Now that the CPI report has hit and the markets have crashed I have seen like a dozen people make the claim that inflation is to blame. Really? Inflation? So when there is a shark attack, we are going to blame the ocean? When the economy gets shut down because of the flu, we blame the virus? Yeah, totally. I hear you.

100%

So the dollar is losing value. And in response to the dollar losing value... everyone is selling their crypto and stocks into dollars? Yeah? Is that what I'm hearing? People are so nonsensical it makes me want to scream in their face. Like, seriously. This is why we can't have nice things. Ya ruined it for everyone because ya bought into the bullshit. Stop already.

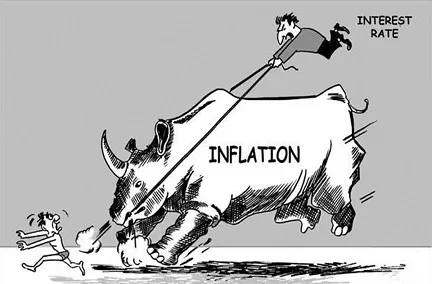

The interest rate can't tame inflation. That's absurd. Do we think this cartoon got drawn for funzies? No, it's totally comically accurate. The only thing raising rates can do is crush demand. "Demand" of what asset, you might ask. Demand for debt. It should be obvious that people don't want to borrow money when they have to pay even more back later.

This becomes a chain reaction.

Commercial banks don't want to borrow "money" from central banks because the central bank raised the interest rate. Of course this isn't actually USD but rather a completely different ledger of value that exists as private money that never enters public circulation. It is the commercial banks that actually print USD, not the central bank.

Everybody made a fuss over the FED printing "20% of the entire supply of money in a year". Yeah, never happened. That wasn't USD. That was behind the scenes quantitative easing financial instruments that the general public knows absolutely nothing about. Because guess what? Banking is way more complicated than numbers on a screen or printer go brrr.

Do you know WHY the Federal Reserve "printed so much money" in 2020? Because they WANTED the commercial banking sector to print more USD by issuing more loans. That's who prints USD: commercial banks, and they do it through the debt based system.

Why was the FED buying up all their liabilities and turning them into assets? Because we needed more money in the economy (still do). We needed the commercial banking sector to be giving out more loans. You can lead a horse to water, but you can't make it drink. The FED has a lot less power than people think. They don't even print USD for god sake.

In response to higher rates, the commercial banking sector will be less likely to take loans from the FED, because the interest rate is higher. In turn, the commercial banking sector will increase their own interest rates to make up the difference, putting the burden on retail and whoever else they do business with. Retail will then also not want to take out loans because, once again, the interest rates are higher. We can see this first hand. I'm getting credit card offers for 26% APR when ten years ago it was firmly under 20%. Yikes. No thanks. Pass.

And yet, "inflation" still gets blamed for crashing markets.

Imagine inflation was actually happening. Imagine there was suddenly twice as much USD in circulation, and the value was cut in half. That's a painfully obvious NUMBER GO UP scenario. The apparent price of every stock and every crypto paired to USD would look like it was doubling in value. In reality we know that it didn't double in value, but rather only doubled in quantity because each unit is half the value it was before.

Don't try to tell that to the IRS though.

So again, saying the market is crashing because of inflation makes absolutely ZERO sense. Inflation pumps markets. That's why it's called inflation. Because it's inflating. Because that's the definition of inflation. Duh. So how are people getting it so wrong?

People are REACTIVE & MISINFORMED

People see prices of goods and services go up. They complain. People see the stock market crash. They complain.

My god.

The two must be connected somehow!

Let's thread this needle of delusion!

So because "inflation" is high (the consumer price index is not inflation) and because the stock market crashed people think they've figured it out by saying inflation caused the crash. It's like a child explaining to an expert how something works.

THE CURE IS WORSE THAN THE DISEASE

COVID did not disrupt the supply lines. The response to COVID disrupted the supply chain. Guess who decided to impose sanctions on Russia. It wasn't the inflation boogieman. These things do not happen in a vacuum. Russia was baited into invading Ukraine pretty hard by the very powers that decided to sanction them. Geo-politics can't be explained inside of a five sentence paragraph, but that's what people want. They want a simple problem and solution they can rally behind. So the spinsters come in and give them what they want, to their own benefit of course. Just so you know, when it comes to world powers, it's almost guaranteed that all sides are completely full of shit.

Within this context, it is not hard to see how people come to the conclusion that "inflation crashed the markets". So simple. You figured it out. Good job, child. Correlation equals causation. Nailed it.

My tax dollars pay for that!

So what is actually happening?

The markets crashed, not because of inflation, but because of the response to inflation. The response to inflation, is unsurprisingly: deflation to balance it out.

The response to high CPI is apparently to raise interest rates. What does raising interest rates do? It chokes the supply of USD and makes USD more valuable. It causes deflation. So the reason the markets crashed is EXACTLY THE OPPOSITE of what people think. Shocking. Never seen that one before. Kinda like saying Bitcoin wastes energy.

In fact, interest rates haven't even been raised yet, so the actual reason the markets crashed was simply speculation of them being raised, implied future deflation, and the increasing value of the dollar. Is the market correct with its estimate and price of assets in of the current situation? It almost never is. We almost always see volatility in these situations as the herd scrambles over one another in a panic.

Markets crashing means people are trading their assets for USD. It means the value of USD is going up. And the obvious question to ask here is the simple one: If USD is going up in value why is the price of product still so damn high? Is that not obvious? The SUPPLY is FUCKED. So in response to supply being fucked the FED is lowering demand, because they have no power over supply and that is literally the only thing they can do while they spin their little narrative.

I honestly think the FED knows exactly what they are doing and they are creating a recession on purpose. I mean as fun as it is to claim they are completely incompetent just like all the other politicians... that's simply not true. They don't serve the public. They aren't on our side. They are doing their job perfectly and then they make it look like incompetence and a failure of the system (which is part of their job description). The system is working as intended. Trust me.

So how can we pivot around this?

Like I said, the value of the dollar is going up. It might feel like your stock/crypto bags have crashed into the mountain, but you're also measuring that value in terms of USD unit-of-account. USD is gaining value, which means the loss isn't as much as it looks like on paper.

There's going to be a deflationary snapback that completely shreds the economy. Deflation is worse than inflation in a debt-based economy, and the FED is completely ignoring this threat. They will blame the CPI data for getting it wrong, but they are WILLFULLY ignoring glaring red flags for whatever reason. They want a recession, and they are going to get one.

And who wins in a deflationary environment?

People who have dollars. Within this context, crypto and stocks can still be sold at these lower levels. The USD we bank today could be worth quite a bit six to twelve months down the road, despite what everyone is saying about inflation and how the dollar is losing value. It's not. There is actually a massive dollar shortage worldwide and these increased rates are going to crush the debt-market.

We have to put this within the relevant context.

How much money are people willing to spend on gas? If that gas is being used by commuters to drive to work, it doesn't matter how much the price is. THEY HAVE TO PAY IT.

How much is your life worth? If the price of food goes 10x, you have to pay it, because if you don't. You're dead. Same is true for water, and to a certain extent power and shelter. Essential assets are essential. The price has to go up A LOT to actually make demand drop. The same can not be said for non-essentials.

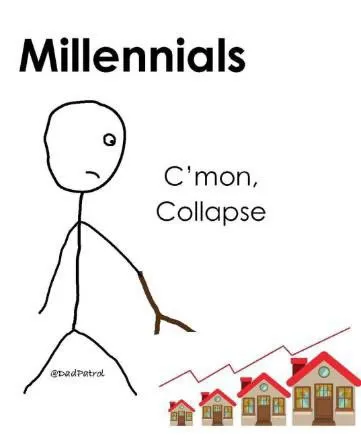

Luckily the housing market is an essential assets that is primed to implode. Too many hedge funds buying property as a hedge and then just letting it sit there with no one actually living inside. Too many people working from home so they can move to a cheap area. All I can say is... don't buy property until the house of cards it resides on crumbles.

Possible bifurcated economy.

My guess would be that the deflationary economy we are headed into will lead us into a very awkward place where non-essential product is dirt cheap but essential product is expensive. There are many many red-flags out there that signal food production will be very bad over the next year. Luckily food is one of the only things anyone can produce, but on a macro scale that might not matter much.

Think about the CPI and the narrative spinners.

Imagine if every single essential product increases 20% or more year over year, but non-essential product is down 20%. The FED will claim they fixed inflation because the CPI is 0%. But they didn't fix shit. The economy will still be completely fucked.

Institutions still control Bitcoin spot price.

Did anyone else notice that Bitcoin once again lost dominance during the market crash? Bitcoin crashed like 10% and other networks were at like 5%-7%. This is completely the opposite of what we saw in the 2018 bear market. This one is totally different, but no one seems to recognize it because omg number is going down.

Be careful what you wish for.

Bitcoin got that institutional adoption, and now it is even more sensitive to these moves in interest rates and the legacy economy than the alt coins. I was pretty happy that Hive is still proving to be wildly decoupled from the market. Still chilling at 55 cents. Pretty good.

Will Bitcoin crash more?

That's the question, isn't it? The answer is very unclear. I still maintain that the trendline currently at $40k is still totally valid. Bitcoin is already wildly oversold, so assuming it will crash more during a legacy economy implosion is a slippery slope. Of course if it does crash to $10k or whatever everyone will sell "well that was obviously going to happen" in retrospect. It wasn't.

Considering that Bitcoin and crypto at large are assets that increase in value exponentially over time... it's always extremely dangerous to bet against them, especially after an 80% retracement. We all know that crypto is the solution to the problems we are seeing today. It is no longer acceptable to allow a private entity to control the money.

From a political standpoint, we should hold on to as much crypto as we can regardless of where we think the spot price is going in the short term. It's not about making money; it's about finally fixing this broken economy and crawling out of this unsustainable hole we dug for ourselves. Everyone wants the quick fix and the easy money. How's that working out?

Even if Bitcoin did flash-crash to $10k... isn't that just free money at that point? I'm more than comfortable going long on leverage at that price. That's where we were before the last bull market even started. Easiest place to go long ever. Within that context it doesn't matter if I lose money riding it down if I can be certain a long at $10k is a sure thing, which I believe it absolutely is. Even $15k might be worth an x2 long position, as the liquidation price would be $7.5k (never going to get liquidated)

Conclusion

Inflation does what it says it does: it inflates. When inflation occurs it increases the value of stocks and crypto on paper, not the opposite. This should be obvious. When USD is devalued everything paired to USD appears to gain value (because USD is our unit-of-account).

The Federal Reserve's stated goal is to create deflation to balance out a high CPI. They want to lower demand in the face of lower supply. The macro side of the moves being made today are going to lead to a Butterfly-Effect level of "unintended" consequences. There is already a shortage of USD within the debt market. The FED printing QE funny money and handing it over to commercial banks doesn't actually mean that the circulating supply of USD is going to go up. The horse is not drinking the water. The water is poisoned.

Like I said before, we are headed to one of the biggest Black Friday sales of all time. On a statistical average, no one is going to have any money left to buy non-essential product, and they will all be wildly discounted at the end of the year as corporations scramble to unload their warehouses. (I'm hoping to buy a new computer on Cyber Monday).

We need to pivot around this by actually being the ones that have disposable USD at the end of the year. The value of USD is increasing. Inflation is a completely false narrative. If inflation was real your crypto bags would be fat right now. Obviously. Inflation inflates.

Never forget that the markets crashing implies people are dumping their assets for USD. Why would they do that if USD was losing value at an alarming rate? Make it make sense. Cash is king right now, so it is not surprising that the powers that be are trying to make you think exactly the opposite using very convincing propaganda.

Return from Inflation: Make it make sense. to edicted's Web3 Blog