So today and yesterday we get a light relief rally... seemingly right on schedule. Another New Moon pump. Today is the New Moon. We seem to be in a "bad news is good news" scenario with the economy. The worse the economy gets the more risk-on traders are betting that the FED will be forced to pivot and be defeated by 'inflation'.

Of course 'inflation' is a very loose term considering that most banks use QE as exit liquidity and don't actually print more money after unloading their securities. It's also a very loose term considering that warehouses across the globe continue to fill up. Black Friday approaches, and the deals are going to be insane. Every day my email is filled with 'deals' from Amazon, Newegg, Target, and Walmart looking to unload their supply. No one is buying. Searches on Google for "late credit card payment" are at an all time high.

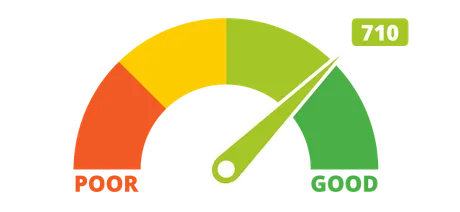

Speaking of credit cards, I lost 50 points to my score on a single report and thought I must have been the victim of identity theft or something. Right when I got back to my score of 700, which is where I was before defaulting on $10k+ worth of credit card debt in 2017, I lose 50 points in a single month. Had to double check and triple check that a new line of credit wasn't taken out under my name. It was not.

I have access to two different credit reporting agencies; one through my bank and one through my credit card provider. I was looking through the alerts and advice they give for why your score would go up and down. According to their own information, my activity should not have created the dip that it did. My credit usage went from like 5% of my total line to 13%. No big deal.

However, I have two credit lines, the first card that I got was a secured line of credit that I needed to boost my score in the first place. The limit started at $200 and cost me $50 in collateral just to get my foot in the door. After six months the limit has increased to $500. The second card has a $3000 limit that I was able to get approved for after grinding out my score with the first card.

I believe what happened here is that even though I was only using 13% of my total credit, the secured card was basically maxed out. I had put all of my monthly purchases onto the secured card, putting it at like $470/$500 with only $30 left (94%). Capital One did not approve. Even though this was only 13% of my total usage I believe that a huge red flag went up.

Not only because my card was maxed out, but because it was a secured card. It stands to reason that people who acquire secured cards to rebuild their credit are a much higher risk than others. I'm guessing their algorithm saw that and immediately slapped me in the face with a 50 point loss. Again, I was looking into this for over an hour a few weeks ago and it was very unclear as to why this all happened. This is all conjecture on my part, but I believe this is 'what had happened was'.

I believe the reports go out on the first of the month, so I'll be waiting a few more days to see if I was right. I've since raged-payed down the secured card to under $10 and plan on never really using it. I just want to keep a very low balance so it looks good on my credit report. A part of me just wants to cancel the card and get my $50 collateral back, but it's probably worth keeping around (for now).

Your credit Card usage changed from 14% to 20%, Keep usage below 30% for a better credit score.

This is one of the reasons listed for why I lost points in the current month of October... just logged in to check it. It is somewhat enraging to follow the rules, be told you are following the rules, and then get slapped with a huge penalty and an explanation that makes no sense. I didn't even notice I had lost 50 points until 4 weeks had gone by, so I think what happened here is that I rage payed off my secured card right before the next month's report happened (late September) but that payment didn't clear until the next report went out and I lost 2 more points.

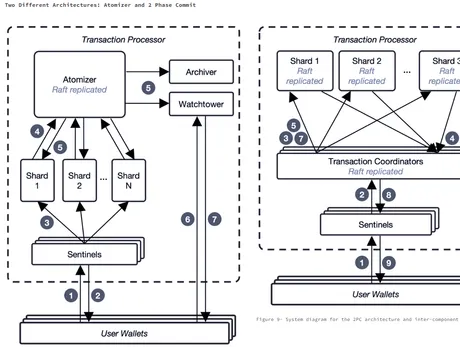

This is all just another reminder that the banking system is embarrassingly slow. It's so impressive that Bitcoin, even though extremely inefficient, can process the most secure transactions in the world in under an hour. Think about how nuts that is. A billion dollars can be transferred anywhere in the world in under an hour, no questions asked. Meanwhile, Hive now creates immutable transactions near instantly, which will almost certainly build a ton of value in our favor over the next 5 years. All of the fundamentals are looking up.

CBDC

Lots of talk about CBDC these days. The new Prime Minister of the UK is a WEF puppet (as always).

I'm not a robot! You're a robot!

Is Mark Zuckerberg taking notes?

Here's another one making the rounds.

Why is crypto Twitter obsessed with CBDC?

If you go onto Twitter you'll see these videos posted as if they are current events. CBDC is being implemented right now OMG! And yet when I find the videos on Youtube they are timestamped 1 and 2 years ago respectively. The real news is that both USA and Japan have said that CBDC is completely worthless and a conflict of interest and a threat to the commercial banking sector.

I've already gone into great detail about why CBDC is completely worthless and never going to happen. Even if it does happen it can only be helpful to mainstream adoption. Two steps forward, one step back.

CBDC is completely dead-on-arrival, just like enterprise blockchain. It's the exact same thing, all that's changed is the centralized agent issuing the idea (corporations >> government). It doesn't suddenly become a more valid idea when government talks about it.

When was the last time the government forced you to use an inferior technology when a superior technology already existed in a fully regulated form? No one seems to understand that the current system we have right now is superior to CBDC. It's more decentralized. It's more robust. It's less prone to attack. It's fully licensed, and it already exists and is fully entrenched within society with zero learning curve because everyone already knows how it works. The fact that so many people think that CBDC is going to instantly takeover everything is mindblowing to me. It simply is not possible on a dozen different metrics.

Regulation

And now @dan, the guy who built the core of our entire codebase, running around making a fool of himself.

Crypto is dead with global regulatory overreach. Compliance turns crypto into a stronger slavery it was supposed to free us from.

Man, seriously @dan? SERIOUSLY?

So the plan was that governments were willingly going to allow us to free ourselves with this tech? Pack it up boys, it's time to give up. The government said no. Seriously statements like this are just super embarrassing and lack any kind of backbone. It's a fucking war! It was always going to be a WAR. All you idealist pacifists need to wake up to the actual reality of this situation.

We are making a slow transition from the early game to the mid game. The early game was full of gumdrop lollypops and rainbows and game-theory idealism. "Maybe we could create a completely peaceful transition of power." In the mid game you are either taking arrows or you're getting the fuck out of the way. We haven't reached that point but it's very obvious we'll be getting there soon enough. It may be physically peaceful, but certainly it won't be mentally peaceful. Let the psyops begin!

To be fair no one ever expected that literal egg-heads would be getting their hands dirty and stepping up to the establishment, and also the context of this statement is important, especially with ETH being captured by regulated block producers.

https://www.zerohedge.com/crypto/war-crypto-privacy-intensifies-amid-oecds-massive-overreach

To be fair I am likely jumping the gun, because I haven't even fully read this yet.

- Record ALL crypto trades on exchanges, DEFI and DEXs;

- Record (large) purchases from private wallets;

- Record all transfers to cold storage and make lists with private wallet addresses;

- Send all this info annually to the (tax) authorities;

- And finally, force governments to pass these rules into domestic law.

But when I open a post and this is the first thing I see, there's a reason why I'm automatically skeptical and unwilling to read the damn thing. If the government demanded that you grow wings and fly what would you say? You'd be like that's fucking stupid and impossible, just like these regulatory demands.

Demands like this are a great thing, they FORCE us to find other solutions rather than using convenient centralized exchanges. They put ridiculous pressures onto those centralized exchanges and make demands that are impossible, while financially incentivizing the banks (exchanges) to buy out politicians and modify the law back into their favor.

I demand that you track Monero.

But I can't do that.

But I demanded it.

Okay well you're delusional.

Seriously look at the last bullet point... their plan is to unilaterally get every country in the world to agree. Are we really supposed to take this shit seriously? Really? I'll believe it when I see it. Thus far I've never seen a pig fly, so I'm excited for global consensus to occur for the first time ever in human history "because crypto is a threat to the establishment".

Together with governments, policy makers and citizens, the OECD works on finding solutions to a range of social, economic and environmental challenges. From improving economic performance and creating jobs, to fostering strong education and fighting international tax evasion. The organisation provides a unique forum and knowledge hub within which to discuss and develop public policies and international standard setting

environmental challenges.

So they're going to magically fork Bitcoin from POW?

How?

Again, impossibility stacked on impossibility, and everyone takes it seriously. I just can't.

All financial institutions that are subjected to these regulations are forced to automatically report to the authorities the name, address, Tax Identification Number(s), date and place of birth, the account number, and the account value as of the end of the relevant calendar year (or other appropriate reporting period).

Okay?

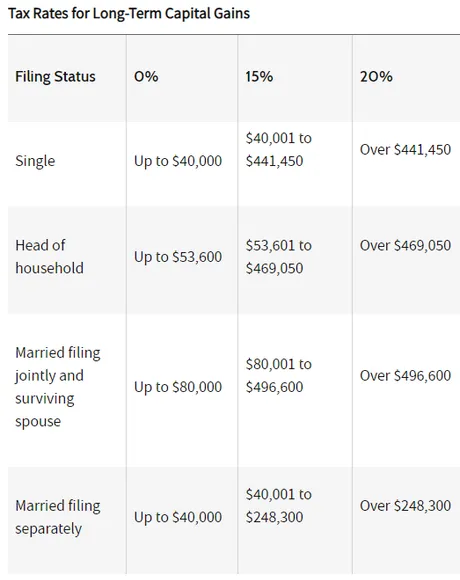

You can also give yourself a $40k a year salary on long term capital gains and pay 0% federal taxes on it, legally. Something most do not seem to realize is that real privacy stems from the government not knowing where we live. What if you didn't need a social security number to buy a house or a car? What if your address wasn't known to any entity but friends and family? Once crypto starts bleeding into the real world we will see how it can pivot around the control grid.

What Are The New Guidelines for Crypto?

As was the case with earlier regulations, Bitcoin will not be banned. Instead, the OECD builds on the approach set by FATF: to regulate the service providers who facilitate transactions.

Sooooo... centralized exchanges? The banks? What a shocking revelation! Now, how do you regulate a decentralized exchange like Thorchain that operates on a global scale when you can't even take down a single Pirate Bay server?

And speaking of regulating the banks... is CZ even giving them the information they are looking for? What about Huobi? There seem to be multiple large scale operations that don't really care about the rules, and constantly find ways to weave their business model around them.

Legit hackers funnel their money through Binance and get away with it all the time. That is how lax they are with regulations. Anyone can launder their own money using an non-kyc exchange like Mandala or Huobi and then make a single transaction on a privacy network like Monero, making it x1000 times harder to trace.

On a final note, the OECD has come up with a trick to limit the opportunity for crypto users to spend their coins anonymously. The CARF also applies to merchant providers facilitating crypto payment for goods or services. In such instances, the merchant provider is required to treat the customer of their customer as its own customer, and report the value of the transaction to the tax authorities of the buyer.

Again, one single p2p solution destroys this entire tracking model.

It also becomes extremely obvious they will have to directly ban merchants from accepting privacy coins entirely. But the funny thing about privacy coins is that they are private... so how will they enforce such a rule? So many holes in the clampdown, which was the entire point right from the beginning. We all knew this type of regulation was coming down the pipe.

What Will Be the Outcome of These Regulations? The outcome of these new international standards will be full transparency towards tax authorities. The aim of these standards is to get automatic insight into all your trades, even laying the foundation to prevent you from spending coins anonymously with retailers that use a third party payment provider.

This means in practice that although you can hold coins in your private wallet, you cannot easily spend or exchange them anonymously. In short: no more privacy when you use third party services.

So... no more privacy when I don't control my keys? What a tragedy. Or more like... if the retailer doesn't control their keys privacy is lost... But that also means we identified ourselves to the third-party in the first place, right? How else would they know who you are?

You know what I read into all of this? Less people will trade and more people will HODL and only buy/sell long-term capital gains. We all know that if there is demand for something to occur, that thing occurs no matter what the regulations are. Demand creates markets no matter what, and cutting the supply just makes the product more valuable (just like the war on drugs). Actions like this also give incentive for someone to create an open source solution that allows retailers to plug & play a crypto solution without the need for a third-party... isn't that the ENTIRE POINT of crypto? Eliminating the middle man? Yeah?

It is not hard to imagine that once all transactions are transparent, more actions can be taken as to which type of payments and type of persons are allowed or not. We can see this financial “cancel culture” already happening around the world.

So much gloom and doom and it's all completely speculation.

I don't know what's going to happen.

No one knows what's going to happen.

Crypto evolves faster than the regulators.

You'd of thought crypto advocates would have realized this by now.

But instead we just see more bear-market FUD that might stem simply from the fact that their personal bags have been temporarily deflated.

The psychological impact of a bear market is embarrassingly potent.

If we actually lived in abundance/balance it wouldn't be a big deal.

Only a massive and radical decentralization movement away from third party service providers can prevent this dystopia. Stay tuned for a next report and a roadmap for just that…

And then at the very end of the post we see it was all an exaggeration that leads into a pivot for a solution. Classic.

Conclusion

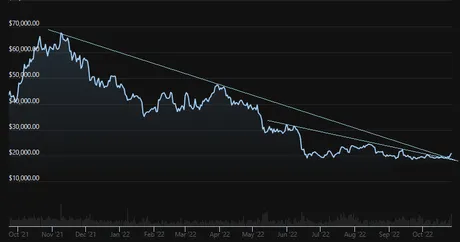

Guess how long Bitcoin bear markets last? Around 1 year

- December 16, 2017 >> December 4, 2018

- December 3rd, 2013 >> January 12, 2014

- July 7, 2019 >> July 22, 2020

And when did we last peak?

November 8, 2021? So we made it one year and everyone still bearish. To be fair the current climate is something we've never seen. Comparisons to the past may be totally invalid. Perhaps not though, eh?

When I see the rampaging FUD combined with high volume and a stable price, all I can think about is how we already know that institutions have basically capitulated and given up on enterprise blockchain. They are looking to move in, and this is the perfect time to do it.

CBDC and regulation are a complete distraction. What they say they want to happen is not the thing that is going to happen. We already know this. Why do so many still believe what the government says? They can't even fathom what is going on here and ramble on about laws that are literally impossible to not only enforce, but to even implement.

It is only a matter of time before government agents squeeze so hard that they force us to look for alternate solutions. Once the convenient option is no longer convenient, it becomes abandoned quite quickly. Again, I don't know how it will play out, I only know that everyone who speculates on these outcomes is wrong. Nobody knows what happens next. We are in completely uncharted waters. Should be interesting to watch it all playout. #popcorn.

Posted Using LeoFinance Beta

Return from Macro Resistance Fail, Credit, CBDC, and Regulation to edicted's Web3 Blog