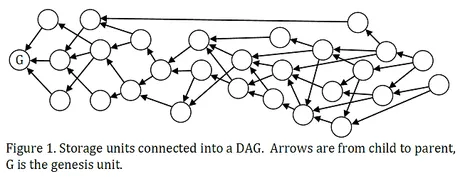

Directed Acyclic Graph coins are an exciting new technology that evolved in the face of cryptocurrency. DAGs are their own technology and have a completely different foundation than the blockchain does. They are basically blockchains with multiple threads that are intertwined. One common theme I've noticed about DAGs is that in order to post a transaction you must first verify two previous transactions. It is in this way that the coin is Directed and not Cyclical. A past transactions could never verify a future/present transaction.

The nice thing about DAGs is that, in theory, the larger the network becomes the faster and more secure it gets. This is pretty much the opposite of blockchain, which has huge scaling issues. It's also said that DAGs are naturally quantum resistant, so even if quantum computing broke encryption we would still have a handful of very solid cryptocurrencies. This raises the question: will DAGs inevitably take over as the world's first choice for processing payments?

I've been looking at three different DAGs during my blockchain research. In order of highest market cap they are IOTA, Nano, and Byteball.

IOTA (Internet of Things Application)

This coin seeks to be the foundation of "The Internet of Things".

The Internet of Things (IoT) is the network of physical devices, vehicles, home appliances and other items embedded with electronics, software, sensors, actuators, and connectivity which enables these things to connect and exchange data.

Basically IOTA wants to be the foundation for self-driving cars and anything else connected to the internet. One of IOTA's main selling points is that there are no fees or miners. This will allow micro-transactions for any amount to be processed on the network. This frictionless business model is absolutely essential when considering The Internet of Things because users may want to sell a service for pennies at a time with a very high quantity of transactions. This works out perfectly because more transactions equals faster speeds and security.

Even the name iota implies microscopic activity. Because there are no miners, all IOTA has been premined and no more will ever be created. The number of IOTA in existence is the MAX_SAFE_INTEGER in JavaScript equal to 2,779,530,283,277,761 (2.78 quadrillion). If you look at IOTA on the market cap it shows only 2,779,530,283 coins. This is because most exchanges are measuring IOTA in terms of MIOTA or 1,000,000 IOTA. So instead of IOTA being worth around $1 it's actually worth one millionth of that. This ensures that micro-charges will always be possible. IOTA would have to go x10000 for a coin to be worth one penny.

The problem with IOTA is that it isn't mainstream yet. This makes the network vulnerable to attack. To combat this, the foundation has created a coordinator node that secures the network. Many people complain that this node makes IOTA centralized, but the foundation has plans to remove it in the future when there is a better node distribution.

Because all coins were premined, this means that the coin distribution is also centralized. Like all other cryptocurrencies, decentralization is tough so hopefully soon™ there will be a way to earn coins without simply paying for them with fiat currency.

https://coincentral.com/what-is-iota-cryptocurrency-coin/

A number of crypto technology experts have questioned IOTA’s viability as a platform. Implementing so many new technologies at once, it’s difficult to believe that there are no weaknesses or flaws in IOTA’s implementation. The technology behind IOTA simply hasn’t been tested enough to know how it will work at scale, and how it will hold up to attacks. This overall lack of testing and peer review is the biggest concern for IOTA’s detractors.

Like many cryptos, IOTA has amazing potential, but we'll just have to wait and see where development leads.

Nano (Formerly Raiblocks)

IOTA's DAG is called the Tangle while Nano's DAG is called the Block-Lattice. The block-lattice gives each wallet it's own special blockchain called an account-chain. Scalability is achieved because you can update your own chain asynchronously from the rest of the block-lattice network.

Like IOTA, Nano has no miners or fees. Nano also uses a form of Delegated Proof of Stake just like Steem and EOS.

The thing I like most about Nano is that it's trying to do the simplest thing possible. Nano just wants to be used for payment processing. No Internet of Things. No smart contracts. This means all they have to worry about now is mainstream adoption, marketing, security, and vendor acceptance. I have a great appreciation for projects that don't bite off more than they can chew.

Byteball

Speaking of biting off more than you can chew, Byteball has the most potential of any DAG coin I've looked at. Unfortunately, this also gives it the highest risk/reward and greatest chance to fail. Byteball has the ability to incorporate both smart contracts and privacy coins. It's a very ambitious project, but don't be surprised if it falls flat on it's face.

Still, at the same time, don't be surprised if it just takes a while before it becomes a standard crypto. Byteball's ability to create smart contracts could be a huge deal. It's the only DAG I've researched that can do it. Also, as time goes on, privacy is going to be very important because there will be more and more ways to violate the transparent nature of cryptocurrency. This is definitely a coin to keep your eye on just in case it starts delivering.

Conclusion

DAG tech is very promising and full of potential, but may be just a little ahead of it's time. We may have to wait for crypto mainstream adoption before this technology is truly needed in the cryptosphere.

Crypto tech is running in every direction at once. I don't think that DAGs can take over the entire space, and I wouldn't want them to. However, technologies and redundancies make this space very strong and unassailable. Some cryptos may fall to attack, but this will just make the ones left standing even stronger. DAG investment is a great way to hedge your bets and diversify your portfolio. If even one of the coins you choose goes x1000 it makes up for every other failed investment.

Return from Is DAG Technology the Future of Payments? to edicted's Web3 Blog