Evolution only occurs in the face of adversity. Change is required. Evolve or die. This sentiment applies to the cryptosphere as well. Did we really want prices to keep going up and up with no killer apps and a total lack of functionality? That's a nonsensical mentality. Personally, I prefer the route of hard work and the feeling of satisfaction that comes with actually getting things done. If you're looking to sit back and be handed a Lambo, we're clearly not on the same page.

In any case, I'd like to offer some good news as we wade through the Red Sea. Many of the coins I'm bullish on still seem to be doing quite well. Sure, Maker may have dipped recently from $700 to $350, but it crashed to that value in September as well and bounced right back. So far, these are simply local minimums, and not free-fall crashes like some of the other coins.

As a governance solution for Dai stable-coin, I have very high hopes for Maker. They seem to be one of the few communities that are extremely prudent when it comes to setting the ground rules. All Dai must be backed by at least 150% over-collateralization of Ethereum. All bad debt is liquidated with a brutal 13% penalty. Unless running a bot, most users prefer to over-collateralize for 300%. Most banks have as little as 5%-10% collateral. Crypto is showing us the path of the future is paved by zero-risk solutions that no one will be able to game.

Due to the questionable practices of Tether, a slew of stable coins are being allowed to thrive. TrueUSD, USD coin, Gemini, Cloud, and Dai are all ranking up. The value of a stable-coin is obvious: vendors can't take any risk when it comes to the volatility of crypto. Stable-coins eliminate that risk by pegging their asset to USD. This is a risk traditional vendors are much more willing to accept. What makes Dai stand out from the rest of the crowd?

All of the other stable-coins have to be collateralized with actual dollars in a bank. It's no secret that banks are centralized. They aren't required to hold 100% collateral and it can sometimes be difficult for them to move around very large sums of money. We've already seen what happens to the value of Tether when they run into problems with the bank. This is an unacceptable solution and on the verge of being completely eclipsed by coins like Dai.

The value of Dai coins are backed by Ethereum. This not only gives the Dai coins value, but it also gives a financial incentive for the Ethereum community to hold. Simply by holding Ethereum in a smart contract one can generate Dai, "Out of thin Air." I've personally done this several times, and even though I lost of few dollars swing trading I can tell you firsthand that the power of being able to give yourself a loan can not be overstated.

Maker and Dai are still totally on the fringe. They don't appear on any mainstream exchanges and very few people know about this duo even with Maker at #23 on the market cap. Most of the coins are owned by private investors and the dev team itself. This puts them outside the bounds of the current regulation scare concerning traditional ICOs and the SEC.

We have to assume that when Dai and Maker are listed on the big exchanges their value and notoriety will almost certainly go up in the long run. Even a big decentralized exchange (think Binance) could catapult more obscure coins like this into the limelight.

Good news

However, I don't want to bombard you all with tales of speculation. The thing that really sparked me to write this post was the fact that Dai has maintained its market cap at 60 million. This is extremely impressive when you consider it in the face of the market crash.

It wasn't that long ago that Dai hit it's debt cap at 50 million and doubled to 100 million. This was in July when Ethereum was valued at over $400 per coin. Since then, Ethereum has lost half it's value, and then half it's value again. Value of the collateral supporting Dai coins has been quartered, but we still see the same amount of Dai coins in circulation today. This is huge.

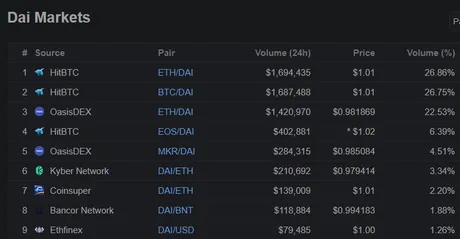

I didn't think I would see Dai in the top 100 market cap for quite some time, but the combination of this crash combined with Dai holding steady has pushed it to #70. This little coin has come quite far for one only being listed on Podunk exchanges. According to coinmarketcap.com, more than 50% of the volume comes from HitBTC. Once this coin gains liquidity across more sources, it's bound to increase the value of both Maker and Ethereum.

More importantly than that, Dai is building a bridge to USD that is completely free of the entanglements of central banking. There are no limits on how much one can transfer and to who. Scaling up is easy, and the MakerDAO has already shown us that they can scale down properly as well. Ethereum did crash from $1400 to $100 after all. In addition to all this, the MakerDAO plans on creating new coins that are pegged to other targets like gold and silver, further decentralizing the risk of crypto and linking it to other valuable assets.

The importance of stable-coins has been made crystal clear. Even in this hurricane market Dai is looking stronger than ever and is primed to be the go-to stable coin. The functionality of Dai trumps other stable coins in every way:

- Easy to invest in with Maker governance coin.

- Not backed by central banking.

- Modular solution that can be applied elsewhere.

- Anyone with collateral can give themselves a loan.

- No limits on scalability

- Self-regulating / Decentralized

None of the other stable-coins being looked at right now have any of these attributes. The only thing that Dai is missing is liquidity and advertising, which, if I had to guess, is completely by design. This is a very patient team that seems to be biding their time quite effectively.

Conclusion

Things look pretty bleak when you look at the price-action of the cryptosphere. However, if we ignore price-action what do we see? Development has increased exponentially over the last year with no end in sight. I haven't heard about a single dev team going bankrupt and closing shop, even though this is exactly what everyone expected during a crash of this magnitude. For this, we should be thankful. It won't be long before we pick up all these shattered pieces and move past this hiccup.

Return from Maker and Dai Still Looking Strong to edicted's Web3 Blog