible. There are many accounts on Hive that would trust me with $10000 knowing that I wouldn't steal it from them. I've never met these people, and yet my reputation is very high and exists without the need for KYC. In fact my reputation is my KYC, and it's fully decentralized and disconnected from legacy systems. That's immensely powerful in the long-term.

Yield farmed bandwidth

Another huge advantage of Hive is the ability to outsource bandwidth costs to what is essentially an off-chain (virtual transaction) derivative. Resource credits haven't even come close to realizing their full potential, and that will become much more apparent when mainstream adoption rolls around and most networks get absolutely hammered by API requests. In the case of legitimate usage, mainstream adoption is essentially a DDoS attack against the network that most communities will not be able to handle.

It's important to note that having explicit accounting on Hive is not a requirement for either of these things. I see no reason why an implicit blockchain couldn't have readable wallet names or be able to yield farm bandwidth to a derivative. However there are very few blockchains that actually employ these strategies. The only blockchain I know of with implicit accounts and yield farmed bandwidth is Koinos Bandwidth Derivative... but does that really count? That network was literally created by Steemit Inc devs. It's a relatively new concept that has yet to fully prove itself within the jungle we call crypto.

Conclusion

There are stark technical differences between networks that simply assume that all accounts exist compared to ones that explicitly create them. There are pros and cons (tradeoffs) for building a tech-stack in either direction, but in many respects Bitcoin has perhaps chosen the worst of both worlds. At least with a privacy coin like Monero public keys don't actually ever appear on-chain, which is highly advantageous for the fungibility required to build well-respected economies that can't be governed by imperial forces from the outside.

For the most part I think explicit accounting is the way to go (on non-privacy coins) because it allows the network to employ decentralized recovery, yield-farmed bandwidth, and non-KYCed reputation systems going forward with relative ease. The biggest drawback is what happens when users leave the network and their account becomes derelict but still needs to exist within the database. But again if we treat Hive accounts like NFTs the accounts themselves can be traded and recycled back into the ecosystem without bloating the chain. Wen is the owner of @dragon going to sell me their account? Will pay $100.

Return from Implicit vs Explicit Accounting to edicted's Web3 Blog