Crypto is slightly in the green today.

Bitcoin is once again approaching that $44k resistance point and Solana flipped XRP on the market cap claiming the #5 ranked position. Of course most people round these parts refuse to touch SOL with a ten foot pole due to the premine and VC nature of the chain, but it's still fun to watch it go with some popcorn. Avalanche also made it into the top 10 today after going over x4 over the last few months. Impressive.

Unfortunately Hive is about to drop below the #300 rank which is kind of a gut punch but whatever. Hive do be like that sometimes. We often lag behind and then one day pump out of nowhere, which honestly is good for any type of volatility trading. I'm personally ready to make a big buy at 400 sats should the opportunity arise.

https://www.youtube.com/shorts/nl3pNXbfDc0

15 second commercials eh?

On the heels of Google changing their terms of service to allow BTC ETFs to be advertised on the platform we see that commercials are already being leaked for just this purpose. Notice how these are not 30 second commercials. AKA not made for TV and much more likely to popup on YouTube or where ever else. What a shock that YouTube just aggressively changed their ad policy to make them much harder to block and skip. What a surprise. Seems like all these things are just lining up perfectly all at the same time.

At this point the consensus strongly leans toward the idea that multiple spot ETFs are going to be approved around January 8th through the 10th. All the signals line up for this to be true, but the idea that the SEC is going to play fair is also a little bit ridiculous considering their track record.

We can clearly see that all the other final deadlines are in mid March (ides of March), so all it would take to push it back two months would be to deny or delay the ARK application, and we've all seen how much respect ARK has been given over the past few years (basically zero).

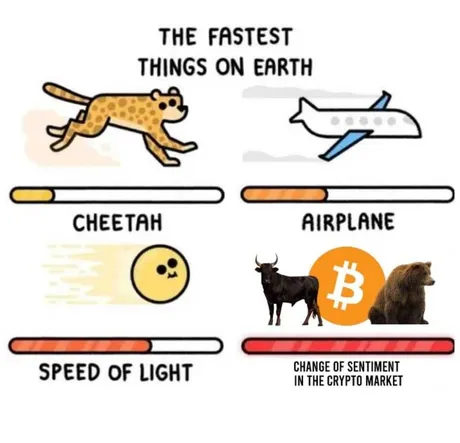

At this point the most conniving way this situation could play out is a flash-crash panic in January with a V-shaped recovery in March. The only certainty is that massive volatility is still 100% in the cards. Everything hinges on the ETF decision at this point. Volume is still in the gutter and most big players in the game are refusing the sell, but more importantly they are also refusing to buy as well, as this pushes up the price too fast when there are no sellers available.

Market cap doesn't move based on money flowing in and out.

This is a concept most people don't seem to understand. If someone sells a billion dollars worth of Bitcoin, the market cap doesn't change as long as there are buyers at the current spot price. Conversely, if there are no buyers at the current spot price then dumping that billion dollars worth of Bitcoin can move the market cap by a hundred billion dollars (like a 12% loss at current valuations).

We are not going to figure out where equilibrium is until people are actually willing to sell their Bitcoin. That means we need to see high volume on exchanges: x5 to x10 times higher than what we are seeing now. Only then can we start to get an idea of how much wealth is about to be transferred into new hands from old ones.

It's pretty much guaranteed that if the ETF gets approved then Bitcoin will will almost instantly be trading above all time highs again. That's already less than an x2 from here, which is honestly pretty hard to believe when taken out of context but here we are. The bull run will likely be kicked off early based on this greed play.

Many also wrongfully assume that the market is literally incapable of pricing in or frontrunning the ETF news. The idea being that an EFT will bring in so much money that it's impossible for the current market to absorb it. This is preposterous sentiment for the exact reason I just mentioned.

The market cap ratio could easily spike to 1000:1 just from the SEC confirming that the ETF is allowed. Meaning $1B of actual dollars entering the market would push Bitcoin's MC up instantly by a trillion dollars. That's a +117% gain from here. The Bitcoin ecosystem can pick and choose whatever price it wants before the ETF launches simply based on market sentiment.

What about altmarket?

I think it's almost guaranteed that Hive will lag behind if and when the ETF gets approved, which is why I'm so bullish on buying Hive at 400 or even 200 sats per coin. Hive can easily trade flat while Bitcoin goes x4 just like it did in Q4 2020.

Other alts are likely in a similar boat, just on different timelines. Usually in these situations Bitcoin has to dip a little and then crabwalk before traders are willing to gamble gamble on the rest of the market. It's going to be a crazy time to be sure.

Conclusion

These leaked interwebs commercials have more hype behind them then Super Bowl commercials. Speaking of the Super Bowl... that happens in February so we will likely see ads for the ETF there as well if approval happens in January like everyone thinks. Gonna be FTX levels of ridiculousness all over again.

We've reached the point in the crypto cycle where all we can do is hold on for dear life as the price goes up without selling out too early. Two more years of bull market to go, and Bitcoin will almost certainly lead the way as is often the case.

Return from Leaked ETF Commercials to edicted's Web3 Blog