Two weeks ago I talked about the MakerDAO raising interest rates from 1.5% to 3.5%. Now they've raised them again to 7.5%. I view this as an extremely bullish signal.

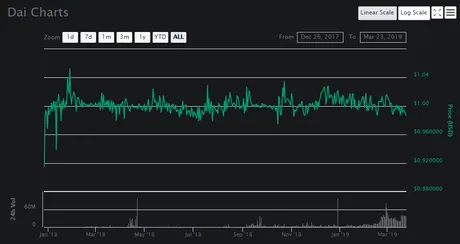

Interest rates keep going up but the value of Dai continues to trade sub $1. This means no one wants to hold Dai, and everyone is willing to take out loans even with this ridiculous rate and continue margin trading with it.

Something big is coming. We might see some insane action in the summer time. I won't be surprised if we see one of these again:

Now, if this summer spike does happen, one of two things could occur imo:

- Spike will be 1/2 as big as all time high ($4)

- Spike will be twice as big as all time high ($16)

If anything, I would say $4 is much more probable.

Of course, such a spike would result in a crash to some kind of baseline.

The higher the spike, the more violent the crash.

For example, if Steem spiked to $4 I would assume a crash back down to ~$1.

However, a spike up to $16 I would expect a crash back down to like 50 cents.

Now, I was already expecting a little bump in April from tax season. I'm starting to think this might be a bear trap.

The bump we get in April may be followed by a selloff and then we hit massive gains in the summer time.

Obviously I'm always super bullish and this is the best case scenario. I'm normally wrong about these things, but hopefully I'll get better at these predictions.

Return from MakerDAO Raises Dai "Stability Fee" To Record Breaking 7.5% to edicted's Web3 Blog