Ah another year has passed.

I must have completely written and posted yesterday before even realizing I find myself one year older. To be fair I have been sick and literally having these crazy hallucinatory fever dreams (minus the fever) so that might play into it a bit. Another November 14th has come and gone. What's happened?

Mid November is always a critical time for crypto that sets the tone.

- 2016: Only up.

- 2017: Amazing

- 2018: Sucked

- 2019: Not good.

- 2020: Amazing

- 2021: Top

- 2022: Bottom

4 year cycle still seems to be in play

Given this pattern we would expect 2023 to mimic what we saw in 2019. What did we see in 2019? A crypto winter for most tokens and a nice x3 bull run for Bitcoin during the summertime. Sounds about right considering the circumstance. Especially true when we consider that even if Bitcoin goes x3 in 7 months that still puts the price below the doubling curve. The market is comically oversold because of three separate overleveraged collapses on top of a recession. It's going to bounce eventually, and when it does, it will bounce hard. Of course we might have to wait several months for that to happen. For example the 2019 run up didn't begin until March. Get ready for more crabwalk.

coffee

Being sick this long has allowed me to completely tame my caffeine addiction, so that's interesting. I haven't made coffee in over five days. Leave it to a cold to be so draining that even my addictions aren't fed. Weird.

I keep having triggered cravings to make coffee... having them right now in fact just talking about it... but they are easy to ignore at this point now that I'm not comically dependent on the stuff. Time for a reset. I'll keep avoiding coffee for as long as I have the cravings just to get it fully out of my system without a reboot (which is what happened last time I tried to quit).

This was a triumph

I'm writing a note here: "Huge success!"

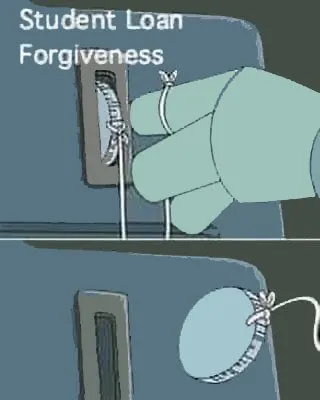

Lot's of people seem to be talking about the predictable actions of the Biden administration. Telling everyone college loans would be forgiven, with news to the contrary denying it a day after elections. I mean we did see a lot of pushback to the forgiveness in the first place, but to see a judge slap it down definitively as "unconstitutional" the literal day after elections? Quite a sight to behold, even if he was republican.

Not that it matters. Less and less people are trusting that our elections are fair. Go figure. Every single time there's a late ballot count the democrats end up winning. 12 for 12. What are the odds? An expert makes sure to tell us that no funny business is going on. Ah well he's an expert we should believe him I see no problem with it now.

To be honest I can't complain too much about democrats winning because I lean left on quite a few political issues, but it's just alarming to see more and more people wake up to the fact that this system is completely rigged. It signals a very brutal transition to something much more authoritarian if the peasants refuse to stay in line. Great Reset indeed!

Speaking of which...

Hedge fund manager Michael Burry of "The Big Short" fame cashed out his chips and now only owns stock in one company: private prisons operator Geo Group. Aug 18, 2022

Yeah... guy who predicted the Housing Crisis sold all his stock in everything except for the prison industrial complex. If that isn't the darkest bet of all time I don't know what is.

And not just regular prisons: PRIVATE PRISONS

FOR PROFIT PRISONS

The worst kind of prisons there are, because every single inmate is actually a slave that works under threat of torture, on top of siphoning tax money from the rest of us. The living conditions in private prisons are abysmal, because the business model depends on serving inmates the lowest quality food and the most overcrowded living arrangements. Seriously, even if Burry is correct in this assessment he's a straight up punk bitch for feeding money into it. What an asshole.

Luckily his last bet hasn't panned out so well. When's the last time you heard anyone complain about the price of clean water? Him buying up water rights in the mountains has yet to pay off, so maybe at this point he's just some crazy doomsayer that got it right once and thinks he's a genius. These things happen.

The GEO Group, Inc. is a publicly traded C corporation that invests in private prisons and mental health facilities in North America, Australia, South Africa, and the United Kingdom.

And mental health facilities?

Let's hope that's where his focus lies. Would certainly make sense considering the situation.

In any case.

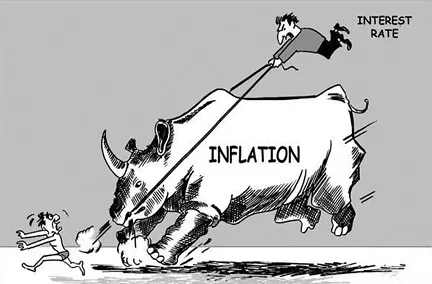

"Inflation" is coming down. Want to know why? Just kidding it's the same reason I've already said a dozen times. Because it never happened in the first place. The money supply did not increase. All the reports are missing their targets to the low side. Most recently the PPI (producer price index) came in lower than expected as well (meaning people who make things can make them slightly cheaper than before).

LoL... yeah... just wait.

It takes NINE MONTHS for a FED fund rate increase to cycle through the entire economy. That means that we haven't even seen the vast majority of the affect on the economy from these increases. Combine this with company after company after company coming forward to announce they are going to layoff workers... yeah, we can see where this is going, and it isn't good. We are headed toward a deflationary recession of epic proportions.

Apartment to myself.

Another weird transition that happened yesterday was that my partner and roommate started working back at the office again. It's so quiet here. It's been a long time. There office has been under renovation since April. So many transitions in such a short time. What are the odds?

Conclusion

2023 will almost certainly be a year of regulatory overreach, especially within the United States. Bitcoin fixes this. There's a reason why FTX dumped all their Bitcoin the second users deposited it onto the platform. Ironically it's the exact reason why we should want more. Bitcoin can't be repackaged and overleveraged over and over again. You either have it, or you don't.

Think of 2023 as you would 2019; mostly pretty boring with one really nice bull run tucked in there somewhere. As we continue to scrap rock bottom and wait for the contagion to settle, remember that we are still in the 'bad news is good news' phase of the economy. Unemployment is good for "inflation". Layoffs are good. People don't matter. Welcome to capitalism.

It did not make a whole lot of sense that democrats had so much success during this election. Democrats have failed in pretty much every way they could have failed over the last two years. They attacked the middle class harder than any time in history. They were constantly hypocritical and never led by example, and they were perhaps the most authoritarian as we've ever seen them.

Personally I was looking forward for power to be a bit more split so that neither side could get away with anything truly stupid. There's a very good reason everyone expected a Red Wave to takeover the house and senate. Now that red wave was nothing but a Red Mirage, just like the news outlets and "experts" told us would happen. How many coincidences need to be stacked on top of one another for all trust to be lost? Let's find out!

Posted Using LeoFinance Beta

Return from It's my birthday! (not) to edicted's Web3 Blog