This week, on Clown World:

Draft legislation to create a U.S. federal framework around stablecoins would temporarily ban the types of payment coins that are not backed by outside assets — similar to TerraUSD, an algorithmic stablecoin that collapsed earlier this year.

Nonbank issuers of stablecoins backed by fiat currency would also be overseen by state banking regulators and the Federal Reserve.

Issuing a stablecoin without approval from those regulators could be punishable by up to five years in prison and a $1 million fine.

wtf does this mean?

Under the bill’s current form, it would prohibit the comingling of customer funds and keys with the stablecoins and other assets of an issuer. In theory, this would allow customers to more easily recoup their money if a stablecoin issuer fails.

Comingling? Customer funds and stablecoins can't touch? What does that even mean? Clown world.

Well that escalated quickly!

@taskmaster just reported on this issue earlier today, but it's certainly worth a few rehashes.

The language of this bill very specifically bans every algorithmic stable coin in existence no matter what. The only stable coins allowed will be ones pegged to dollars in a bank.

Many on Hive (or on other networks with an algo-stable-coin) would see this as an attack on the network. I see it as a massive opportunity. This is EXACTLY what we signed up for. This law is going to make it extremely difficult (if not impossible) for algorithmic stable coins to pop up. The regulators are standing above crypto with their hammer ready to whack-a-mole any algo-coin that they see. Meanwhile SBD and HBD have been around since 2016.

Think of the kind of press Hive will get if we are just chillin here with our algo coin, the regulators are smashing everything in sight, and then they get to ours and are like... "Uhhhh, what do we do with this one?" The only way to get rid of HBD would be for our core devs to fold and implement a hardfork that buys everyone out of their HBD by printing Hive and eliminating it entirely. If that happens I think I might just dump my entire stack into Bitcoin. That's just too big of a fail for me to personally tolerate.

HBD will be the biggest algo stable coin in the world.

Given enough time and development of course. But think about how badly a law like this would just completely destroy something like DAI and MAKER/MAKERDAO. That project is so intertwined within the corporate world it's enough to make one's head spin. Their majority userbase are a bunch of wealthy private buyers. The project literally can't do what regulations tell them they need to do. I'd be worried if I still held MAKER tokens, but I dumped those years ago when they announced that it was okay to collateralize DAI with USDC. Mmmm hm... sure.

Issuing a stablecoin without approval from those regulators could be punishable by up to five years in prison and a $1 million fine.

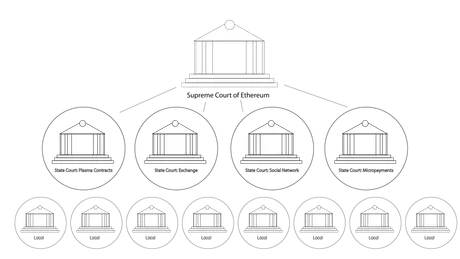

We see that once again the regulators can not even begin to wrap their brains around a decentralized ecosystem. In their minds, every stable-coin has a listing on some centralized exchange located in the United States they can legally control and an issuer they can put into jail if they disobey. How else would they take away someone's liberty for five years?

Imagine the possible scenarios:

Extreme pressure is put on Blocktrades to eliminate HBD with a hardfork. He writes the code and then Hive witnesses just... don't allow it. Then the government tries to apply pressure for other nodes to push the code. Imagine those witnesses are viewed as compromised by the network and voted out. Something like this could even create a network split where one side refuses to push code mandated by the government.

This is why people fretting over ETH regulation don't understand what is actually going on here. It doesn't matter what the SEC says. Their words are irrelevant. Ethereum is a security? So what? What are they actually going to do about it? Are they going to try to push code to the network? Who's going to write it? Who's going to allow that code to be pushed? How do you stop the network from splitting because of this attack?

So many people out there just assume that the regulators have all this power that they don't actually have. Oh no the regulators are going to come in and regulate stuff. Then if you ask 'HOW?' everyone just shrugs. No one can come up with an actual scenario where what is being said actually happens in the real world.

Spoiler alert:

The SEC is going to fine some centralized dev teams for issuing unregulated securities. Who cares? That's a completely irrelevant nothing-burger that everyone seems to think is significant. Nothing changes. The world keeps spinning.

The regulators are irrelevant.

In fact, they do exactly what we need them to do: root out the centralized garbage and kick it to the curb. The regulators help by slapping down the bullshit. Goodbye, you won't be missed.

Ripple Lawsuit

How can anyone be afraid of the SEC when they can't even win a lawsuit against the most obviously centralized garbage out there? It's been two goddamn years! LOL! WHAT!? That alone needs to give people pause. Look at how slowly these government organizations operate. Look at all the developments that can happen in crypto within two years. What about five years? It's crazy.

Update on Ripple Lawsuit

So, many people speculated that the SEC was going to bust out a very solid case because a lot of the information of the case was unknown, until now. At this point, it looks like that the SEC has a very weak case against Ripple. It's even weaker when we consider that the XRP community has stepped forward in a big way and helped Ripple during this entire process.

Ripple’s general counsel Stuart Alderoty said,

“My hot take – after two years of litigation, the SEC is unable to identify any contract for investment (that’s what the statute requires); and cannot satisfy a single prong of the Supreme Court’s Howey test. Everything else is just noise.

So not only does XRP fail every single prong of the Howey Test, but also the XRP community themselves comes forward and says there is no agreement with Ripple in terms of an investment contract. Ripple owes XRP nothing. How wild is that? Crypto people are insane.

Say what you want about Ripple and XRP, but it just keeps getting more decentralized. All the tokens that will ever exist were printed all at once. Where there dev funds and founder stake? Yes, of course, but they aren't going to mint more tokens. Compare that to central banking and our debt-based legacy system. It's a completely different brand. Totally non-comparable, but people just assume they are the same thing. It's not.

“I think there’s a reason for Stu to be confident. I have to tell you something, I was proven wrong already by these briefs because if people go back to my tweets a couple of weeks ago, I tweeted out that when we see the summary judgment motions and they’re unredacted, that we’re going to see evidence that we were unaware of. I said I probably predict that there will be some evidence against Ripple that is more damaging than some people think…

[But] it’s missing. I was surprised that the SEC did not have more specific evidence. All the specific evidence that they pointed to was to institutional investors and accredited investors. They made no connection to XRP holders, the retail holders, you or me or people out there.”

lol wut?

If Ripple wins this case it's going to send the entire crypto market into a rampaging bull run. I guarantee it. It doesn't matter how bad the legacy economy is doing. Think about how many investors are worried about regulations. Then Ripple wins the lawsuit and all of them are like "wtf how did that happen?" Huge win for everyone.

Deaton represents 67,000 XRP holders in the lawsuit after U.S. District Judge Analisa Torres granted the crypto investors “Amici Curiae” status last year.

“Amici Curiae” means “friend of the court,” according to Cornell Law School. Amici curiae can submit documents known as amicus briefs on issues relevant to the case as long as the court approves the briefs in advance.

FRIENDS OF THE COURT

So the XRP community is just constantly backing up Ripple and showing over and over again how the SEC is in a constant state of overreach. You have to admit... the SEC's stance of "we're here to protect investors" falls flat on it's damn face when the entire community rises up to protest the SEC's bullshit. It's pretty wild to see, even if I have zero interest in personally holding XRP. I can still root for them. The enemy of my enemy is my friend.

Conclusion

The regulators are doing exactly what we've been expecting this entire time, but somehow people are surprised. This push to reign in stable-coins is potentially the best thing that ever happened to HBD. We are going to get quite a bit of attention when they realize what we have going on here.

And to be fair, a lot of these regulations are going to be reserved solely for centralized exchanges operating within the United States (and perhaps centralized/doxed dev teams and founders). It actually might be quite a while before they try to reach any farther than that.

Hive needs to stand its ground and state the obvious: no one controls HBD. It's just out there and there's nothing any one centralized agent can do about it. Deal with it.

Regulations are an excellent test of decentralization. The best test even; The ultimate test. Can the network stand as a sovereign nation against an empire? Or will it fold like a house of cards? Time will tell, and these are exciting times.

Posted Using LeoFinance Beta

Return from Making HBD Illegal to edicted's Web3 Blog