My dad could beat up your dad!

Who'd win in a fight?

A lion or a shark?

A stupid question asked by stupid people!

Put the lion in the water and it loses instantly to the shark (Great Whites are x10 the size anyway). Put the shark on land and it gets defeated by suffocation.

The obsession that people have with apex predators is fascinating. We see ourselves at the top of the food chain and then compare ourselves to other animals at the top of their respective food-chains.

- A good poker player is called a shark.

- "If it was not for the river then there would be no fish."

- People call others lions to commend their fierceness and bravery.

- "A Lannister always pays his debts."

I've said it before and I'll say it forever:

We seem to be entrenched by this ideology of competition and domination. The world has taught us to value cutthroat capitalism from the cradle to the grave. This false narrative is being constantly pushed onto the cryptosphere.

Who would win in a fight? Bitcoin or Ethereum?

I suppose Bitcoin is the Great White shark (much bigger liquid market cap) making Ethereum the Lion. Again, it is a pointless hypothetical, because both animals live in a totally separate ecosystem.

Taking this concept to the next level:

Why are we even thinking of these currencies as apex predators? What wins in a fight: a turtle or sloth? Answer: turtles & sloths don't fight. Stop projecting your disgusting principals of imperialist domination onto this space. They need not apply.

Access denied.

There are no Ethereum killers. There are no ______ killers. These communities sink or swim together. This is not a competitive space, and that simple fact blows people's minds so hard that they refuse to believe it or even recognize the perspective itself.

Who wins in a fight: Los Angeles California or Paris France?

Answer: you're both slaves to the military industrial complex. Get back to work and don't forget to pay your taxes, slaves.

The idea that we can "win" without engaging in zero-sum behavior that fucks someone else over is unthinkable to some. The concept of free-market synergy and communities working together is totally out of the realm of "rational" thought. Because how could multiple communities come together and build something greater than the sum of their parts? Impossible! Amirite?

Conclusion

Regarding the cryptosphere, if you find yourself engaging with this concept of cutthroat imperialist vulture-capitalist Roman Colosseum war-games... You don't understand this space. Different coins provide different tools. We shouldn't run around like children wondering if a hammer beats scissors in a duel. They are both useful tools used for separate activities.

You hear that guys? Hammers crushed scissors!

Stop using scissors now, they lost the war, we can use a hammer for that!

This problem is only going to get worse as time goes on. Imagine next bull run when all the people who've stuck around for the past 3 years, clawing and scraping to get by... are all of a sudden wealthy beyond their wildest dreams? It's gonna get ugly. "My coin is the best coin" and all that.

This false narrative being projected leaves a huge vacuum in the space just waiting to be filled by those who understand where this is all going. Trying to compete is a fool's errand filled with loss and unnecessary overhead. Those who race to the bottom will become the most wealthy with the highest reputation.

Even Zuckerturd realized early that putting ads on Facebook was not the way to go until he had captured a huge market share. It's embarrassing that crypto is somehow greedier than that douchebag.

What does this mean specifically? It means that charging interest on a loan (MakerDAO and DeFi) is incorrect and will get undercut by open-source code that doesn't exploit users. The same is true for gambling and other services. It used to be one had to figure out a way to skim money off the top to enrich themselves and scale up the project. Now the opposite is true: the project will not scale up if you skim off the top. Friction is the worst thing ever.

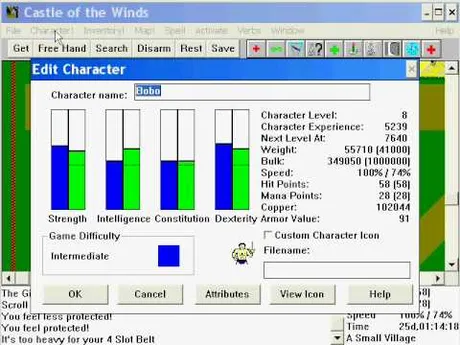

We are creating frictionless systems to compete with the legacy economy. A $2 fee to transfer millions is pretty good (Bitcoin) but a $0 fee is better if you aren't rich and need access to micro-charges or income-streams (Hive). The latter comes at the cost of security (trusting 20 witnesses), but the applications are far greater. Everything in this space is a give and take of attributes.

Does the project have more speed and scalability, or security and robust simplicity? Do you focus on money transfer or smart-contracts? Is there a premine to fund development? High inflation? POW, POS, DPOS? Every choice matters.

Bottom line

The only thing that can kill USD, is USD. Bitcoin exists because the legacy economy has failed to serve 99.999% of us. The only thing that can kill Bitcoin is Bitcoin. The only thing that can kill Ethereum is Ethereum. Etc etc etc. These communities sink or swim based on their own merit of existence.

Return from Lion vs Shark to edicted's Web3 Blog