Yesterday when I was ranting about Koinos/Hive and their respective derivative bandwidth assets I happened to step in a huge pile of figurative intellectual shit. I made the claim that Koinos is DPOS. Many of my readers hyper-focused on this misrepresentation even though it has absolutely nothing to do with the point I was trying to make. However, I hold myself to a higher standard than most people and it would be a bit silly to simply shrug something like this off like it was meaningless.

To quote myself in my last post about the Koinos Whitepaper:

We have to ask ourselves: if they are wrong about this, what else are they wrong about?

I mean obviously I'd be a hypocrite if I didn't apply that same logic to myself, yeah? Running around saying ridiculous stuff like "Koinos is DPOS" isn't exactly a great way to get people to trust what I am telling them. So today I'll try to be a bit more careful in regards to my research about Koinos and their consensus algorithm rather than cherry-picking the whitepaper to make a point.

It's also important to point out that I've been, shall we say, in a mood. I'm extremely combative and contrarian as of late; more than usual. Chalk it up to the bear market and the state of the world and my personal life and whatever else. It's certainly not doing me any favors in terms of networking and building value within this industry. So hey I might be a dick but at least I'm a self-aware dick, eh? I'm working on it. No promises.

Interestingly enough... considering I want to create a proof-of-burn token right here on Hive it is perhaps very important to understand exactly how the Koinos network operates. This is true even though my token would be completely different and more akin to a second-layer asset on Hive than anything else. So let's get into to the meat and potatoes of this issue.

I asked around for some resources on Koinos consensus/mining and received several good links.

What is VHP on Koinos Blockchain?

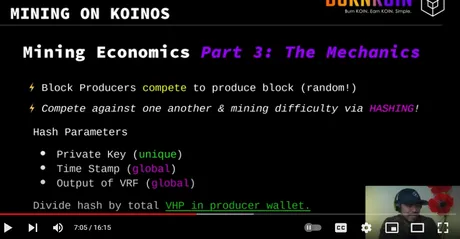

First of all Koinos has a little something called Virtual Hashing Power (VHP). Essentially you 'destroy' Koin in exchange for this derivative asset. It then acts as a multiplier to increase your chances of mining a block.

The more $VHP a user has, the higher probability they have of producing a block. Remember that block production under PoB is randomized so it is a game of probabilities and the only way to increase the odds is by having more $VHP.

Statistically, if a miner holds 1% of all VHP and runs a node with all of their VHP, then they will be able to produce 1% of all blocks in a year and this would scale linearly. Similarly, if a user holds 51% of all the VHP, then they can perform a 51% attack on the network much like PoW and PoS.

In trying to learn more about Koinos from the whitepaper and whatnot these were some of the issues that cast confusing without access to other resources.

Important bullet-points from this video:

- 2% inflation per year

- 100% of all inflation goes to virtual mining and minting new blocks

- The virtual supply includes tokens that were burned and exist as VHP (similar to Hive virtual supply liquidating all HBD into Hive).

- Random block production to simulate POW mining.

So the more VHP (burned Koinos) you have on your node, the higher the chance you have of producing a valid hash that is lower than the defined difficultly (basically the same as POW). However, this leads me to question how solo mining could possibly be more advantageous than pooling resources. At this juncture I'm also a little confused about iterations on the timestamp and pumping out more hashes than other competing nodes.

Funny because the second question may answer the first. If a node is limited by how many hashes they can produce in a 10 millisecond period, multiple nodes and solo mining suddenly make more sense. If you split your coins between two nodes you'd be able to pump out twice as many hashes and the end result would be the same number of Koin mined on average, implying that pooling resources only has the advantage of less volatility (just like POW mining).

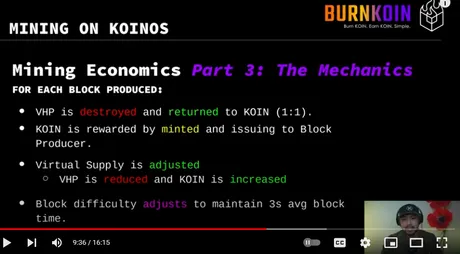

This is a slide that pointed out that KOIN is never destroyed during the mining process, only converted to Virtual Hash Power which will eventually be turned back into Koin when blocks are minted. I was a little confused on the subject before but now it's a bit more clear. At the same this is another reason for me to make the claim that Koinos isn't proof-of-burn because tokens aren't actually being burned, but rather converted into a derivative asset that will eventually come full circle at a 1:1 ratio. The tokens are never actually destroyed. All things being said I don't have a better name for this unique system so might as well concede this point. Surely proof-of-timelock would be more factually accurate but doesn't sound as cool.

Also important to note here that in addition to getting their VHP returned as Koin miners get a block reward on top of that (the 2% inflation metric).

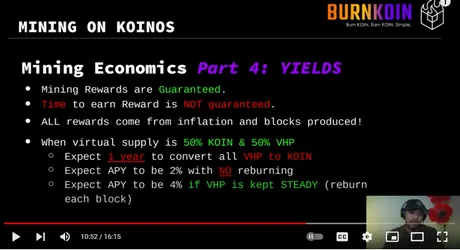

Again this is a very interesting slide that I find to be a little confusing. Koinos miners can expect to turn all the virtual mining tokens back into Koin after just one year, even though their chance of mining a block dwindles over time as their VHP goes down. I feel like I still don't fully understand this process, but I understand it well enough to cast judgment upon it. And this judgment is that I find it to be a very interesting system that I was largely ignoring before for various reasons.

Differences Between Koinos & Hive

This post was written by @justinw in response to my last post, and it has a ton of good information in it. I remember learning a bunch of this stuff back in the day but it's good to have a solid reminder now that the Koinos mainnet is actually up and running as of November 2022.

Can you believe that he was going to write this thing as a comment in response to my own post? A man after my own heart. Been there done that, lol. 2000 word comments for the win. People are passionate about these topics, and that's a good thing.

Highlighting important stuff from the post:

- Koinos does not have this by design as there is no stake weighted voting and no "rewards pool".

- Ability to perform chain upgrades without hard forks.

- General purpose smart contracts instead of being an application specific chain.

- Free accounts (bitcoin style) that don't have to be subsidized by anyone to be able to use.

I don't think I need to discuss the "exchange attack" and moving away from DPOS because most Hive user's here already know the backstory behind that.

Here is something I vehemently disagree with (respectfully).

Neither Hive nor Koinos have solved the custodial attack problem. Both Hive and Koinos can be thought of as proof-of-timelock tokens (which is why it's very easy to see that they both strong proof-of-stake elements as well). As long as a custodian is willing to timelock customer funds, they absolutely can influence on-chain governance.

Many would try to claim that this would make them insolvent, but those who make this claim need to be reminded that standard banking practice is a fractional reserve system... so think again. This problem isn't going to magically go away because Hive put a 30-day delay on governance votes, and it won't go away because Koinos forces miners to timelock their assets within a derivative that increases virtual hash power.

Given actual adoption, it is guaranteed that exchanges will start powering up Hive and converting Koinos to VHP at the request of their own users. This is the Trojan Horse gateway of fuckery that leads to exploitation down the road. Right now it's not worth it for them to bother with such things because adoption levels are quite low, but we've already seen them do it with yield-farming tokens that had higher market caps. Remember FTX? You think the FTX's of the future are going to give a shit about going insolvent in exchange for yield? We already know the answer. Regulators can do nothing about it.

Look at JP Morgan and the rest of the banking sector for a treasure trove of evidence to this effect. Once adoption comes the banks will always capture the regulators. Doesn't matter if those banks are regular banks or crypto banks. In fact we can easily make the argument that crypto banks will be even worse as crypto continues to exponentially gain value over time.

Please be reasonable!

It's so easy for these institutions to simply hide their liabilities and act like they are simply doing what their users are asking them to do. It's called being a proxy, and we can't stop them from doing it on a technical level without blacklisting accounts as custodians and tarnishing the fungibility of our assets, and even then the exchanges could easily sidestep such measures simply by creating anonymous accounts that aren't blacklisted.

Analysis

The really funny thing about all of this is that my posts that are the most aggressively inaccurate and the most triggering are also the ones that I learn the most from. I really have very little incentive to stop myself from doing it when it ends up being the quickest path to learning more. As I recall I've made this same conclusion multiple times in the past but it's been a while since it's played out like this. Last time was probably my understanding of the HIVE >> HBD conversion mechanic back in July.

Reward Pool

If you ask me the reward pool is probably the best thing about Hive. I've been planning to write a relevant post on this topic but haven't gotten around to it yet. The fact that Koinos has 2% inflation that goes 100% to miners makes it a completely different animal than Hive. After doing this research it's clear that the differences are so extreme that these two projects don't even exist on the same wavelength, which is a good thing. Diversity is important.

Technically Hive will eventually reduce inflation rate to 1%, which would be lower than Koinos, but I don't think this is a good idea. If I have anything to say about it in ten years we'll be jacking up the inflation rate and allocating it to obvious winners that bring in more value than they cost. It will be interesting to see if the risks that Hive takes will prove themselves worthy against more conservative networks like Koinos that opt to remove uncertainty and politics from the equation.

Compared to Bitcoin I also think that Koinos has the right idea. The halving event on Bitcoin leads to extreme volatility and uncertainty. No halving event on Koinos is great, and a 2% inflation rate seems pretty solid. It will lead to less volatility and more consistency, and because the mining is virtual in nature it will not be limited to real-world power consumption like Bitcoin (which is why the halving event must exist so that the price can actually go up without miners dragging it down).

Ability to upgrade without hard-forks.

This is something I remember from way back in the day and is highly technical. I don't fully understand it, but then again very few people do. It's a really cool and modular feature. Perhaps there is some downside to it, but I'd have to be an expert on the tech to tell you one way or the other.

General purpose smart contracts instead of being an application specific chain.

Always be wary about decentralized networks that want to do everything on chain. Everything is all good until it actually gets adoption and then all hell breaks loose because decentralized networks don't scale very well no matter how they are implemented. That being said I believe Koinos devs know their shit and this will be handled very gracefully for quite some time.

Free accounts (bitcoin style) that don't have to be subsidized by anyone to be able to use.

This is a big talking point that most would not realize, as it has many hidden implications. For starters, we can think of Hive accounts as an abstraction of code, and abstractions are inefficient. We can think of Hive accounts as NFTs. It's just like programming in Python vs C. Python is an abstraction of C: it is written in the C language, and is highly inefficient compared to C, but there are huge advantages to using a scripting language like Python over C.

Hive accounts as NFTs are the same thing.

We store them on chain, making them inefficient, but what do we gain? For starters, we gain the ability to have multiple keys associated with our account, modify those keys as we see fit, and even engage in account recovery when our account is stolen. Koinos can do none of these things because every public key has one private key and if it gets hacked you are fucked.

You can't have account recovery without timelocks and yields and reward pools and all that. More importantly you can't recover accounts if they aren't stored on chain as a child of a greater container like @account names and their associated posting/active/owner/memo keys. I think account recovery is one of the coolest features about Hive, so I wouldn't trade that for efficiency (but I do think it's interesting that Koinos chose this valid path and I respect that decision).

Number go up, number go down.

On one final note, something I'm always harping on is the need for elasticity within these economic systems to create long-term stability. Have you noticed that Koinos has some elasticity? That's pretty awesome. During a bull market miners will (hopefully) sell into the newfound demand and take profits. In addition to their mining reward, they get the burned Koin back as well, which can also be sold. This theoretically increases supply when the market demands supply with an increased drip of reclaimed assets.

The ideal state of the Koinos network is that half of all coins will get burned to increase virtual mining power. However, in the middle of a rampaging bull market where Koinos goes x10 or whatever, VHP tokens should decrease as miners realize gains and dump tokens on the overbought market. This in turn will make mining even more profitable for those who still have stake locked in the system. The opposite is also true: during a bear market we would hope to see old-school miners buying the dip, getting cheap koin off exchanges, and "powering them up". Of course greed might kick in and create the exact opposite scenario so we should definitely be paying attention to what happens in practice.

Conclusion

After doing all this research on Koinos I can safely say that I believe it's a really cool project with a true use-case and future. That being said I still stand by my previous assessments. When we are excited about a project we tend to exaggerate the ideal concepts when real-world proof is lacking. The idea that MANA will never have value while adoption increases is contradictory. Calling the platform "proof-of-burn" is more of a marketing selling point rather than actual reality. Nothing is being burned.

When you burn gasoline in your vehicle does the exhaust turn back into gasoline after a year's time? "Burning" tokens implies a permanent one-way transformation. Both Hive and Koinos are proof-of-timelock, which is a derivative of proof-of-stake. Delegated-Proof-of-Stake is also just a different flavor of POS. All of these systems rely on the stakeholders playing nice and following network incentives to turn a profit in accordance with the ruleset.

Calling Koinos DPOS is not inaccurate. There will be huge mining pools on Koinos that mint a lot of the blocks. People will "delegate" their "stake" to the block producers to mint blocks and earn yield. Spoiler alert: that's DPOS. What I'm trying to say here is that a lot of this argument is purely semantics that hinge on tiny details and definitions that don't really matter all that much. The only way to truly know is to do the research. Hopefully I've done a better job this time.

Posted Using LeoFinance Beta

Return from Koinos Consensus Algo: Proof-of-Burn to edicted's Web3 Blog