Honestly, this is getting pretty out of control.

Institution after institution is announcing their intent to enter Bitcoin, and most of the cryptosphere is bored that Bitcoin is "only" trading at all time highs.

I think a lot of this has to do with COVID. Not only is this a great time for institutions to enter the market because of flagrant money printing, but at the same time retail investors have been so devastated from the lockdowns that they can't be bullish even with Bitcoin goes x2 in a couple months and x4 over the last nine.

Lucky number 7's

This $17777 level has been huge for three weeks running. There is massive support at this level and massive volume. It's hard to imagine Bitcoin crashing much farther given these circumstances, even with the doubling curve being all the way down at $13k.

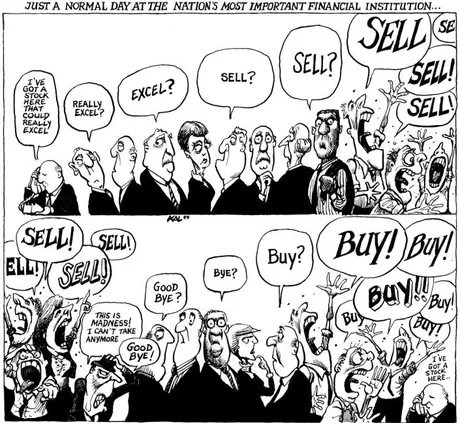

The thing about technical analysis is that it was invented by people looking to ride these wave. Meanwhile, institutions are the ones creating the wave.

Ask yourself:

- Who is selling right now?

- Who is buying?

We know that miners are selling. In fact, 50 BTC chunks mined back in 2010-2013 are popping out of nowhere to sell at these levels. That's pretty crazy. Money that hasn't moved ever that was mined before the first halving event is popping out of the woodwork to sell here. What happens when all that selling pressure is gone?

More decentralization.

This isn't meant to be bullish sentiment in terms of price, it's meant to be bullish sentiment in terms of token distribution. Those who mined Bitcoin for a much much lower price are taking gains here, and that's great. Volume is high and tons of money is trading hands. The market looks very healthy. Every time the price dips a little volume skyrockets and entices huge buying pressure.

It might be a little alarming to see this Bitcoin all falling under control of huge institutions. Is that really decentralization? The answer is yes. Just because one entity technically controls the Bitcoin doesn't mean it actually belongs to them. This is how the legacy economy has always operated, and it would be foolish to think this was going to go down any other way. Mainstream adoption is coming.

https://bitcointreasuries.org/

So again, Who's Buying?

- Grayscale

- Paypal

- Microstrategy

- MassMutual

- Fidelity

- Square

- Venmo

- All the secret buying pressure from executives.

It's not a random accident that Microstrategy's Michael Saylor decided to pump $50M more into Bitcoin even at all time highs. Or that he's announced this weird convertible senior notes bond sale for Bitcoin for $400M.

https://cointelegraph.com/news/microstrategy-completes-650-million-bond-sale-to-finance-next-bitcoin-purchase

Oh wait, did I say $400M?

They've already gotten $650M!

Seriously, this is insane.

The raise was finalized mere days after the company first announced plans to leverage bond proceeds to acquire more Bitcoin. As Cointelegraph previously reported, MicroStrategy was initially targeting a raise of $400 million. At $650 million, the firm can purchase over 36,300 BTC at current prices.

If this was happening even a year ago everyone would be flipping their shit. Enter COVID and everyone seems to think that Bitcoin trading at all time highs is boring. The transference of wealth is happening now right under our noses and most of the world seems none the wiser.

Bitcoin Doubling Curve

| 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|

| $100 | $200 | $400 | $800 | $1600 |

| 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| $3200 | $6400 | $12800 | $25600 | $51200 |

I must admit, my x10+ the doubling curve prediction for 2021 seemed pretty ridiculous a year or two ago. A quarter million dollars for a single Bitcoin? So stupid.

Now I'm going to be surprised if it doesn't happen. How could it not? Even the institutions are on board and the dominoes have just started to drop.

These announcements of public corporate adoption of Bitcoin have just begun. They will continue on and on and on throughout 2021. Whereas Bitcoin used to be a risky investment, now it is perceived as risky to ignore. The tipping point has been reached, and the snowball has just started rolling.

More and more BTC is being taken off the exchanges and being stored in cold storage or personal wallets.

Conclusion

The people selling Bitcoin right now are the ones who acquired it at a much lower price (or miners who have bills to pay). The entities buying Bitcoin are INCREDIBLY strong hands. These are institutions that are in it for the long haul and they will not panic if the price dips, in fact, we see that they are aggressively buying during the dip, creating a huge buffer in the market and massive volume during every price drop.

These people don't ride the wave; they are the wave.

Don't sell your crypto to the 'enemy' at such a discount.

Financial Political advice.

Posted Using LeoFinance Beta

Return from Institutions don't care about TA; they are the wave. to edicted's Web3 Blog