99% of everyone seems to think inflation is bad. No one wants their currency devalued by printing more. Why not? Every economist knows that inflation can be used to create growth. The inflation that we print can easily be used to generate more overall value than the liquidity it dilutes when injected into these markets.

Higher inflation means higher market cap. In fact, if the inflation does what we want it to and actually generates more value than it takes away, not only does higher inflation equate to higher market cap, but it also makes the token price higher than it was before. It's a win on every level.

The problem with fiat is that it's controlled by a very small group that engages in crony-capitalism rather than actually helping the bottom of the pyramid. In order to maintain power one must not please the little guy, they must give favors to their keys to power (the ones right below them on the pyramid). So on and so forth it goes down the chain: Trickle-Down Capitalism.

The problem with comparing crypto inflation to fiat inflation is that you can't. They are completely different. It's like comparing apples to a grain of rice. Crypto inflation is smart-inflation and can be allocated anywhere the network sees fit. Not only that, this value is not owed back to a central authority at interest. It's new money owned by the entity that minted it. Again, it is impossible to compare this to central banking.

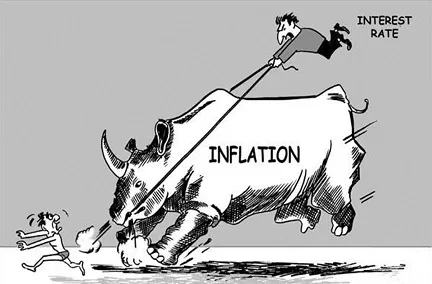

On top of this fact, the ways fiat institutions can distribute fiat inflation is extremely limited. What can they do? They're only tools in the chest are loaning money to commercial banks and manipulating interest rates. More recently they've been doing quantitative easing and security buybacks. Compared to crypto their ability to distribute inflation is a sad joke, and they are at the end of their rope. How many years have interest rates been forced to 0%? They are at the end of the line: it's time for crypto to take over within the next ten years.

Why is Bitcoin valuable?

Because it takes zero risk. Zero inflation means zero risk. Bitcoin governance does not have to worry about corruption when it comes to distributing inflation: because there is none. Why would I make the claim that Bitcoin has ZERO inflation? Because when we consider that millions of BTC are already lost forever and/or will never be spent again, it's clear to see that the market cap based on a supply of 19M BTC is already more the maximum supply. We will never get to 21M. Only more will be lost over time.

Less Risk == Less Reward

It becomes obvious that because Bitcoin has zero inflation, it has no opportunity to allocate value into areas that would greatly benefit the network. It is 100% guaranteed that networks that figure out how to best allocate inflation will skyrocket past Bitcoin in market cap, and all the Bitcoin maximalists will cry their tears of greed as they slowly become more irrelevant.

Bitcoin maxis will be the next Peter Schiff.

You know how stupid and annoying Peter Schiff is? That's exactly what Bitcoin maximalists are going to be like when Bitcoin gets flipped. They'll spew their rationale for why Bitcoin should be number one just like Schiff claims that gold is superior to Bitcoin. It won't be a good look: I assure you.

The trend in DeFi has already made this reality quite obvious. When the network has control of a lot of inflation, even if that inflation is just distributed randomly to stake-holders, that's far better than no inflation at all. Inflation creates growth.

This isn't to say that every network with inflation is going to do well. Quite the contrary, perhaps even more than 75% of these tokens will become completely irrelevant, which is why Bitcoin will remain the safest option for at least a decade. However, sooner or later we are going to figure out a template for inflation that is essentially superior to Bitcoin in every way.

Crypto can scale higher than any corporation. Some of these crypto networks are going to have over a million developers working on them full time. Could you imagine that? A corporation with a MILLION developers? Imagine how fast things would get done, especially when all the code is open source and available to all. This is the direction we are headed in.

What do we need inflation for?

We need inflation to pay devs. We need inflation to teach people the skills they need to be successful in these networks. You heard me right: the future of education is getting paid to learn, not drowning oneself in debt in order to get a worthless college degree. Bitcoin will most certainly not be able to keep up with any platform that figures this stuff out.

Again, that's not to say that I don't like Bitcoin. In 2022 when everything is crashing into the mountain I'll go full Bitcoin maximalist. Bitcoin will do what it always does: maintain its value better than every other crypto. Zero inflation will be a big part of that happenstance. Bitcoin is the anchor.

Conclusion

Inflation is the killer dapp of crypto, and no one seems to realize it. In fact, 99% of the world seems to think exactly the opposite: that deflationary economics are the way to go. Funny considering we already know that's 100% false. When gold was money society ran into all kinds of problems. Removing fiat currency from the gold-standard wasn't a bad idea, in fact it was a really good idea. The problem is that those in charge of printing new money allowed their greed to get the best of them: happens every time.

Now we are in a situation where greed cannot factor in because no one is in charge. These networks distribute inflation based on consensus, not the greed of the elite. Again, to compare fiat inflation to crypto inflation is an extremely foolish mistake that I see pretty much every single person making. Don't do it. Nuff said.

Posted Using LeoFinance Beta

Return from Inflation is the killer dapp. to edicted's Web3 Blog