I feel like I've been having trouble coming up with ideas lately.

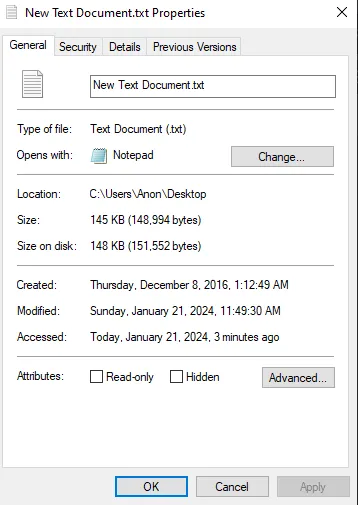

These things happen. Not every day can be a creative day. This is why I note all my ideas down in a simple text file on my desktop. If I can't think of anything for the day I go back and grab an idea from the previous day. This file dates back to December 8th, 2016; a full year before I even started blogging. It has since reached a legendary size of over 20k words, meaning it would take two hours just to read the entire thing. This would be rather pointless for the most part because it's just random scrawling of bad or middling ideas that I never pursued further. I even wrote an entire post about this file a while back. Didn't even bother to change the default name.

"New Text Document.txt" LoL

Where you 'anon' before it was cool, anon?

I often use crypto twitter to scry for ideas when it comes to my blog posts. I've burned a lot of time there but often it can give me some inspiration to write about a topic that's more in line with current events or sentiment. Lately though everything has been cat videos, engagement farming, and ETF speculation. It hasn't been a very good source of creativity lately. Sentiment still seems to be very much stuck in a holding pattern as sell-the-news action continues in line with Grayscale dumping of BTC, which last I checked has bled $5B out of $29B and continues to bleed from the difference in fee competition from up and coming funds.

This is actually kind of funny now that I think about it because it's exactly the same concept as, "If you can't explain the yield, you are the yield." How many of these people who are selling all their GBTC into another fund are going to lose everything in order to save 1% on yearly fees?

Maybe none of them will, as the expectation is that these new markets are heavily regulated and it will be far less likely that these funds are going to print paper Bitcoin and go bankrupt from it during the short squeeze. At the same time I think that the whole, "This time is different," attitude is extremely dangerous. This time is almost never different. People are infinitely greedy and will do whatever they think they can get away with. Bull markets have a way is inciting the most legendary amount of hubris:failures ratios that I have ever witnessed.

Compare this to the 2019 Bakkt bull run.

We are actually doing a lot better now than we were back then. For one, Hive still towers over our all time low in the 10 cent range, which is a nice change. Chalk it up to flushing out a lot of corruption during the 2020 exodus. Bitcoin is also doing well on a relative scale. If we look back to summer 2019, BTC took a -20% death-candle immediately after the futures market opened. Not only that the peak happened weeks before the grand opening of the big nothing burger, whereas the local peak for the Bitcoin spot ETF happened days before the approval and slightly after that as well.

Not only that, but the subsequent opening sell-the-news dip was only 7% instead of 20%. In addition, we have a narrative for why the market is bleeding (competition with Grayscale). It's possible that once Grayscale stops bleeding that will mark another local bottom and we get some of that halving hype into February and March. Of course I'll be making no bets to that effect unless the price hits my buy range of $31k-$35k. 30% dips are quite common during the bull years. 50% dips are very rare. IMO $25k is a good all in and-then-some target. Unlikely we ever get there though.

But ETF speculation is pretty boring and fruitless.

I've already talked about it more than I wanted to. Market sentiment right now is bored, and for good reason. The 3rd year in the cycle can be pretty boring. Look at 2016 and 2020. These are moments in history that only get interesting as the year is drawing to a close and the shitcoin casino is open for business.

Speaking of the shitcoin casino.

We've gotten zero indication of what it's going to be this time around. Maybe this time really is different, but I doubt it... 2016 ICOs, NTF/DEFI 2020. What will 2024 bring us? It's still very unclear, which is surprising. I thought it would have revealed itself to us by now. Maybe I haven't been looking hard enough. It's true that for the most part I've stopped researching new things and just tend to focus on BTC, Hive, and DEX (interoperability). In any case I expect it will reveal itself to us sooner rather than later. 2024 will be a crazy year for sure... at least when we get to the end of it.

HOLOZING

The pokemon clone being built on Hive seems to have a lot of hype. I have it in my notes here I was supposed to write a post on it, but it looks surprisingly complex and the game isn't even out yet, so I've been waiting. I do know enough about it to anticipate that it's going to have some pretty big pump and dumps, and may even pump Hive somewhere along the way. I haven't farmed or bought any of the tokens yet. We'll see how it goes.

Conclusion

This post lacks focus, which is by design.

The entire market seems a bit scatter-brained.

Perhaps we'll have a lot more to talk about once Hive gets them second-layer smart-contracts rolling and whatnot. Until then we may be relegated to boredom. 2025 is still a year away.

Return from Lack of Inspriation to edicted's Web3 Blog