I know I've already blogged about this topic several times, but there's a lot of angles to come at this from and even more reminders that need to be issued. As a DPOS network created by by literal Steemit Incorporated employees... knowing more about Koinos can help us understand our own network a little bit better as well. Why did they leave Hive to create a new thing? Perhaps they know something that we don't, or even more likely signed a non-compete clause that legally prevents them from doing so. To be fair all devs know the joy of abandoning a spaghetti factory project to start out fresh and try to "get it right this time". Untangling spaghetti is a god damn nightmare. Shoutout to our own devs who are putting in the work.

OMFG it works! How does it work? Who cares! It works!

OMFG it works! How does it work? Who cares! It works!

No such thing as free transactions

I'm getting very tired of DPOS devs thinking they've solved the issue of fees with a 2.0 upgrade that is superior in every way to the old system. They absolutely have not and it's really fucking annoying that DPOS devs either don't understand the pros and cons of creating a bandwidth derivative, or they simply don't give a shit and want to shill their own network. Both of these forked scenarios are unacceptable and seem to be the paths we continue walking down to our own detriment.

Yesterday I was on Twitter being a little contrarian bitch as always (my glorious 'new' brand) and I was talking trash about this very issue. Ruffled a few feathers of some people who I don't even know, but seem to be hardcore Koinos fans. That's cool: I hope the network succeeds. That's good for everyone. It's not a competition.

And the reason it's not a competition is because it's impossible for a single decentralized network to scale up and capture the entire shebang. That's the entire point of decentralization; it's wildly inefficient. This is something that maximalists who only shill their own network fail to realize: their network can't do everything. In fact their network is just a tiny piece of a gigantic puzzle. Greed gets in the way of this knowledge, and many refuse to understand it, often deliberately.

It is simply not possible, on a technical level, to create something like a decentralized Facebook. Facebook already had a hard enough time scaling up as it is... now you want to build a redundant system where at least 100 nodes are all storing the same information across the board? Yeah: not possible. Maybe in a decade or two. Maybe. Until then, dream on.

If we look at a network like Hive or Koinos that promises it can scale to the moon: That's just game theory. The actual bandwidth on DPOS chains at in this moment isn't more than Bitcoin. Imagine that. It's simple math:

- Bitcoin: 1-2 megabytes per block... let's say 1.5 on average. That's 79 gigabytes per year.

- Hive: 65 kilobyte max blocksize 651 gigabytes maximum. Both https://hiveblocks.com/ & https://www.hiveblockexplorer.com/ Do not show the size of the actual blocks we produce. Because we're fucking noobs. Assuming we only fill up 10% of our blocks on average we are processing the exact same amount of data as Bitcoin.

And this is the point in the conversation that a lot of people (including top 20 witnesses) would counterpoint with the idea that we can increase our blocksize. And to that I say: no, we can not. If anyone is even thinking about increasing the blocksize without first stress-testing the current blocksize they are not to be taken seriously.

Think about how many times critical infrastructure on Hive has just failed and websites were down because this or that thing wasn't working. More often than not, when one frontend to Hive is down (like peakd.com or leofinance.io) they are ALL down. That's inherently centralized bottlenecks getting in the way of robust 99.99999% uptime, which is clearly the uptime that Hive should have (if not even better). We have received zero indications from actual real-world implementation that Hive is ready to scale up any higher than it already is. This should be obvious to anyone that actually uses the product, and yet, it is not obvious somehow. Why is that? Perhaps it's because we are told over and over again how much this thing can scale (in theory). Drinking the koolaid.

You know what network actually does have the ability to increase their blocksize? Bitcoin. The BTC network could easily do it, but they are extremely conservative so it's going to be a while before that actually happens. This is a good thing considering BTC is the backbone of the entire industry. No need to build a bigger anchor when the current one does its job just fine; that would just weigh down the ship.

And on top of all this: Bitcoin ONLY DOES P2P TRANSFERS (in practice). Compare that to something like Hive where I'm going to click "publish" and post this entire monstrosity of a blog post directly to the chain. Think on that for a moment. Bitcoin doesn't have that kind of weight on it. It's far sleeker than that and serves a very important niche.

Then why are BTC fees so expensive?

Because the thing that Bitcoin does (security)... well, they do it exponentially better than anyone else, and the world is willing to pay a premium for that service. Have you seen the hashrate chart? Holy hell, Bitcoin aint never getting rolled back for nothing. No double spends here. No changes to the ecosystem. No bullshit. It does what it was built to do, while many other networks are still trying to find their niche.

But this post isn't even about Bitcoin... is it?

Nah, it's about DPOS and the bandwidth derivatives we are shilling as the ultimate upgrade to on-chain network fees (which they absolutely are not). Everyone seems to be looking at where the ball is today rather than where it's gonna be in ten years, so allow me to elaborate (again).

Here's what's going to happen:

- DPOS chains like Hive and Koinos will gain adoption.

- This adoption happens faster than the network can scale (always).

- The governance token that creates the bandwidth will become too expensive for the average person to get the bandwidth that they need.

- A secondary market will emerge where the bandwidth resource will be sold separate from the governance token.

- We run in to the exact same problem of on-chain fees, except different. In this scenario we create a rent-seeking scenario just like bid bots on Steem. Those with stake sell their bandwidth to those that don't. Arguably this is even worse than on-chain fees.

No one thinks this far...

Why? Because if it actually happens all of us will be millionaires, and the people at the top will be multi-billionaires, so nobody actually cares what happens to the plebs or the future of scaling for the network. Fuck it! We ball! Amirite?

Shit I was more right than I thought!

Shit I was more right than I thought!

What does Koinos think about all this?

I decided to do some actual research yesterday instead of just full on know-it-all talking out my ass. Turns out I didn't actually need to do the research as my know-it-all strategy was spot on, but it's nice to have some evidence to back it up.

Two whitepapers! WUT?

Did you know that Koinos actually has a separate whitepaper just for bandwidth allocations (MANA)? Smart, it's a really important topic!

https://koinos.io/unified-whitepaper/

https://koinos.io/mana-whitepaper/

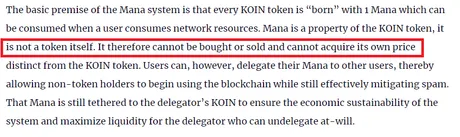

Very similar to resource credits

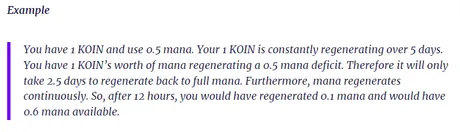

You stake Koin to create mana and post transactions to the chain. Basically that's how Hive does it as well: a timelock is employed to create a derivative bandwidth asset used to post to chain. It even has a 5-day regenerating period just like Hive. Makes sense.

What we have to realize is that given any amount of adoption that stress-tests the network, suddenly this bandwidth acquires a non-zero value. But don't worry about it the Koinos whitepaper has you covered BB!

Ah, you see?

The whitepaper pinky promises that their bandwidth derivative will never have a non-zero value! Thank goodness, I was getting worried! Eh, well, what about delegations?

We can see that Koinos has made some pretty impressive upgrades to the bandwidth derivative yield farming system. The way mana works is arguably superior and more streamlined than Resource Credits on Hive. Again, the reason for this is because they got to build their system from the ground up while we have to continue to build atop the spaghetti factory. However, what we have will still work in exactly the same way, we just might have to jump through a few hoops to get there. The end result will be identical, even if the way they do it is more streamlined.

Being able to charge the receiver the bandwidth cost is really cool because if I launch an app and want to offer completely free service all I have to do is acquire enough stake to subsidize all my users. All they have to do is charge me like a collect-call on a payphone (but what is a payphone, you may be asking). Kudos to Koinos for these new developments; we can learn something from them after all.

The problem?

Well, it's downright childish to make the claim that: a) You're going to get adoption. b) The bandwidth will never have value.

They can't stop a secondary market from popping up where users pay for mana directly, and it's foolish to claim otherwise. This is especially true considering how easy it's going to be to delegate MANA and create that secondary MANA; it's already baked directly into the cake. We have to ask ourselves: if they are wrong about this, what else are they wrong about? Whitepapers are largely meaningless in this regard. It never works out the way the founders expect it to.

So what is the advantage of on-chain fees?

Like I said, creating a 'free' derivative asset is not a 2.0 upgrade to the bandwidth problem (although it is a pretty cool implementation IMO), and expecting that everyone will eventually transition to this solution is incorrect. There are pitfalls.

Stagnation

When we create a derivative asset that represents bandwidth to be yield-farmed, the stakeholders unilaterally control the network. This is not the case on Bitcoin (stakeholders have very little say on BTC, which is good and by design to prevent a hostile takeover).

Say someone builds an app on DPOS that is sub-par and isn't nearly as good as other apps on the network. This doesn't matter if the founders of that app have enough stake to force the network to give them bandwidth to operate. The sub-par app will continue to dominate the network because that's where the stake is being allocated. Other apps that are clearly better will be choked out because they didn't get in early enough.

Comparing this to a network with on-chain fees like Ethereum, we see that this is no longer an issue. Every app must constantly be fighting for its life in the jungle. There are no subsidies; There are no guarantees. If today your app is good and worth paying the on-chain fee: great. If it completely breaks down at the seams during a bull market spike: you better figure your shit out and streamline it so it doesn't use so much bandwidth.

Conclusion

The bottom line here is that networks with on-chain fees are going to prove themselves to be far more competitive over time without having the option of getting soft and lazy like DPOS apps on a chain that guarantees them bandwidth for 'free'... forever. Users on DPOS chains can not seem to envision an environment where the derivative asset that represents bandwidth would ever have value, which is comical because any level of significant adoption guarantees the bandwidth to have value. It's going to catch many by surprise when it happens. Not I. I will be ready for the inevitable rent-seeking bandwidth market.

Yield-farmed derivative bandwidth tokens are largely underappreciated by those outside the DPOS system, while overappreciated by those within it. We love to advertise our chain as one that has zero transaction fees, but that simply is not the case. Any network that actually offered free service would immediately be Sybil attacked and destroyed due to the systemic failure of providing free service on an open network. There is no getting around this fact: WEB3 isn't WEB2. Get over it.

Far too many people out there think that WEB3 needs to offer free service to compete with WEB2. This again is incorrect. WEB3 is defined by paying for service. The difference between WEB3 and WEB1 (subscription model) is that WEB3 actually pays users to engage with the network in productive ways using proper monetary incentives. Even though it costs money to use the system, one can easily make a lot more money just by trying to be a productive member of crypto society. In this sense, the user becomes an employee of the network, and that's a great thing. We just need to understand the bumps in the road we are about to drive over before they knock us out of the cart.

Return from MANA: Koinos' Yield-Farmed Bandwidth Derivative to edicted's Web3 Blog