Demand to create Dai stable coin has been at an all time high this past few days. The debt cap of 50 million was reached and held for over 24 hours. This caused the MakerDAO to cast a vote.

Should we raise the debt cap?

The vote passed and now the new cap is 100 million. I think this is a smart move by MakerDAO. 24 hours later 352,000 more Dai coins have already been created. Most of this money is flowing right back into the cryptosphere in the form of leveraged investments.

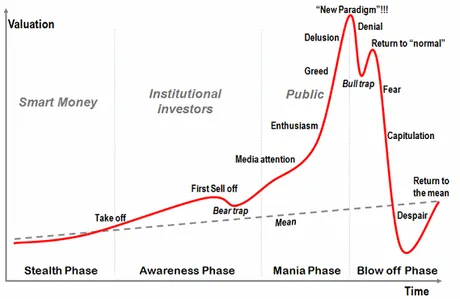

Dai is a stable coin that normally fluctuates between $1.02 and $0.98. For the past three weeks it's been around $1.00 to $0.98, rarely ever hitting $1. This points to the conclusion that users of the Maker platform are using it to make leveraged margin investments. No one wants to hold their Dai right now. They want to create it and spend it on more crypto. Clearly, users of the MakerDAO believe we are at the bottom and the crypto market can only go up from here.

Why is there a debt cap?

Risky collateralized loans can lead to catastrophic systemic failure. This is actually what caused the housing crisis. Risky home loans were given out over and over again until the entire top-heavy system came tumbling down. Who paid the price for this crash? Was it the banks giving out the loans? Was is the real-estate agents who pushed them? Were the people responsible for the crash actually held responsible? No!

USD holders and taxpayers are the ones who paid the price. Gotta bail out those incompetent and greedy markets! This is what makes the MakerDAO so special. If the system collapses they are the ones that pay the price. Bad loans given out by the MakerDAO are paid off by creating more Maker coins. This gives a huge incentive for the MakerDAO to ensure that the system never fails, because they are the ones paying the price in the form of coin supply dilution.

On the other side of the coin, the interest on Dai loans can be paid only in Maker, and maker spent this way gets permanently burned, increasing the value of all other maker coins due to lowered supply. These two factors force the MakerDAO to find a balance between risk and reward as they regulate the system.

How safe is the system?

This recent decision to double the debt cap is a very safe one in my opinion. It's hard to even consider that Dai coins are even loans, because the Ethereum collateral backing them is currently 287%. This mean for every $1 Dai created there is $2.87 worth of Ethereum backing it. The system is set up so that if a loan dips below 150% collateralization a member from the MakerDAO can force a margin call and start liquidating the Ether to pay off the loan. This margin call comes with a 13% fee penalty, so no one who takes out a loan would want that to happen. The fee is used to auction the Ether off at a reduced price to the community, ensuring that it gets sold immediately and the platform stays afloat.

I would make the argument that the debt cap is small potatoes compared to these other factors. As long as the margin call stays at 150% and the penalty stays at 13% the system feels incredibly safe. The platform came online right before the Christmas pump and dump, so it already has an amazing track record of working perfectly even as Ethereum crashed from $1350 to $350.

Legendary Ethereum scaling issues.

The current gas cost to exchange Dai right now is an all time high of $9.00 right now on decentralized exchanges like https://oasis.direct/. This is an insanely huge barrier to entry. This flat fee is only worth it when you're trading in very high volume. This is why DPOS platforms like EOS are going to be incredible. I maintain that collateralized debt position loans linked to stable coins will emerge on all the smart contract platforms. However, unlike Ethereum, platforms like EOS are going performs these transactions for "free". All you have to do is stay under your monthly bandwidth usage. Shouldn't be too hard if you hold a few EOS coins. This will greatly reduce barrier to entry, allowing anyone to participate and get rewarded for keeping stable coins stable.

Coinbase to the rescue!

Coinbase has announced its intentions to get licensed for securities and start listing ERC-20 tokens. Can you imagine how much money will flow into Ethereum projects when this happens? Not only that, Coinbase has the advantage of being a large centralized crypto hub. They don't have to pay those ridiculous Ethereum flat fees all the time. They simply have to track who owns what on their own private servers.

This will lower the barrier to entry for Dai, in addition to linking it directly to USD that is easily accessible by Americans. This dynamic will stop Dai from fluctuating 2% down to a much lower percentage due to all the reduced friction and increased accessibility. I can't wait for the day when centralized stable coins like Tether, TrueUSD, and Cloud become completely outdated while they crash and burn. Only then will we truly know if they were running a fractional reserve and become insolvent.

The MakerDAO is the opposite of a fractional reserve, because all loans are over-collateralized. It is also fully decentralized and can't be shut down or censored. The organization that regulates it is also the one that takes responsibility if it fails. It's a superior system and will pave the way for businesses to accept crypto as payment for goods and services.

Dynamics of an Over-Collateralized Reserve Coin

There are only a few reasons to buy Dai:

- Fear of market volatility.

- Bought slightly below $1 and intend to sell slightly above $1. (Paid to help stabilize)

- Bought below $1 with the intent to pay off a loan for a cheaper price.

- Bought at $1 or above to free up the locked Ether and sell it.

The reasons to sell Dai are:

- Making leveraged investments.

- Dai > $1.

- Liquidate for fiat.

I bring up these reasons because they have many interesting side-effects. Currently, Dai isn't even being used for it's primary purpose, which is a stable-coin. No businesses are accepting Dai as payment, so this platform is being bootstrapped by its ability to allow leveraged investments and its ability to reward razor thin profit margins to the users who keep the coin stable. The only people actually using it as a stable coin are a small minority of swing traders who are trying to avoid losses during declining price action. Most people just use a Tether to accomplish this because it is actually listed on big exchanges. This means that there is no core group of people who are actually holding the coin on a long term basis. However, let's assume that this was no longer the case.

Possible market manipulation opportunities.

Let's say that a billionaire comes along and decides it would be fun to mess with the MakerDAO. He could slowly buy 50 million Dai coins. All he has to do is keep buying. This pushes the price of the Dai up to $1.01. This action incentivizes Ether holders to lock up their coins in a CDP, draw DAI from it, and sell it to the billionaire for a free 1% profit. The billionaire loses 1% of 50 million. No big deal, he's having far too much fun. What happens now?

The billionaire lost half a million dollars on his little stunt, but now he indirectly controls a quarter of a billion dollars. How? His 50 million Dai are collateralized (on average) by 250 million dollars worth of Ether (at least 150). As long has he holds his Dai coins. No one can unlock their Pooled Ethereum and sell it on the open market.

Can you see where this is going? What if this were to happen during the next bull run? What if the next bull run creates a frenzy of MakerDAO platform users looking to lock up their Ethereum and sell the Dai to make leverage investments. The billionaire could sit back and buy the Dai at a discount. In this scenario, he'd be buying Dai at $0.99 instead of $1.01 because there is more demand to sell Dai than buy it. Huge difference; he's going to make a profit no matter what.

Let's say that the next big bull run goes x20. Now Ethereum coins are worth $9000, but the market is bound to make a huge correction yet again back down to $2500. Everyone who holds a CDP on the MakerDAO is now freaking out, because they want to get out and sell their Ethereum, but they can't because the billionaire won't sell his coins. The billionaire is a smart guy. He knows that CDP holders can max out their loan to 150% collateral and then take the 13% penalty to get out of the CDP. Instead of letting that happen, he will allow people to buy his DAI at $1.10 a coin, so it's more worth it to them to buy from him than let the loans default. This was a super easy low-risk way for Mr. Billionaire to make a profit from his investment.

I bring up this example, not because I'm worried about it happening, but simply because it helps you and I get into the mind-space of this crazy financial sector. Replace the single billionaire with people using Coinbase and businesses who start accepting the Dai as payment. The logic can get very complex very quickly when multiple variables start getting added to the equation. The main thing to take away from all of this is that Dai coins that get held are basically locking up 2.5x their worth in Ethereum. Therefore, in addition to the previous scenario, holding Dai could also be a way to stabilize the value of Ethereum during a crash. Food for thought.

Regulation of cryptocurrency is scarce and also hard to enforce, so actions like the ones described above aren't even illegal yet. This is further proof that we are entering an entirely new industrial revolution. Rockefeller always bragged that he never broke the law, yet his exploitative tactics were the basis of many regulation laws that came after his reign.

What comes next?

There has been talk of being able to put the deeds of physical assets on the blockchain. Could you imagine buying a house with crypto, putting that house on the blockchain, and then drawing stable-coin loans with your house as collateral? This could also be applied to cars and other large assets. This is the world we are entering. It's pretty crazy to think about.

Return from MakerDAO Doubles Debt Cap to edicted's Web3 Blog