Very clickbait title, but it's kinda true.

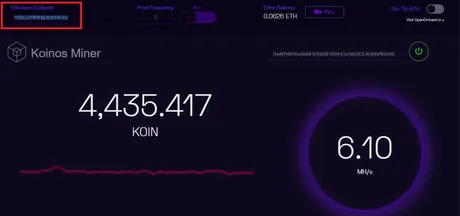

After changing the default "Ethereum Endpoint" to:

http://mining.koinos.io/

My miner has not crashed for the last 12 hours.

Good stuff.

Assuming I can continue mining 12k coins every week on average...

That's around 280,000 coins after 6 months... Weird coinincidence that I'm targetting a Bitcoin price of $280,000 Q4 2021.

However, it would probably be foolish to assume I can mine this many coins on this linear scale, because theoretically more and more users should start competing to mine the coin. The higher the hashrate goes up the less coins you'll get from your CPU power. Mining is a lottery and the more people who print tickets the harder it is to get a reward. This is how POW security scales up, as we've seen with Bitcoin.

Wait, so how much is one Koin worth?

https://app.astrotools.io/pair-explorer/0x3e9b04c0a11fc801335b0c436a3ae3dea0dc2188

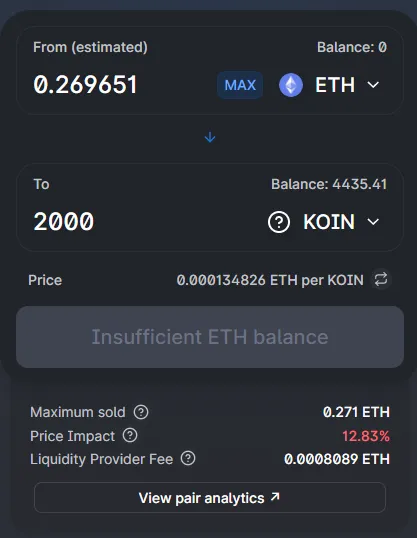

On this random Ethereum pool it's trading for 3.5 cents a coin, and it was trading at 5 cents earlier in the day. The liquidity is razor thin and the liquidity pools have less than 2 ETH in them.

However...

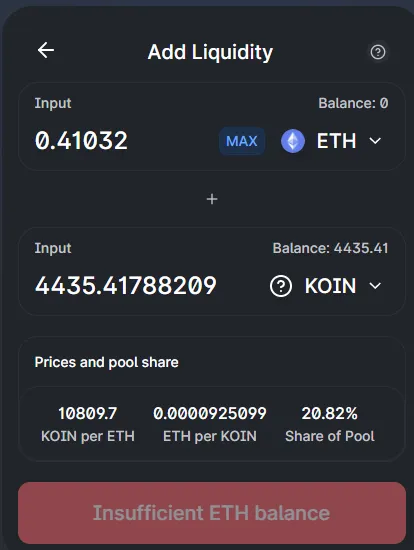

We can see on Uniswap that the lucky reward I mined is currently worth 0.41 ETH. That is INSANELY RIDICULOUS. Think about it, it cost me $2 to mine this Koin in gas fees, and I can mine this amount 3 times a week. Theoretically, that means PC mining (and my PC is 4 years old) could net me $450 a week at these prices. What?

WHAT?!?!?!?!?!?!?!?!!!!11

So yeah liquidity is razor thin. If I added my 4k coins to the Uniswap pool I'd own 20% of all the LP tokens. If I dumped my 4k coins the slippage would be steep and I'd only get like 0.35 ETH. STILL... THINK ABOUT IT! RIDICULOUS.

It's a damn good thing liquidity is so low and the Cryptonight (Monero, Zcash, etc) community doesn't know about this development yet. If they did they'd be dominating the pool and dumping coins hard.

How does mining work?

Remember back in the day when Bitcoin was performing poorly and a lot of entities had to full on shut down their mining equipment because it wasn't profitable? When mining competition gets fierce, you're doing well if your gross yield is double what the energy costs. You're doing really good if you're mining triple or quadruple what the energy costs.

So how much energy to mine Koinos?

Napkin math:

Say my computer is drawing 500 watts and I'm mining 20 hours a day. That's ten kilowatt hours. Say a kilowatt hour costs me 13 cents. That's $1.30 a day.

Meanwhile, at these prices, Koinos mining is netting me $450 a week? $64 dollars a day... x50 times what it costs to run my computer for the day. From a mining perspective, these prices are absolutely NOT SUSTAINABLE.

Therefore, we can probably expect a serious dump on the market at some point IF Koinos speculation doesn't remain very strong. Again, the ONLY way Koinnos can maintain a price close to the extremely thin liquidity one we've been given is if the speculation gets out of control and a lot more people want to buy rather than sell. It could happen, but if it does that's going to make mining EXTREMELY PROFITABLE and likely very competitive to counteract that profitable dumping opportunity.

Personally, I'm thinking about adding liquidity to the Uniswap pool for Koin. This would likely be a great way to buy coins, because Koin should flood the market because mining is so profitable. Therefore my 0.5 ETH would start getting drained from the pool and be replaced with Koin. This way I wouldn't have to pay exchange fees or the insane slippage costs associated with trading on a Uniswap pool with insanely thin liquidity. Uniswap pools allow you to "buy the dip" automatically using the algorithm as the market floods. All LP providers are simultaneously farming the dip (higher volume).

Again, providing liquidity to a Uniswap pool is a great way to hedge your bets. If miners dump Koin into the pool, that means I get to buy a bunch of Koins on the cheap (for less than 0.5 ETH). If speculation gets out of control and ETH floods the pool, I basically get to mine the most profitable coin in existence and get paid for my troubles in ETHEREUM. Good deal either way. All the while I'd be farming the pool and Uniswap fees, which should be quite large going forward if their is a lot of dumping/buying pressure at the same time.

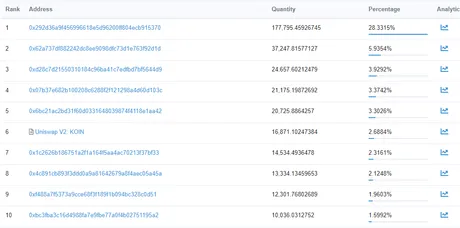

https://etherscan.io/token/0x66d28cb58487a7609877550E1a34691810A6b9FC#balances

Koin Richlist

As we can see here, the UNISWAP pool, even at razor thin liquidity (due to project being 24 hours old), is the 6th biggest account to hold KOIN at this point. Expect this number to rise as more users start mining, trading, and providing liquidity. I expect it should at least hit the #2 spot within a week or two.

Salty from wLEO

After a devastating hack that pretty much wiped me out for $10k, you'd think I'd be a bit risk averse to providing liquidity for Koin. However, Koins can only be minted in the event that the proof-of-work algorithm is solved. It's a fully decentralized solution, and it is near impossible for users to find some trick that will allow them mint coins out of thin air like was done with wLEO. Also, instead of putting $10k into the pool, I was thinking more like a couple hundred dollars (half of that being coins I mined for free). Numbers matter.

Totally unsustainable

There is ABSOLUTELY NO WAY Koin can maintain this token value from a mining perspective. Normal people like you and I shouldn't be able to x50 our power consumption using a personal computer that isn't even designed to mine.

Push-Pull

This is a battle of mining vs speculation.

It might get quite out of control.

You guys remember EOS ICO?

What if that had been minable with a CPU?

I guess we're entering the Yieldfarm Era.

Conclusion

All signs point to massive volatility of this newfound Uniswap pool.

I think I want to mine Koin and then mine the Koin liquidity pool on Uniswap.

Why not? Yield farm it twice.

Expect major competition to enter this pool if it gains any liquidity.

Details to come.

Return from Koinos The Most Profitable Coin to Mine in the World! to edicted's Web3 Blog