DogeCoin Moon Machine

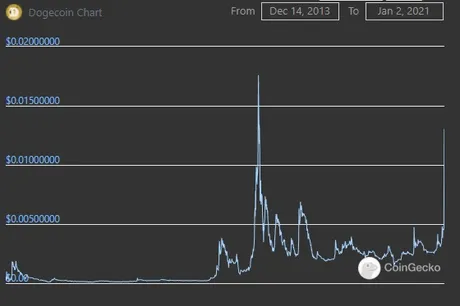

First order of business, Dogecoin spiked up 40% yesterday. I was pretty happy about that, thinking it only needed to double to reach 1 cent parity per coin. Lo and behold a day later the price is up 140% in a couple days. It's almost at all time highs. This is a great development for the alt-market at large.

Bitcoin posted a six-hour candle that put all other 6-hour candles to shame. It's important to note that last night there was at least $100M sell wall at $30k between Coinbase and Binance, so the true number across all exchanges was much higher than that. This number got liquidated immediately and we posted another measured $3500 flag.

However, instead of spiking up within 24 hours like normal, this time all the gains were made during the 6-hour candle... impressive. We may want to reset the "two weeks to peak" metric because of this goliath move.

This puts us on our third flag up, but it looks like we have at least one more to go. Another $3500 gain would put us at $37k... the exact level above the doubling curve that we were in Q2 2019.

I personally sold some Bitcoin at the $29.9k level because that sell wall was massive... but I also set up a stop loss at $30.1k just in case the wall got bought out. Pretty glad I did that... now I'm still sitting pretty.

When should I sell?!!

How much should I sell?!?!

Well as I write this post Bitcoin is aggressively crashing and losing a lot of the gains it just made.

Is the price wedging and completing the flag? Or is this the signal that the top is blowing off the volcano? I guess we'll have to wait and see. If we lose all of those gains and crash back to $30k, there's a significant chance this party is over.

In fact I can't write this post fast enough... because it just happened...

We lost all those gains... the USD spread is spiking to $50-$100... just like that... this volcano top has blown, and this parabolic run is likely over. It's time to take some gains.

Here's the problem with trying to trade during the mega-bubble year:

2017

This is the mega-bubble year of 2017. We are in another mega-bubble now 4 years later in 2021. So, show me where in 2017 you should have bought and sold to make a profit... anyone?

Yeah, exactly, if you tried to trade 2017 in all likelihood you would have gotten straight up wrecked. The same may very well be true in 2021. Trading in a mega-bubble year is very risky, because the price can always go higher than where you sold... like... really easily.

Conclusion

This post was supposed to be about market cycles and how I'm changing my thought process up a bit... but I was very rudely accosted by a possible volcano blow off top in the middle of it.

We're gonna have to give this market a couple of days to see where we are at. If we end up posting another all time high in the near future it's going to be hard to tell where this is going. Personally I think this morning marks the end of this bull run and we are going to trade volatile sideways for the entire month of January.

Posted Using LeoFinance Beta

Return from KABOOM! to edicted's Web3 Blog