The regulators are fighting the damn war of their lives right now.

-

Binance is lowering daily cashouts from 2 BTC to 0.06 BTC, in addition to ceasing operations in many European countries and Malaysia.

-

The new infrastructure bill is trying to tax crypto by capturing as many as they can in an umbrella of "brokers". All brokers must be KYCed and regulated and taxed, and the wording is such that it could legally declare miners to be brokers. Good luck, fellas.

-

The Wall Street Journal just reported how easy it is to avoid IP blocks by using a VPN. Exposing the ease at which we can shadowbank and calling for a "solution" to the "problem".

The FUD machine has been turned on full blast, but no one is listening anymore. Perhaps there are some deep pockets who'd like to buy in at these lower levels. Looks like that's not really an option. Supply shock confirmed, twice.

Any one of these crippling stories would have shattered the market just weeks ago. Now we find ourselves back in mega-bubble territory quite quickly.

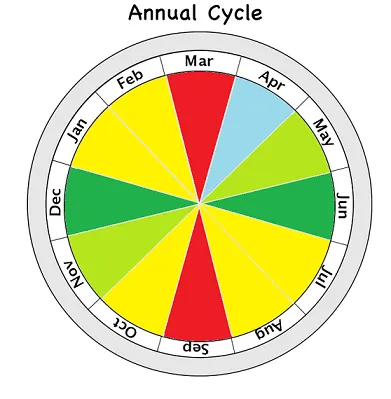

It's really hard to ignore how aggressive this FUD is, and even moreso how little affect it has on the market at the moment. If these supply shocks keep getting confirmed we'll be up for another 5 months in a row no problem, cycle-chart be damned.

CZ has agreed to set up an official global headquarters.

He said if authorities expect Binance to have a headquarters, then his firm will establish regional headquarters to have a "very easy to understand structure."

"We need to be a licensed financial institution everywhere that we operate," Zhao said.

WE OPERATE!

If you ask me CZ is still running circles around these guys. A few slaps on the wrist and Binance has agreed to shave off the top of the iceberg tip. The regional headquarters will obviously be located in the most crypto friendly country in the world.

It doesn't matter who bans Binance, and CZ knows it. What matters is which countries will allow them to operate the way they want it to operate. And trust me they are doing so much crazy stuff in the background it would make your head spin. We just can't see behind the veil, but we can see the results and the profits.

CZ has figured out that his corporation sits on a gateway of borderless value exchange. Banks don't like that. Regulators don't like that. They are trying to crack down and ban him, but you can't ban him in every country... so... you fail. That's how crypto works. CZ is putting in serious libertarian work that borders on mafioso levels of wealth. Same thing happened with Silk Road, but shutting that down was a bit easier to sell on the mainstream channels. Drugs are bad, m'kay?

BSC

BSC acts as an amazing shield for Binance. As a clone of ETH, it will be basically impossible for regulators to control. Already projects like the LEO bridge allow value to flow in and out without Binance's permission. It's truly a sight to behold, because these developments are only going to continue on exponentially. If Binance can't control BSC, then regulators can't control BSC.

These regulators think they can keep up with exponential growth in a new emergent sector? This vacuum of trust that has been created from thousands of years of imperialism is BURSTING with crypto. You can't put the toothpaste back in the bottle. The void has been filled, and it's not going away.

Quite the contrary it is expanding exponentially, and will continue on because that's how important crypto is. The opinions of the dinosaurs don't mean a lot. Try to avoid their flailing as they cry foul and try to flip the game board after losing like petulant children. That's how badly humanity let this situation devolve to before a solution was invented by a mystery entity. Stranger than fiction.

Posted Using LeoFinance Beta

Return from Infinite FUD has no affect. to edicted's Web3 Blog