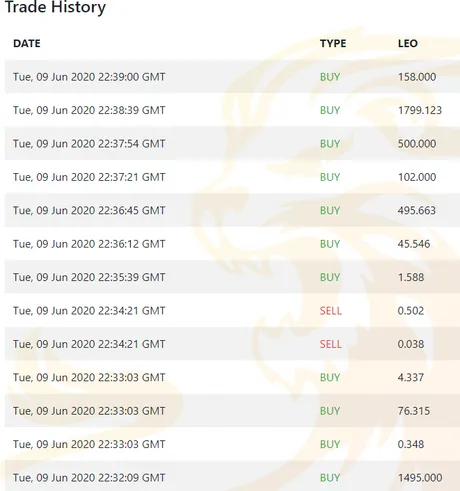

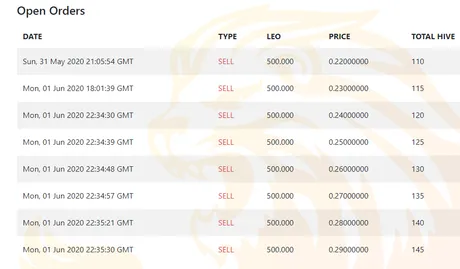

HiveEngine traders can't seem to get enough of Leo today! I've been providing liquidity to the network selling off chunks of 500 coins at 0.01 intervals for a while now starting at 0.17.

In the beginning I was even doing like 0.005 intervals. So I would sell 500 at say 0.17 and 500 more at 0.175... 0.18... 0.185... and so on.

Now we can see that even my 0.21 sell order has sold. Leo seems to be moving on up.

I enjoy being able to create this kind of liquidity. It's weird being a mega-whale on a tiny network. I think I own like 1% of all Leo that's been minted.

When you're a small fish, you have to ride the waves up and down. However, when you're a big fish, you're the one creating the waves. It's super weird honestly and perhaps good practice for the future if I start gaining more influence on other networks. Plus it's always fun to gamble gamble, who doesn't like that?

I'm currently sitting on 1830 Hive Pegged tokens ($450) inside HiveEngine. Feels weird to just be holding onto them like I am. However, cashing out incurs a 1% fee and trading them is free. If Leo starts crashing perhaps I'll start buying on the way down. Also it's nice to have some liquid coins laying around in case Hive spikes out of control again.

Speaking of Hive spiking out of control, Leo seems to have a history of maintaining its USD value pretty well. It ends up being a hedge against Hive in a lot of situations because that is the only trading pair available. Hive spikes, everyone cashes out to Hive. Hive dips, now everyone wants to buy cheap Leo. Again, it's pretty weird the patterns that are forming.

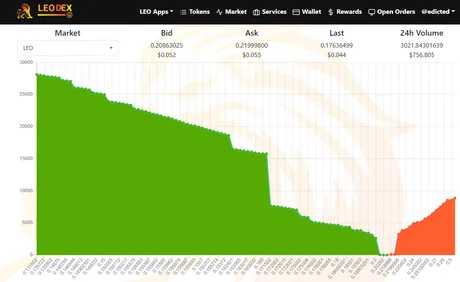

Leo liquidity running dry.

There are only 9k coins left on the open market. If this buying pressure continues without new sell orders being opened, things are going to get crazy pretty quickly as we engage in vicious price discovery. For many people, this is a fun exciting time, but honestly it is very irresponsible of whales to allow this to happen unless the network is under attack (money attack).

Market making is very important. Users need to feel like they can enter and exit the market at will without a lot of slippage. It is basically the job of the whales to attempt to buy low and sell high, creating liquidity in the process so that the smaller players can enter/exit at will. This process of buying low and selling high is obviously a paying job, and provides the network a lot of value.

Because I have no idea where this buying pressure will end, I'm simply playing it safe and selling at scheduled increments. Hard to get burned using safe cost-average selling and buying. Perhaps one day I'll even write a script that helps me or even fully automates the process.

Another project that I'd really like to see on the LEO network is a Fantasy Bitcoin League. You place bets in LEO in exchange for fake dollars. By trading those dollars for fake Bitcoin you can rank up in the league and take your fair share of the betting pool.

It's interesting, because I've thought about the advantages and disadvantages of making a project specifically for LEO. Why do that when I can just make my own coin and try to scoop more of the profits? Well, you might ask the same question in the same vein of, "Why would you ever airdrop another community?"

The answer is that having a built in community is very profitable. By "airdropping" a dapp on an already established community/token, that could actually be a lot more profitable than starting from scratch. It also allows one to build up their reputation in that already established community. The synergy is real.

What happened to PAL?

If LEO didn't exist I'd probably be pretty mad. I dumped $2000 (5000 Steem @ 40 cents) into PAL coins. Since then all that happened was that the admins airdropped themselves millions of coins and the value of the network dropped to near zero. Pretty annoying. Was it just a money grab? Why does the coin still have zero utility? Whatever, I'm willing to give it more time, but doubts float in the back of my head.

The nice thing about LEO is that it capitalized on the PAL airdrop and DIDN'T gift a bunch of free tokens onto 20 admins. In fact, LEO doubled down by only airdropping users that POWERED UP PAL and held it. Pretty cool. We are a network of holders. Hopefully we don't hold too hard as the demand to buy spikes out of control :D

P.S

Check out https://hivestats.io/ Essentially a Steemworld clone for the LEO/Hive community.

Posted Using LeoFinance

Return from LEO has some sick buying pressure right now! to edicted's Web3 Blog