The road to recovery is daunting and arduous.

Healing takes a lot of time and injuries sustained can be devastating while on the mend. It's no fun being crippled. Anyone with a hardcore back injury or whatever else can tell us that. Perhaps being economically crippled is even worse.

The perceived economic damage to our portfolios during this time has been a true test of HODL culture. Let's be honest: Crypto Twitter has failed miserably. Many have found themselves emotionally thrashed and/or enslaved by FUD. These crashes, much like dangerous physical encounters, are triggering the fight or flight response for many as this fear runs rampant across the sector.

The key to mitigating damages in the long term is rooted in prevention. We must be preemptive rather than reactive. We must employ strategies that prevent the damage from ever happening in the first place rather than focusing on mending that damage after the fact.

It doesn't matter whether the damage caused was emotional or physical, it's always better to have an insurance policy and spend a little bit of extra effort to avoid these issues entirely. Of course we can't prepare for everything, but we can maintain balance in our lives. Pushing to the extremes often ends poorly.

If we're going to the gym, we should stretch and do warmups to avoid pulling a muscle. If we're investing in one of the most risk-on assets in the history of the human race, we should take a more balance stance to avoid getting destroyed on the downswings. Such a simple concept, and yet so rarely employed. Gamble gamble.

Never forget... 2018

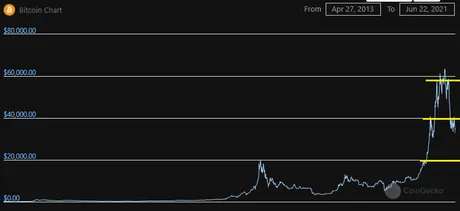

Now more than ever it's important to remember the last bear market we sustained. Many seem to think we have already started the next bear market, which is patently absurd. As soon as we get back to the doubling curve the bull market will immediately be back.

2021 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $13867 | $14933 | $16000 | $17067 | $18133 | $19200 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $20267 | $21333 | $22400 | $23467 | $24533 | $25600 |

As we can see from this metric, that has been scarily accurate for almost a decade now, there actually isn't enough runway left for even a year-long bear run, let alone a multiple year one that so many people seem to be panicking about. Hell, we don't even have enough runway left for another month of bear market. We are one 35% dip from being back at the curve and fully back in a bull market. Simple as that.

How is this possible? Because we only experienced a regular bull run (x3.5 curve), not the mega-bull (x10+) run we were expecting at the end of the year. Fitting considering how it isn't the end of the year yet. My how quickly everyone forgets that most of the gains of the mega-run are made within three weeks.

Bitcoin is still doubling every year with mind-boggling precision.

I'll let you know when the pattern fails to deliver. So far it's been nothing but aces.

Timelines

If for some reason we don't get the fabled mega-bull run this time around, it's just a regular run. Regular runs only take 3-6 months to crash back to the doubling curve, the most recent of which was the 2019 summer run that went from $13k to $7k from July to November. The COVID crash doesn't really factor in here as that was a one-time event that recovered in three weeks (exception proves the rule scenario).

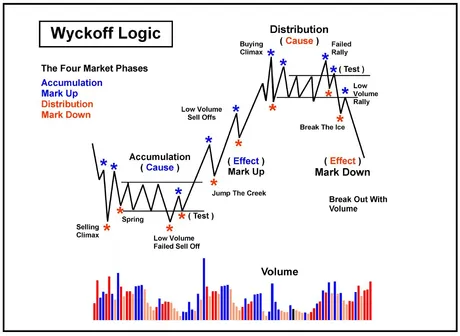

So what we really have to ask ourselves is: do these current timelines make sense? Look at the chart. We lost all our gains in 10 days and we've been consolidating for a month. How is that a bear market? Legit: that logic makes zero sense. The technical analysis here is a textbook Wyckoff pattern.

It doesn't get more textbook than that.

- We had a distribution phase for 3 months.

- We had a brutal markdown over 10 days.

- We've been accumulating for 1 month.

And this is all happening during the mega-bubble year of 2021. There's such a strong chance that we are on the verge of a reversal, and everyone is in complete despair over testing support for the third time.

That's the truly crazy part. Bitcoin hasn't even lost any value for a month but everyone is deadset on calling this a bear market because their alts are getting wrecked. Spoiler alert: your alts were overvalued and Bitcoin dominance was extremely low. Sorry, not sorry. Granddaddy Bitcoin needed your liquidity to maintain this support line, and granddaddy Bitcoin always gets that liquidity when it's available. Why is everyone so shocked? Infinite greed I tell ya.

WEN NUMBER GO BACK UP OMG!?!

What about DEFI?

Clearly, defi yield farms are the new ICO 2.0s. Everyone is throwing their money at everything because no one has any idea of what's going on except that you can x10-x100 your money if you get lucky... sometimes within a few weeks. It's pure gambling and batshit insane, but in many cases it feels like the odds are still tipped in the investor's favor. While this remains the case people will just keep throwing money at DEFI just like they did at ICOs in 2017/2018.

And then it all comes crashing down.

Like I said, we are still in the middle of a mega-bull run as far as I can tell. Still 50% higher than the doubling curve and everyone is freaking out calling for a nuclear winter. The absurd level of fear is just that: absurd. When the bear market actually starts, it's going to be way way way worse than what we just experienced. Probably even worse than 2018 (if that's even possible). Trying to forecast years into the future on one ten days worth of data is ridiculous fear-mongering.

So, like I said, yield farms are the new ICOs. What does this mean going forward? It means that people will keep throwing piles of money at everything until we hit an actual bear market and most of these projects lose 99% of their value. This actually NEEDS to happen eventually so investors can learn the hard way why they can't just throw money at everything and hope for the best.

This is why the only farm I'm messing around with is CUB. I have no intention to "diversify". In crypto, diversification is an oxymoron. The lower one goes on the market cap the more risk they incur.

And risk they shall!

Investors aren't going to learn their lesson from these farms until they lose it all just like they did with ICOs. Sure, you might be able to get a yield of 20,000% on some of these new farms. So what? That's completely unsustainable greater fool's theory gambling. We need sustainable solutions, not an endless string of pump and dumps.

A 40,000% yield on an asset that crashes to zero turns into a 0% yield real quick... aaaaannnndddd it's gone. This purge absolutely needs to happen so that the survivors can stop getting diluted by all the garbage out there. Shit gets done in the bear market, but again, said bear market isn't even close to starting.

Bull markets are for starry eyed children looking to escape the clutches of scarcity and debt-slavery. Bear markets are for grizzled survivors more determined than ever to make it back to those euphoric victories. Volatility breeds volatility. To expect one side of the equation without the other is pure denial and the rejection of reality (until it slaps you in the face months later).

Conclusion

Bear markets have a great and terrible purpose, but we aren't in one. Wanna know how I know? Because the mob is always wrong. Again, we don't even have enough runway left down to the doubling curve for even a single month more of downward action.

Regular bull runs do not breed year-long bear markets. That's how long Bitcoin bear markets last: 1 year, and they only happen after a mega-bull run, not a normal one. Normal bull runs simply correct to the doubling curve over the course of a few months. We've corrected one time over ten days. Do the math. Most of the FUD out there is totally make-believe fear-mongering based on non-existent patterns that have literally never materialized.

The absolute worse case scenario is just a classic head-and-shoulders pattern back to $20k.

That's not a bear market.

It's 4-8 week correction.

Posted Using LeoFinance Beta

Return from It's a long road. to edicted's Web3 Blog