- The market is boring as hell.

- "Bitcoin will be stuck at $30k forever."

- This is when we make trades.

- Not during FOMO/FUD cycles.

First thing's first.

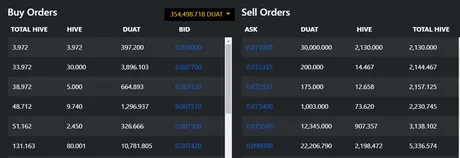

I went ahead and bought out all the Ragnarok tokens for sale.

This market has such thin liquidity that it can be dominated with $100 here and there. There was a huge gap between the ask price of 0.01 and 0.07 so I went ahead and bought everything at 0.01 and pushed the ask up x10 from the lowest bid at 0.007. Essentially I 10xed the buy price with less than $100.

However, this was short lived as another $50 worth of DUAT has appeared at the 0.01 level like 30 minutes later, and I'm not looking to buy at an inflated price with an unknown amount of selling pressure behind it. Still, it's tempting to buy it out again.

At this point it's comical that these future NFTs are selling for less than 1 Hive a piece. It takes 112 DUAT to mint an RCT NFT. At a buy price of 0.007 that's 0.784 Hive per card. Again, that's a comical price considering how 10k Hive Punks sold out in 24 hours at a 20 Hive mint price.

I feel like this is a great example of how most people need something visual to look at before they gain interest. In this same vein, if I'm being honest, it's surprising that my blog gets as much support as it does. I know for a fact that I'd get a higher payout with video content. But I'm gonna pass on that.

If something like a Hive Punk can sell for 5000 Hive during peak FOMO, surely Ragnarok can at least match that, given the fact that these NFTs have actual utility and are needed to play the game. I'm almost positive that I'll be able to sell a single card that will make up for all the money I've put into this market so far.

Very thin liquidity.

Entering/exiting this market is nearly impossible for a variety of reasons. The first of which being there is an insanely aggressive cap on how much can be sent to the market making bot (for security reasons). The second being that there is simply no product yet and most people are just waiting for the game to come out. Well... guess what? That's what everyone's doing. Wait that long and it will be too late.

Of course there's a certain level of trust required here. DLUX isn't exactly a proven technology. Neither is the SPK network. Still, I'm willing to be on the cutting edge when it comes to supporting Hive development.

Splinterlands

I've also been making some moves in Splinterlands but it's been slow going. This is actually worth it's own post so I'm not going to really talk about it, just thought I'd leave this footnote here.

Polycub

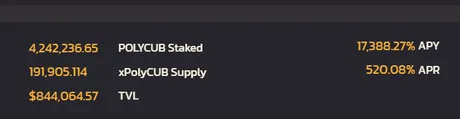

Polycub is still in only-up mode. Now double the market cap of CUB and climbing. The weird thing about Polycub is that the LP yields are still super high which pushes the price up, but also because of governance votes and impermanent losses, more people want to buy and hold the token in xpolycub than provide liquidity to the market. This pushes the price up even more, which pushes yields up more. This creates an upward hype cycle that doesn't really care about what the greater crypto market is doing.

All the trash I talked about this project is flipping back to the upside now that we crashed into the dirt at $700k market cap. Yields are still shockingly high considering there are only 1M more polycub to mint total... forever. We'll get a good indication of how well the Vault is propping up the price/yield of the network during the next halving event... which should be happening very very soon (days).

For example, the Hive/Polycub LP has 119% APR. Given the halving event we should expect the new yield to be around 60%. However, if the vault is doing its job the new yield could be as high as 70% or 80%. The higher it is above 60%, the more sustainable the Vault has become. We can apply this logic to all the other yields as well (assuming the APR factors in the yield from Vault buybacks).

Speaking of factoring in yields...

The APR on this pool is something like 50 or 60 percent but it's constantly displayed at a level x10 that. I'm told this is because the math that calculates the number is volatile and based on users who take the 50% penalty on LP farming, but this is obviously not true. If it were true then this volatile number would dip lower than the average, but it is always much much higher than the average, which is very easy to calculate.

On June 3rd 10 AM EST the ratio of xpc was 22.06. 27 hours later it's 22.11. That's 73.5% apr. Clearly horribly bugged and should be fixed.

Rune

Thorchain is definitely a fun coin to speculate on.

Cheap as all and constantly manages to spike around $10 before crashing again. The token is insanely volatile and good for day trading. But really more than that the liquidity and security between networks that Thorchain creates will be a huge part of interoperability between chains. I'm always trying to get more but find it difficult to sell other assets into it.

Bitcoin

The big dog is still the main play, and arguably it's not a good idea to be messing around with alts right now. The moon cycle and current volume tell us the market is extremely weak right now. I think we are going to hard bounce off $28k before moving back up. Still grinding at the bottom of this consolidation period. Sure, it's not a fun time to be in the market right now, but flushing out weak hands at the bottom is what the market is best at. We can always count on maximum value extraction in both directions.

Conclusion

Are you bored yet?

That's a great sign.

Never trade when afraid.

Oh it even rhymes look at that.

Never trade when afraid.

Title of my next post?

Posted Using LeoFinance Beta

Return from Making Moves to edicted's Web3 Blog