I've been here in the cryptosphere since that fateful spike up to $20k. I always had thought Bitcoin was a cool novelty before that; even remember when Bitcoin hit $1 parity (Wow! It can't go much higher than that!!). I always told myself I was going to enter the crypto arena one day, but I never did until that fateful bull run of 2017.

That was the signal

Bitcoin hitting $20k told me something very important: that it was no longer some kind of toy or novelty; that it would eventually rampage throughout the globe and topple entire governments. After all, the best way to control a population with government is through the native currency itself. If everyone starts using a currency that has fair rules and can't be exploited...

everything is going to change.

For the last couple years I've been getting pretty wrecked on the investment side of things, like so many others. I've never even come close to having to worry about paying taxes on any kind of gains, because there were no gains, only magnificent losses.

Now, things are a bit different.

By the end of 2020 I might be up a significant chunk of change (or not). By the end of 2021 I plan on being up by an astronomical sum. I figure it's time to put a tiny bit of research into the taxes I might have to pay.

So I did what everyone else does: ask Google.

Tell me what to think Google, you are my muse!

https://www.investopedia.com/taxes/capital-gains-tax-101/

Here, we look at the capital gains tax and what you can do to minimize it.

Sounds good.

- A capital gain occurs when you sell an asset for more than you paid for it.

- If you hold an investment for more than a year before selling, your profit is considered a long-term gain and is taxed at a lower rate.

- You can minimize or avoid capital gains taxes by investing for the long term, using tax-advantaged retirement plans, and offsetting capital gains with capital losses.

Cool beans.

(Capital Gain) = (Selling Price) − (Purchase Price)

You don't say?

For tax purposes, it's useful to understand the difference between realized gains and unrealized gains. A gain is not realized until the appreciated investment is sold. Say, for example, you buy some stock in a company and a year later it's worth 15% more than you paid for it. Although your investment has increased in value, you will not realize any gains, or owe any tax, unless you sell it.

Useful information? Say what?

You don't have to pay taxes on unrealized gains... so if I have Bitcoin and go ahead continuing to hold Bitcoin I don't have to worry about taxes... same goes for any other crypto.

It gets a bit convoluted when the government then tries to tell you that trading one crypto for another is also a tax event. So if I sold Bitcoin into Ethereum/Tether the IRS might tell me that I own taxes on any realized gains I made. Personally, I think that's a bit ridiculous and convoluted, but it is what it is.

What happens if I sell BTC into ETH but the cost of ETH for BTC has gone up? Meaning I technically lost money (unless you're measuring everything in USD for some reason). The unit measurement of the realized gain could manipulate the perceived taxes owed. These are the kinds of questions I'd never get an answer to here because this website is just for Capital Gains tax in general and doesn't mention crypto. I guess I'll worry about that later.

Capital gains taxes apply to what are known as capital assets. For example, stocks, bonds, jewelry, coin collections, and your home are all considered capital assets.

Hm, no mention of crypto.

That's how early in the game we are.

Google, what say you?

If Bitcoin is held as a capital asset, you must treat them as property for tax purposes. ... Like stocks or bonds, any gain or loss from the sale or exchange of the asset is taxed as a capital gain or loss. Otherwise, the investor realizes ordinary gain or loss on an exchange.

Not super clear but I'll take it.

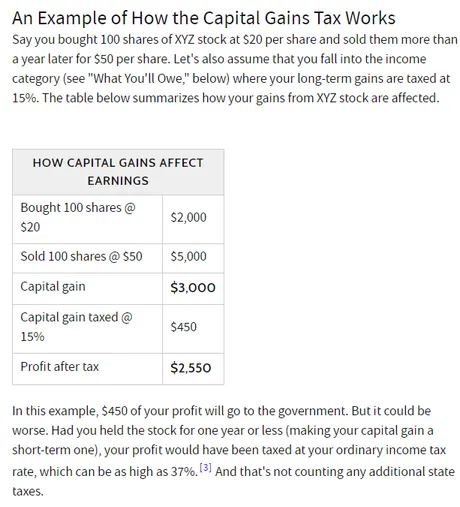

Short-Term vs. Long-Term Capital Gains

The tax you'll pay on a capital gain depends on how long you held the asset before selling it.

To qualify for the more favorable long-term capital gains rates, assets must be held for more than one year.

No Problem!

Now I would never do this, but wouldn't it be like really easy to lie about something like this? Would they even check? Imagine buying Bitcoin from someone in cash just because the money has been sitting in their wallet for a year. A month later you could sell and claim long-term capital gains tax and there would be no proof to the contrary. So many things about crypto are going to break the system going forward.

Personally, someone like me has no reason to be sneaky. It's not hard to hold something for a year or more before selling it. You could simply set up your investments so the crypto you sell has been held for a year, while the crypto you're buying can't be sold until that time-limit is up. Sorted.

Any gains on assets you've held for one year or less are short-term capital gains, which are taxed at your higher, ordinary income rate.

Tell me more, Investopedia!

Okay, cool, just as one would think...

While the tax rates for individuals' ordinary income are 10%, 12%, 22%, 24%, 32%, 35%, and 37%, long-term capital gains rates are taxed at different, generally lower rates.

The basic capital gains rates are 0%, 15%, and 20%, depending on your taxable income.1 The breakpoints for these rates are explained later.

Whoa whoa whoa?

Zero percent you say?

How about we explain that NOW!

HAHAHA... WHAT?!?!

So you're telling me if I make less than $39,375 a year then I pay 0% capital gains tax? Bro, I made $12.5k last year and I was able to save more money than most people do.

Conclusion

So I guess I don't have to pay taxes after all. All I have to do is HODL and cash out small enough amounts that I don't bounce up to a higher tax bracket. Good to know, and incredibly surprising. Perhaps I'll get a second opinion on that before I start selling. This is the first time I've actually been compelled to say "not financial advice™" in a way that isn't meant to be ironic. I'm not a professional accountant over here.

Truly, my ultimate goal would be to renounce my citizenship altogether and move to a crypto city-state that actually cares about privacy and the citizens it claims to protect. Unfortunately, I obviously don't have a lot of options on that front (oh wait, I have zero options on that front). Baby steps.

Still, it's actually kind of mind blowing to think that I could easily play by the rules and pay zero taxes for astronomical crypto gains. Oh course I won't be able to 'realize' those gains without paying taxes; no lambos for me... but still. Kind of amazing.

$39000 a year works for me just fine.

Return from Investopedia: Capital Gains Tax 101 to edicted's Web3 Blog