It is always with the best intentions that the worst work is done.

The ends don't always justify the means, but that's just a fancy and potentially convoluted way of saying sometimes investments don't pan out the way we want them to. Sometimes it is worth it, and sometimes it not. This is a basic concept often disguised as some kind of guru sentiment.

Wait... what?

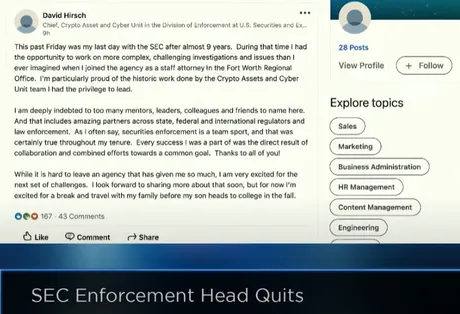

This is actually the first time I've ever heard anything about the SEC that didn't involve the chair Gary Gensler. The chief crypto asset and cyber unit enforcer just quit his job... but why? There's a lot of speculation.

Important to note here that this guy has been on the job for 9 years.

lol @ nine years. That's 2015... which means this guy is at least partially responsible for every move the SEC has made against crypto pretty much in its entirety, as 2015 significantly predates even the ICO craze.

That's some interesting timing...

First off... what the hell are you doing?

The interview seems to be no-holds-barred.

When asked about why Bitcoin and Ethereum aren't on the list of not "targets" a simple deflection is provided:

Well I think we should be focused on which assets are on the list.

Bitch please.

When asked about the lawsuit against Coinbase he makes the claim that the lawsuit is valid as long as they've been transacting in at least one security. Which actually goes against the literal legal president that has been set in the Ripple case where secondary sales are not subject to this type of jurisdiction.

Why sue Coinbase instead of the issuer of the security?

Blah blah blah deflect deflect deflect.

These regulators seriously have no shame... and now the guy has quit without any type of explanation. Look at this dude's punchable face. Legit a human thumb of a man. I'm totally unbiased in this assessment.

Regulation by enforcement.

Is it coming to an end due to resignations like this?

I guess we'll have to see who replaces the guy.

I'm sure Blackrock will have something to say about that.

Starbucks is issuing token rewards. Nike is issuing NFTs. Is Roblox a security?

At what point do you call them securities?

And then this dude has the audacity to say... "Getting back to the Howie Test". That is just offensive.

The people that buy Roblox buy it primarily because it might be worth more in the future.

Well now that starts to look a lot more like an investment and a security.

This bitch...

So this statement is the entire reason I chose this specific title. The head of enforcement in the cyber division is telling us that the INTENT of the investor is what makes something a security or not... which is patently absurd. It's basically the same as saying the consumer just gets to decide what is and is not an investment contract, while the creator of the actual product has absolutely no say in the matter. Vintage shoes? Security. Housing market? Security. Making the claim that this falls under the Howey Test is simply hiding behind the complexity and nuance of the Howey Test and hoping nobody knows any better because it's complicated. Notice how they never explain what a "common enterprise" is... ever. Because if they did the entire argument would fall flat on its own face.

Some of this is judgement and viewpoint... clearly.

Pretty much anything in the world that could go up in value can be a security under this definition.

Oh but wait... everything goes up in value because the unit of account that we measure everything against (USD) is going down in value every year.

We don't need more digital currency. -- Gary Gensler

Why would the chair of the SEC be in a position to say what the market needs?

First, I would I take mild issue with the idea that we don't always take action based on the letter of the law. That's not a conversation I've ever heard; I would be appalled if that happened.

Oh really bitch?

What about when a literal judge told the SEC:

“The denial of Grayscale’s proposal was arbitrary and capricious ... The Commission failed to adequately explain why it approved the listing of two bitcoin futures ETPs but not Grayscale’s proposed bitcoin ETP,” the court said in the ruling. “In the absence of a coherent explanation, this unlike regulatory treatment of like products is unlawful. We therefore grant Grayscale’s petition for review and vacate the Commission’s order.”

Could it be more obvious?

This absolutely is regulation by enforcement and they just blah blah blah their way out of the discussion like any other political body.

That's not the way we approach our jobs.

Cool story bro; tell it walking

So who is going to replace this guy? No idea but it's worth paying attention to going forward. In fact someone made a joke about him going to work for crypto and this was the response:

This is false, I have not yet announced my next role but it is not with any meme-coin platform.

The language used here is very strange for someone who choses their words so carefully. Why specifically say you're not going into meme-coins? It would make a lot more sense to say "crypto" in general if that was the case. Again this is a situation worth paying attention to. Would be hilarious if he got a crypto job. And would also make a lot of sense for any project looking to avoid regulatory overreach. This guy has a lot of value to any project looking to avoid $100M lawsuits.

Even XRP got a quick pump/dump here.

They were offered a settlement offer from the SEC for $103M. Again, worth paying attention to.

Was this a good use of the agency's time?

- Ripple spent $200M

- SEC spent a ton of money as well.

apparently Ripple is also launching a stable coin?

Many interesting scenarios playing out.

Conclusion

The political landscape of crypto is pretty crazy right now. As the entire market bleeds we seem to be getting win after win on the regulatory side of things; be it court cases or high-class resignations. Even Blackrock is talking about launching a new stock exchange in Texas and it would likely be a blockchain solution.

During these times of dumps and strife it's often hard to see the forest from the trees but 2025 is shaping up to be the most insane bull run ever. Just hunker down and try not to think about the thousands you've lost from fumbling the bag. 🤑

Return from Intent is Irrelevant to edicted's Web3 Blog