It's very hard to concentrate during a crypto rally.

All eyes are glued to the price. Wen moon? How high?

And now with Hive catching a bid it's even more difficult to remain focused. Again I'm kind of annoyed because I wanted to buy Hive at 400 sats but now it looks like that has a much lower chance of happening as the altmarket starts to wake up. Even Doge is up by over 100% in the last week. Insanity!

4-year cycle

There's a lot of concern or just various angles of speculation when it comes to this rally. Many are already foolishly declaring an end to the 4-year cycle because Bitcoin has never tested all time highs before the halving event before. Another valid point being made is that when gold was first listed as an ETF the spot price went up over a very long time (8 years?) and never really came back down again and has been crab-walking ever since. Of course Bitcoiners like to take the best parts of this story, apply them to Bitcoin, and then ignore the crab-walking bit.

Last bull market sucked

The reason why being at all time highs right now "a year early" is wholly unremarkable is that the 2021 bull market was extremely lack-luster when compared on the log scale to 2013 and 2017. By those metrics we should have peaked around $250k, which was my personal target for years and also the reason why I fumbled my bags so hard during the 2022 bear market even though I knew in my heart that my time was up. "This time is different" is a strong psychological barrier to overcome within the FOMO of the bull market year.

"What if it goes 10x... I can't take gains here!"

Seeing as 2021 only went x2.5 higher than the doubling curve trendline (which is just a regular bull run not a mega-run which is x10-x15) it is quite unsurprising to me that we are currently testing all-time-highs before the halving event. Especially considering halving FOMO is stronger and more hyped in the current cycle than any other cycle I've participated in. Not to mention the ETFs accumulating like 2% of the total supply in two months. They're only going to get more. Insanity!

Doubling curve at $800k circa 2026.

So what are my targets this time around? Well I have several, the first of which is $400k. If the market peaks around $400k in 2025 it will mean that the doubling curve trendline has failed and now acts as resistance. Sadly, I would have to retire this metric if it turns out this way, but I actually think we are going higher than that.

The next target would be somewhere around $1M per BTC. This would be x2.5 higher than the doubling curve which would end up being pretty much what we did back in 2021. It would be very unclear how big the dip from here would be. Again, if the curve can act as support in Q4 2026 it will be all the way up to $800k, so I think there is a real possibility that $800k BTC will be the BOTTOM of the BEAR MARKET rather than any kind of peak.

Of course these astrological astronomical numbers make me sound like a crazy person so I have to temper this speculation with a message that I constantly have to repeat over and over again: I DO NOT WANT A PUMP AND DUMP. I want crypto to go up slowly over time predictably and for everyone who enters the market to make money no matter when they enter or exit. Ironically this is exactly the type of environment that makes people FOMO and dump everything into crypto making it a volatile pump and dump. Regardless, do not mistake my vibe. Just because I say these things CAN happen doesn't mean I WANT them to happen. Stability is more important than infinitely greedy pump and dumps.

Final target: $2.7M - $5.2M

Imagine that... one Bitcoin for millions of fiat dollars. My lord, imagine how people would be acting during this time. Peak euphoric greed right there. Total irrational behavior and emotions running wild under the guise of false genius.

Why $2.7M?

Again all my targets are based on the idea that Bitcoin is doubling in value every year since 2013 at $100. When we look at Bitcoin on a log scale (on the right) we can see that every 4-year cycle is a little bit smaller than the last one. Each bear market forges a softer and softer landing. First we get an 85% dip, then 80%, then 75%. More exactly the last drop was $69k to $16k which is 77%.

In any case say we crashed 70% next cycle to $800k this implies a peak of around $2.7M. Whereas if we spike x13 higher than the doubling curve this gets us the $5.2M target. Again, no matter what happens, the target for peak is somewhere in 2025, and hopefully more towards the end in Q4 like it usually is. November always seems to be a pinnacle month no matter what year it is (in both directions).

How could this possibly happen?

Well like I said ETFs already have over 2% of the total supply in two months. That number is never going to decline. By the end of this cycle it could be higher than 5%, so think on that for a bit. Characters like Michael Saylor also hold like 1% and are diamond-handed forever holders. In fact go look at MSTR's stock valuations:

MSTR stock price

It's gone up 160% in one month. These are securities ninjamined and printed out of thin air that are essentially loosely pegged to the success of Bitcoin. How long before other corporations see this and copy the strategy? How long before MSTR is the top performing stock of all time? Now long before Saylor is the first trillionaire the world has ever seen? Imagine the hype among billionaires if and when this happens.

El Salvador and Argentina

How long before all nation states are competing to own the best collateral in the world? How long before some nations adopt a Bitcoin standard in which they print fiat currency and other derivatives (CBDC?) using their Bitcoin collateral?

Larry Fink and ESG

Haven't you heard? Bitcoin is no longer bad for the environment? Even the WEF agrees. Why? Because the CEO of Blackrock said so, that's why. All of this political resistance is melting away now that Blackrock has wet their beak on this action. Checkmate.

Banks

Multiple banks are coming forward and launching their own ETFs. The writing is on the wall: you either adopt Bitcoin and follow in Blackrock's footsteps, or you get absolutely wrecked.

The banks, the corporations, the nation states, the hedge funds, and all the institutions are coming for Bitcoin all at the same time, and $5M Bitcoin is not on the table? I assure you it is. Laughably, even the most diehard of Bitcoin maximalists have argued with me on Twitter saying that not even $1M is possible. $5M is max pain. They will sell early and aggressively, and they will regret it.

Larry Fink is not to be underestimated

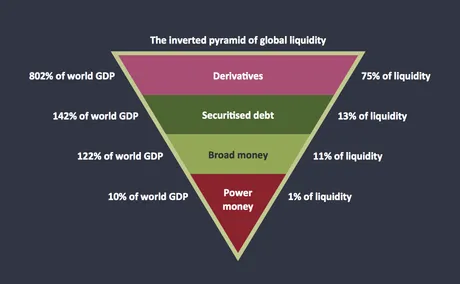

The CEO of Blackrock is the person who basically invented the mortgage backed securities that obliterated the economy in 2008. Now he's creating derivatives for Bitcoin; a collateral that is exponentially better than housing (until the bear market hits of course).

Call and Put options are coming. The ability for ETF holders to extract low APR loans from their position is coming. An entire full fledged futures market is coming with Blackrock at the helm. Their fees are low and the utility is high. They are tapping into markets that were previously completely cut off from the rest of the space.

Do the maths.

Do not sell to Blackrock. Do not take gains in 2024. Yes, this is financial advice, and if you don't know why I can't be sued for giving it then I suggest studying a bit harder because that fact is very relevant within the current context. Because the same rules apply to everyone else shilling Bitcoin as well. It's not a security, and the billionaires in charge are going to make sure it stays that way. Forever.

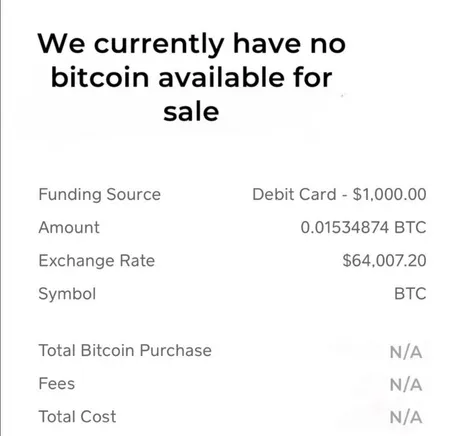

Fake news: out of Bitcoin

There are several fake reports of endpoints who sell Bitcoin being out of Bitcoin. While this is not true the sentiment perhaps is true. There are many reports of Over The Counter BTC desks being completely out. Supply shock is coming, right on time for the blow-off top I've been predicting in mid March. Noice.

Conclusion

Bitcoin is currently trading at $67k and I'm quite certain we will be trading at all time highs within days. When that happens the entire market sentiment will shift and we will engage in total supply shock resulting in a blow-off top mid March one month before halving. At least this is the story I've been telling myself for a few months now.

If Bitcoin has a chance of going to $5M this cycle, it means we'll at least have to get to the number we were speculating in 2021 by the end of the year. That means $250k BTC by EOY, so quite a ways to go. If this happens it's painfully obvious that many will turn bearish and forsake the 4-year cycle. "This time is different." It isn't. We are just catching up on lost time.

Return from Making up for Lost Time to edicted's Web3 Blog