Alright so it's been three weeks since Bitcoin started pumping.

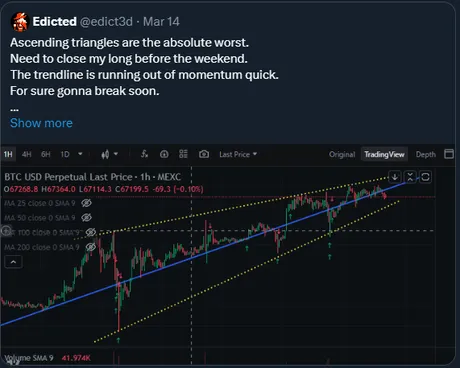

March 15th is here, so how did my predictions do? Well we certainly have not experienced a blow-off top, but rather the trend was slowly and strongly up the whole time into and above all-time-highs. However, yesterday the signals for reversal were painfully obvious.

LINK

Yep

Called it pretty perfectly. The Bart Simpson move we got the day before was clearly a bad omen. The ascending triangle is also bearish. Once volatility was gone the trendline collapsed.

7 hours later...

5 hours later... dead cat bounce

So I did what I said I was gonna do, I pulled out thousands of dollars at $71.5k to pay back my debts and load up my bank account. On top of that I opened a short to hedge the position. I have to say I was not happy about it, but obviously I feel a little better and vindicated about it today now that we are down even farther. It can always go down more. Never forget that.

The price currently trades in No-Mans-Land and there is no trend. The price has collapsed too hard and too fast over a sustained period of time to see any kind of new pattern or trend. However, there are a couple of different metrics we can use to guess what the next floor will be.

I hate to say it but it REALLY looks like a bearish head and shoulders pattern. This is something I can't ignore because I've been predicting this top for 3 whole weeks and here it is almost exactly on time. If we don't make a quick recovery within days and just chug along $65k-$70k range during that time I'm going to have to expect a crash down to the next level at $62k.

$62k

When trying to find a support line to retreat back to I always take a look at the 25-day moving average. It just so coincidentally happens that $62k is both the the MA(25) AND the next leg down on the head-and-shoulders. That's hard to ignore. Wouldn't be surprised if we caught a bid there but also I think April is going to be a long and punishing month so that's probably not a low enough target for a local bottom.

$58k

Looking at the chart nothing happened at $58k, which is the perfect reason to suspect it might be significant this time around. Hardly anyone got the chance to buy here, and there is even a social media Bitcoiner community specially called the $58k Gang (created during the peaks of 2021). This is a place I'd bet on holding or at least putting up a good fight for a good chunk of time.

Another reason to bet on $58k is that a dip here would be extremely consistent with previous dips we've seen. A dip from all time high to $58k is 21%, which is the exact type of dip we are looking for in this environment of aggressive and consistent ETF buyers. I'll definitely be throwing a bid in a this level if only to say I held the line with the $58k Gang.

$50k

The final destination of the head and shoulders pattern would take us all the way down to $51k or maybe even a little lower. I don't actually expect this to happen, but if it does I'll be making a big bet that it will recover here. No matter what happens I'm going to continue assuming that April is bearish. We could spike to $100k from here and I'd still place my bets in this way.

Other possibilities

The absolute best situation to be in is one where Bitcoin crabwalks in the $65k-$75k range for the rest of March and into the entire month of April. That would be an incredible outcome and would likely spark a nice little altmarket for everyone else, much to the maximalist's dismay.

The final and least likely thing to happen at this point is supply shock sweeps over the market completely randomly and sends us parabolic. After all the signals we just got I'm not going to hold my breath on this front. We made it the 3 weeks; we are out of runway; time to prepare for a pullback and some halving event disappointment. The rumor will not live up to the hype, even if it is just a V-shaped move like the ETF launch.

All this being said we really do need some more information here, and I think next week will signal the new trend into April. This market is wildly unpredictable and volatile. In my opinion we should easily already be at $120k because of how many tokens the ETF has sucked up. The market doesn't care and wants to play this speculation game. Let's see who wins.

I'm betting on the $58k gang.

New trendline just dropped? Woof. Down. Down. Down.

Return from It's so over! to edicted's Web3 Blog