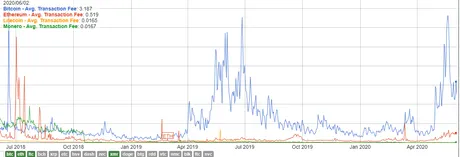

The more I look at this chart the more I just can't get over it.

Moving Bitcoin around is expensive!

And it's only going to get more expensive, likely astronomically so.

Remember at the end of 2017 when Bitcoin spiked to $50 transaction fees?

How high will fees spike during the next bubble?

$100? $200? $500? $1000?

My guess is somewhere between $500-$1000 for a single Bitcoin transaction.

Let that sink in for a bit.

Think that's ridiculous?

A lot of people are predicting a new bubble of Bitcoin up to $280k per coin, myself included. If that was the case, how could Bitcoin fees not hit these ridiculously high targets? If it was $50 per transaction at $20k isn't the logical assumption a linear progression of $500 fees at $200k?

It will be that this point that many will realize that Bitcoin does not exist for the common man; it exists for the super rich. We were just lucky enough to be here first before all the banks, governments, and corporations wanted needed a piece of the action.

Bitcoin is the original chain with the highest security and the most inefficient redundancies that boost said security. Anyone who wants to use it will have to pay a steep price, and pay they will, because it will be totally worth it for them. A $1000 fee on a transaction of a few million dollars is not a big deal, especially when the entire banking system is going belly-up and hyperinflating.

We also have to assume that Coinbase will be forced to stop offering free Bitcoin transactions.

That's just the name of the game; they will no long be able to afford that luxury.

LN

I have absolutely zero faith that the Lightning Network will solve this scaling issue. A second-layer solution is effectively just a new chain. Why would anyone use this new chain, that has so many problems, when they can just overflow to another chain with better security like Litecoin. When atomic-swaps become commonplace, this dynamic will become even more obvious.

And what about Hive?

What are our transaction fees looking like these days? Still zero? Hm...

Trickle-down theory actually works with crypto!

I wrote this post at the end of 2018, and it is still valid. You know what isn't valid? All those references to the Dot Com bubble! Do we remember that? Everyone was talking about crypto like it was the Dot Com fiasco for the entire year that Bitcoin was crashing in 2018.

Who's talking about Dot Com now? No one. Stupid irrelevant comparison, and NO ONE admits that they were totally wrong in making that comparison after the fact even though no one is making that reference anymore and they so vehemently did before.

Ridiculous Dot Com Bubble Comparison

Comparing crypto to Dot Com was, and always has been, a fool's errand. Seriously I wonder if they will try to pull that shit again on the next bubble. That would be even dumber because they were already proven wrong. Yet, I fully expect it to happen regardless.

Bitcoin

With it's four-year halving cycles, Bitcoin is creating floods of value in cycles almost like the Nile River in ancient Egypt. The Bitcoin River floods and everyone gains. It's the year-long famine afterward that you have to worry about.

Litecoin

I'm always flip-flopping back and forth with Litecoin wondering if it's a valid project. Once again I've flipped back to a pro-Litecoin stance. It's the second oldest crypto ever. It uses a different hashing algorithm (huge deal). And the transaction fees are dirt cheap. I transferred Litecoin around the other day for a tenth of a penny, and that was double the price I needed to pay (simply wanted it to be guaranteed on the next block).

Not only that, but Litecoin's second halving was last August. We've almost had a full year of liquidity drain on the market. When the supply runs out, we'll know, that's for damn sure.

Ethereum

This is the second safest asset to invest in, as it is the second highest project by market cap with the second-most liquidity. Ethereum sets itself apart greatly from both Bitcoin and Litecoin with the smart-contract and DeFi niche. It's not going anywhere. There is no such thing as an Ethereum Killer!

Hive

Not as sure of a thing as these other projects I've listed, but still my favorite one (obviously). Where else can you find a social network presence so intimately connected to a blockchain? "Get paid to _____" will certainly be our motto going forward, and as the world goes to shit and people out there get more and more desperate for any form of income, Hive will be sitting pretty.

Bitcoin forks (BCH, BSV, Bitcoin Diamond)

In my mind, these forks are doomed to fail. They all use the SHA-256 algorithm so their entire security is compromised. Any big miner from the Bitcoin network can attack and double-spend them into the dirt. With the ability to rent hashpower, this is even more relevant.

Conclusion

No one project can do it all. Everyone tries to project competition onto this space, but there is no competition. All of these projects are collaborative and open-source. They all have their own niche.

As the Bitcoin Flood begins we will see the cycle complete once again. It's been a long four years, and I'm glad to see so many people here have stuck it out and stayed the course. Our patience will be rewarded.

Return from Inevitable Overflow on the Horizon: Revisiting Trickle-Down Theory to edicted's Web3 Blog