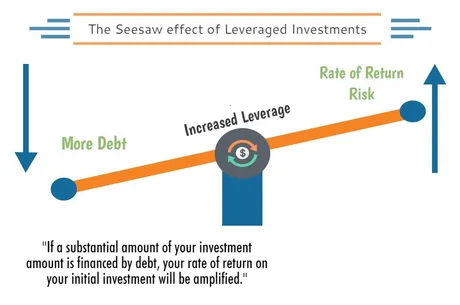

When we think about margin/leverage trading, a common term would be going long or going short. We assume these two things are opposites, and in many ways they are. However, there are many strange edge-cases that more novice traders such as myself don't tend to consider when first starting out.

My first long ever was when I was messing around with MakerDAO and DAI in 2018. Locking ETH, pulling DAI out of the contract, and dumping DAI for more ETH. How weird is that? My first experience ever with leverage and taking out a loan using collateral was a decentralized permissionless iteration. Such a thing would have been impossible even in 2016. These things just didn't even exist yet. We are still quite early in the game.

So what did I learn?

I learned that margin trading is very risky and it's quite easy to get liquidated in such a volatile landscape. This is especially true with MakerDAO loans, because MakerDAO requires a 150% overcollateralization. Centralized exchanges only require a tiny bit higher than 100% before the collateral is liquidated to pay off the debt taken out.

The math of it all.

For simplicity going forward I'll assume that margin trades get liquidated at 100% without having to calculate interest rates or anything like that. Normally you'd have to pay interest on the loan you take out, but that's not really relevant to this post so we'll just eliminate that variable out of convenience.

2x Long

In a 2x long, we would be borrowing just as much as our collateral provided, in the form of stable coins. If we were 2x longing with a stack of 0.25 BTC acting as collateral, and BTC was worth $35k, our collateral is worth $8750, and we would borrow $8750 actual dollars and dump them on the market for more Bitcoin. Now we have 0.5 BTC (ignoring fees and slippage and interest rates), for a total USD value of $17,500.

So when does this position get liquidated to by back the $8750 loan we took out? When the collateral is worth as much as the loan itself. Calculating this with a 2x loan is easy, if Bitcoin loses 50% our 0.5 BTC will only be worth $8750 and it will be seized and dumped on the market to pay back the debt. This is why liquidated longs in mass can totally wreck the market and cause temporary flash-crashes in the price. Cascading long liquidations combined with stop-loss orders are the worst.

3x Long

In an 3x long, we take out twice as much as our collateral was worth. Using the same example from above, we'd start with 0.25 BTC and end up with 0.75 BTC. However, we'd owe back $17,500. This long would be liquidated after a 33% drop from $35k to $23,333. That's when the 0.75 BTC is only worth $17,500, and the only way to stop liquidation is to add more Bitcoin to the collateral (risky) or pay off some of the USD debt (less risky). Either way, this is not a fun position to be in.

| Long | Liquidation |

|---|---|

| x2 | -50% |

| x3 | -33% |

| x4 | -25% |

| x5 | -20% |

| x10 | -10% |

| x100 | -1% |

principal + loan = collateral = 0.25 BTC x leverage x price

Correct

Some platforms allow users to margin trade on x100 leverage, which is obviously insane. If you put up a bet of $1000 you could borrow $100k. Should the price crash even 1% you're wrecked and you lose it all, but should the price go up you could find yourself ridiculously wealthy in quite short order.

Shorting is the opposite of this... sort of...

Instead of using Bitcoin/crypto as collateral, the stable-coin/USD is used to secure the debt. Secured loans have collateral. Unsecured loans rely on reputation and credit score alone.

In the exact same scenario we might decide to sell that 0.25 Bitcoin for the $8750, but that's not enough. We want to leverage that sale into a short position to hedge against further losses. This is what makes shorting a lot more different than longing in many situations. It can be used as a tool to lower volatility and make money in both directions. On the other hand, longing the market is mostly just a greedy play that very much suits gamblers and mega-bulls to attain maximum returns.

Shorting as a hedge.

So in this scenario, we've sold 0.25 BTC, but it is implied that we have a lot more crypto than this in our portfolio. We don't want to sell anymore crypto, but rather use this USD as leverage into a short position so if the market bleeds more, we will still probably lose money overall, but the short will generate income and the amount that we lose will be mitigated.

Should the market go up in this case we will make money, but not as much because of the short position. It is in this way that the short position is a valuable tool that allows us to curb volatility and feel like we are making money no matter what (the psychological affect is extremely positive). In fact, sometimes very well placed leveraged positions can do just that, given the correct circumstances, but that's more of a play in the institutional playbook... although I have seen people talking about these scenarios in crypto as well.

taxes

It's also important to note that incurring debt is not a taxable event. If we happen to generate income with a liability like this we have to report it as a gain, but the debt itself is never taxable, and interest on debt is tax deductible.

For example, if we earn +30% on a short position, but then pay off some of the interest, this is actually a net-loss tax wise. The interested we paid off is 100% tax deductible, but the value we removed from the short position is only up 30%, so only 30% of the money we take out of the short is taxable income. This would seem to imply that after paying off the interest, 70% of that payment could be used to deduct gains from somewhere else. For example, if you pay off $100 interest but only $30 of that $100 was profit from a trade, you can deduct $70 from your taxes that will cancel something else out later (or rather you have a $30 gain and a $100 deduction thus far). I'm not an accountant so don't quote me on that.

Living off debt to pay no taxes, Saylor Playbook:

Therefore, if Bitcoin just keeps doubling in value every year, it is theoretically possible to never pay taxes ever again simply by leveraging these assets into debt and paying all living expenses with the debt incurred, while never actually having to pay back the loan principal. Simply just keep paying off the interest forever because the gains are exponentially higher than the interest rate for debt. There are also ways that we can turn the gains into long-term capital gains and pay only 15% (or even 0%) in taxes. This allows us to pay back all our debt extremely cheaply during bull markets.

Moving on to the actual example.

2x Short

We use our $8750 to borrow 0.25 more BTC and dump it on the market. We now owe back 0.25 btc, so in the context of the short, we hope that Bitcoin will drop in price so we can buy it back on the cheap to pay back the loan and turn a profit (and perhaps even flip long). Again, in this situation, if the price of Bitcoin doubles, we are in a world of hurt and our position will be liquidated unless we add more USD collateral (risky) or pay back some of the BTC debt (less risky).

However, this is where shorts become completely different than longs. If Bitcoin goes up in price and now you need more USD to collateralize the short, this is not a problem, because that's actually what you wanted all along.

Allow me to explain

Imagine you were still holding 2 BTC in your portfolio after selling 0.25 and opening a short position. You don't actually want the price to drop. You'll still lose money if it does. The short position is only a hedge that allows you to buy the dip if shit hits the fan. In this context the short can never make you money: it can only lower volatility during times of uncertainty (usually after a big pump).

As a hardcore HODLer of BTC, you were already prepared to take losses should the price drop, but you wanted a little something to sweeten the deal just in case. That's where the short comes in. Conversely, it is much more difficult to leverage a long position into a hedge like this.

So why did you open the short instead of selling more BTC straight up? Why pay interest on this loan? Again, taxes. Selling your BTC is a tax event, but selling someone else's BTC is not. Ironically, them letting you borrow it to sell is also not a tax event for them. Weird how that works out, eh?

Shorting is a sneaky way to dump assets on the market without incurring a tax event on the sale. Kinda makes you wonder how many people have loaned assets to "themselves" to dump on the market, tax free. Doesn't it?

This is how gold and silver have been so heavily manipulated by the derivatives markets. If you're a precious metals whale you can short the market as much as you want while at the same time knowing if the price goes up out of spite, you still made money and now you have even more leverage to short and manipulate the asset in question.

You can simply double down on the short at that point essentially risk free. Sooner or later the market capitulates and the whales that engaged in these manipulations make a boatload of money and can continue manipulating the market forever.

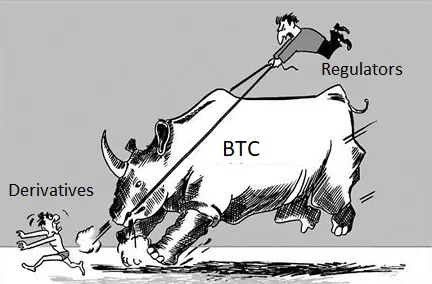

Could this happen to Bitcoin?

People say it could, but I highly doubt it because of the doubling curve trendline. On a long term scale Bitcoin dominates all shorts and squeezes them into oblivion. Gold and silver can't do this because they are not unicorn technologies doubling in value and adoption every year. In fact gold and silver are the opposite of that: old archaic money that never evolves and never actually gets used as money. The comparison to crypto in this regard is absurd. Crypto is evolving exponentially and gold will always be just gold.

| Short | Liquidation |

|---|---|

| x2 | +100% |

| x3 | +50% |

| x4 | +33% |

| x5 | +25% |

| x10 | +11% |

| x100 | +1% |

Shorts are capped; Longs are uncapped.

When you really think about it, the super weird thing about shorts is that you can only make as much money as you borrowed, and even then, the price of the asset you borrowed would have to crash to zero (which is practically impossible). The absolute best one can do on a short is never being required to pay back the loan... which again is not a thing that actually happens in the real world.

Meanwhile, nothing stops Bitcoin from going x1000 over the next ten years. So an x2 long could make millions of dollars in profits, while that same stack used to short would at best generate a couple thousand dollars. Definitely something to consider. Perhaps Saylor had it right all along.

Conclusion

While a short is logistically the opposite of a long, their macro functionalities within the economy are non-comparable. While longs are often used for funding platforms by incurring debt and getting in early while price is low, shorts are more often used as a hedge or even in some cases to manipulate and suppress markets artificially through the lending process.

In many scenarios an entity can short a market without having to worry about incurring global losses or tax events while they do it. Those who long are often all in and gambling compulsively fueled by pure greed. There is no limit to how much one can make with a long, especially considering the growth and volatility of crypto. The same cannot be said of shorts, which are often much more conservative in nature when used as a hedge against volatility.

As institutions acquire more and more BTC, we can be sure that they will attempt to flex their power and manipulate these markets. Will they be able to tame the beast and bring it to heel with these markets, or will it rampage out of control, crushing all the shorts in its path on the long run?

It very well may be we didn't get a mega bull run for this exact reason. Institutions have enough power to mute the market and bring it back to earth before it spirals out of control. Is that a bad thing? As someone who appreciates stability and loathes year-long actual bear markets (not these fake 2-month ones) I must admit that the diamond handed sharks may be bringing actual value to the table. Kudos to them: looks like they are good for something after all.

Posted Using LeoFinance Beta

Return from Long vs Short (+taxes) to edicted's Web3 Blog