Analytic investing is a total crapshoot. You draw some lines, do some calculations, and try to guess where the wind is going to take the price action of a graph. However, you can afford to be wrong a huge percentage of the time if you engage in analytical investments. If you were right 60% of the time and wrong 40% of the time you'd still make a lot of money on average with that 10% edge.

When you're doing analysis on a stock the only information you have is that particular stock. However, cryptocurrency seems to be an intimately connected web. I've seen Bitcoin fall in price as Ethereum hit a resistance line. I've seen coins breakout and spike up immediately after other coins are spiking up. The bottom line is that there is a ton more information out there about the cryptocurrency markets than there are of the stock markets, and I believe that most of this information is an untapped treasure trove.

Fundamental Investment

Analytical investment is just looking at points on a graph and trying to find patterns. The real driving force of long-term investment and value increase comes from the fundamental technological growth and its application. These are things like crypto ATMs and ATM cards, custom made smart contracts, and instant unreversible transations made anywhere the Internet exists.

The biggest investors don't care about day to day price action. They have so much money to invest then when they enter/exit the scene they are the ones creating the waves that the smaller fish try to surf.

Personally, I think the safest investments in this space are smart contract platforms. Smart money is the future of money. Being able to tell your money what to do given certain variables is revolutionary. Granted, there are many other interesting technologies out there. The generic term "smart-contract" encapsulates many of the advances that we are excited about.

At the core of this revolution is the ability to take the power of creating money out of the hands of the elite and into the hands of communities. Considering blockchain tech is in it's infancy we have a long way to go, both developmentally and value wise.

More than just Fundamental and Analytical

In my experience there are many more factors that help us determine were the price action of the blockchain is going to go. This gives the space a huge leg up on traditional stock investing.

Relative coin market cap

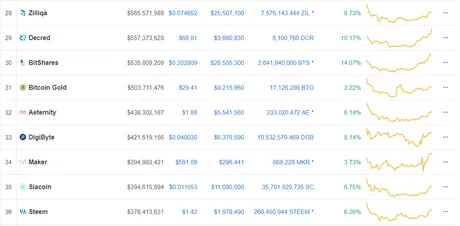

I should really make a bot that taps into the market cap website APIs and track this information. Whenever I see Steem at #36 (right now) on the market cap I try to swing trade it. Steem has bounced between #36 and #27 numerous times. Buy at #36, sell at #27. Easy. Steem would currently have to jump up 50% in order to hit the #27 spot again. Quite a tempting gamble. Because I don't have a bot tracking this information I can't do it with other coins to find patterns. Unfortunate...

News

When I tell people that I've played poker professionally they always ask me about "tells". This is how people think the pros make money. Someone makes a face or scratches their ear and that means they have a certain hand because they "told" you with their tell. The movies also make a big deal about tells. This is likely why novices think this is what it's all about.

This mentality could not be more wrong. Poker is a game of math and statistics. You try to guess what range of hands a player has given how you've seen them play in the past. You calculate pot odds based on this range of hands. What percentage of the time will your hand beat your opponent's range? Even if you have a 66% chance of losing, if you only have to put $200 into a $1000 pot you're going to make a ton of money on that bet in the long run. Your ratio to win is 2:1 (loss:win) but the pot odds are 5:1 (pot:bet) so you'll still make money on average.

This analogy works perfectly with cryptocurrency. There are a myriad of invisible variables that affect the value of crypto, but everyone and their mothers run around saying it was the news that caused the upswing or the downswing. It's quite convenient thinking because good and bad news about the blockchain comes out everyday. If the value went up choose the good news, if the value went down choose the bad news.

That being said there is obvious truth the news affecting price action. This is what allows people to overvalue the news in the first place. For example, Coinbase's announcement of consideration for listing five coins very obviously affected the price. All those five coins saw huge green numbers in a red market.

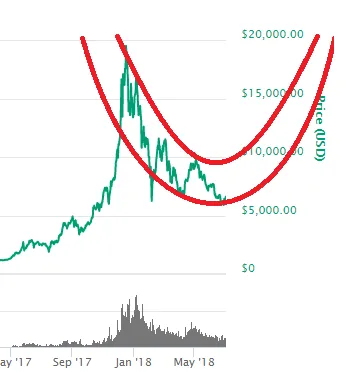

However, there are many claims of news affecting price that are much more flimsy. When Bitcoin spiked to 20k from 1k it was obviously going to crash back down. People blamed regulation uncertainty, social media bans, and taxes, but the truth of the matter was that the price was going down no matter what. To assume that it should have stayed at 20k is ridiculous.

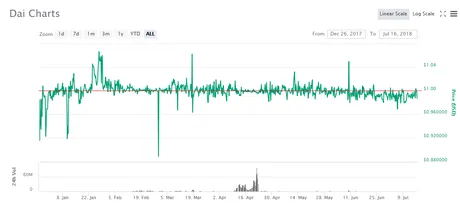

Stable coin flux

This is an indicator that I just recently noticed. My favorite decentralized stable coin Dai is supposed to hover around $1. However, it appears as though it hovers less than a dollar when the market is coming up and higher than $1 when the market is crashing.

When users of the MakerDAO platform think the market is going to crash they buy Dai with their crypto to maintain its value. When they think it's coming back up they sell their Dai back for crypto. As you can see, users of the MakerDAO have been expecting a run up for over a month now.

SBD

Steem Backed Dollars are an epic fail when it comes to being a stable coin. However, SBD is still a very nice coin to have around. When dumb money enters the space and pumps SBD up to $10 we all get rewarded with huge payouts. When SBD is near $1 we know it's safe to buy/hold them. Sometimes I wonder of the price of SBD is a power bar indicator of the entire market.

When SBD is near $1 this might signify the end (or near end) of a bear market. When SBD is $10 this might signify that a crash is imminent. This is an idea that we should be putting to the test in the future as more information becomes available.

So many indicators

As you can see, the cryptosphere is a web of interconnected value that has far more information attached to it than simple stock investing. We should always be on the lookout for more information because a signal on one blockchain could end up being a signal for them all.

Return from Indicators For Price Analysis to edicted's Web3 Blog