The month of March and early April can be a very cringe time for crypto.

Many a time have traders taken massive taxable gains during the bull market year, only to realize that they're completely fucked come April 15th IRS ultimatum. Pay up: peasants! IRS don't care!

The problem here is that by the time April actually rolls around we can often find ourselves in a slump or even a full on bear market in which the cost in crypto to pay the taxes has skyrocketed due to spot-price decline. Most citizens are degenerates, so they don't actually set aside any money when they cash out like they should.

Even worse, many will "buy the dip" with their "winnings" only to realize that it was the first dip of four separate 30% dips. So basically they have to pay taxes on gains that don't even exist anymore because of how the system breaks everything up into fully segregated fiscal years. You can't claim a crypto loss in 2022 to make up for the gain in 2021. Which is somewhat ironic because the loss in 2022 would have never happened if you weren't being forced to pay the capital gains tax from 2021.

Of course the simplest solution to all of this is simply to maintain balanced positions and make sure to always have a sizable stable medium of exchange to cover such expenses. However this 'solution' becomes irrelevant in the face of the reality of the situation. Statically the population is NEVER going to learn their lesson and these problems will always keep happening. This will always be true no matter how many warnings are given.

The most classic example of this was March 2018 when a bunch of distressed sellers created a local bottom because of tax season. Many were complaining about it. That's the way the cookie crumbles I guess.

March 2019 was the opposite situation.

Because so many people had lost money in 2018, tax season had very little affect on the market. In fact we might even come to the conclusion that through tax-loss harvesting and tax returns March 2019 helped fuel the 2019 summer bull trap before getting slapped by COVID 9 months later.

Looking at all the March months over recent history we can see a pattern emerge. March is a critical pivotal month every single year. Either the market is winding down because we just had a bull market, or the market is winding up because we've been scraping the gutter. Which scenario do we think 2023 plays into?

In both 2021 & 2022 March was followed by a 50% decline in price shortly thereafter into the next summer. Is this our fate yet again this time around? I mean... I highly doubt it considering the pattern we can see before us. If anything I expect to see a repeat of 2019, which as luck would have it is exactly 4-years away and plays into the idea that we are still on a 4-year cycle created by Bitcoin's halving event.

Speaking of the halving...

The next halving event is being hyped up to the moon, and I think this is going to be the perfect time to dump crypto. Why? Because it's going to happen in mid April 2024. Taking gains from January to March 2024 is probably going to be a good idea... but to know for sure we'll just have to wait and see what the spot prices look like and how much hype/FOMO/greed that's floating around within the public sentiment during that time.

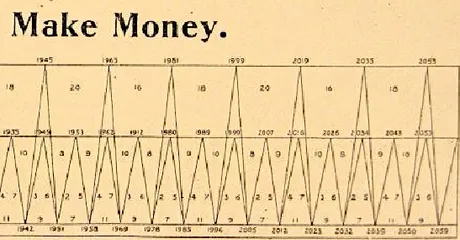

Here's a fun cycle chart that @acesontop showed me on Twitter (assuming you can even read it, lol). This thing seems to be predicting boom and bust cycles pretty well over the last hundred years. It's crazy to think that a prediction model created in 1872 could even be remotely accurate today... but if you check some of these dates they seem to line up fairly well.

And wouldn't you know it 2023 is a rock-bottom year with the most room for upside. Have we already reached the bottom of 2023? Who knows, but if this chart has any accuracy whatsoever it's not going to matter either way for long term holders. According to this we're going to be up up up for three years straight after the bottom does materialize. Again that idea fits in quite nicely with 4-year cycle theory on Bitcoin. We may see some fireworks after all.

Think about how much money was lost in 2022

Not just in crypto as per usual given a normal bear market year, but across the entire economic sector. Elon Musk was criticized for losing what, $200 BILLION dollars in a single year? Some absurd amount like that. Something tells me that no one is paying taxes this year when considering the global corporate scale of things. If anything there should be some hefty returns. How much of that savings will make its way back into crypto? Hopefully quite a bit.

Is it not serendipitous that the stock market just happened to peak on the very last day of the 2021 fiscal year? Perhaps we can tin-foil-hat this development and even try to claim that this was by design. Doesn't really matter either way. What's done is done. More tax-loss harvesting was done in 2022 than any other year we can see on the chart. But don't worry Biden hired a bunch of IRS agents to make sure that waitresses aren't taking cash tips under the table. God Forbid.

Conclusion

March Madness is a fun month to gamble, that's for damn sure. Will tax season cripple the market as we have seen in previous iterations? Somehow I doubt it. The new trend seems to have set in a bit earlier than it usually does. An act of god can always rain on our parade, but I certainly won't be betting on that outcome.

Posted Using LeoFinance Beta

Return from March Madness: Inverse Tax Season to edicted's Web3 Blog