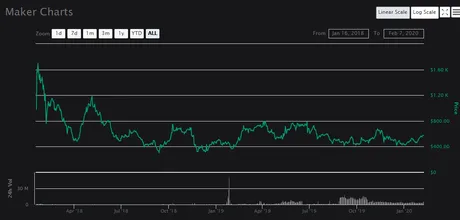

Maker has pretty much the most stable price action of any project out there, apart from actual stable coins. When we consider how small the market cap is and how centralized distribution is, this should not be the case. However, here we are.

I have to assume that the small Maker community is very good at regulating their own volatility. They've been hovering between the $400 to $800 range since summer 2018 and the band keeps narrowing. Andreessen Horowitz and A16Z are putting in work.

It makes a lot of sense that Maker whales would get together and somewhat have gentlemen agreements about where the price should go. Buy low. Sell high. Make some money, but also don't let the market get out of control so people feel safe investing. However, this stability will eventually have to come to an end.

At some point the Maker market will have to engage in price discovery up to a higher level. I think Maker is slightly oversold right now because the investors are playing it safe and adding a lot of liquidity to the market. When that liquidity get's bought out it might not get replaced. Maker whales are taking gains now rather than let buying pressure build up. It can't last forever. At some point Maker will begin to catch a bid in an upward direction with the rest of the market.

plan

Personally I'm hoping that the price of Maker stays suppressed. I plan on taking some profits in late March, and if this is the case I can throw some of those gains into coins that lag behind the market. In this instance I'll be looking at BNB and Maker. It's possible that I could dump out half the gains to stable coins and the other half to projects that look like they still have momentum. In all likelihood this won't happen but I am considering it.

On the flip side a price of $800 may signal once again that the market as a whole is ready to correct again.

KICK?

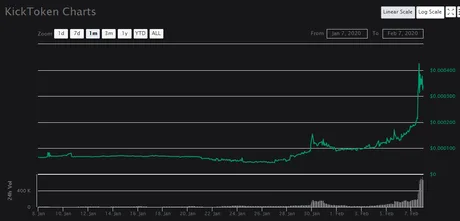

On a side note what's up with KickToken? My $60 airdrop is now worth $300+. It jumped up to #34 on the market cap. With my airdropped stake at just under 1M tokens, it would be absolutely insane if the network retook its previous value of 10 cents per coin.

Conclusion

Maker stability is essentially being leveraged via centralized corporate regulation. Supply will soon dry up enough to activate a price discovery mode. Remember, the total supply is less than a million and dwindles even further with its deflationary economic policy. Unlike Bitcoin, Maker is actually being destroyed every day, not created.

The growing value of the network is undeniable. Everyone talks about Ethereum in reference to the defi niche. The MakerDAO is a huge part of that movement, even if it does revolve around around USD at the moment.

Posted via Steemleo

Return from Maker Price Suppression. to edicted's Web3 Blog