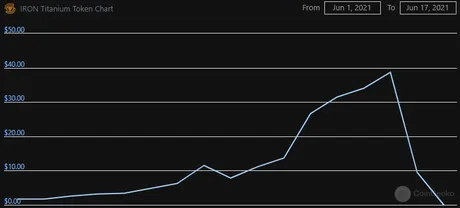

As you may or may not know, a random DEFI token called Titan got wrecked yesterday. Crashing to zero after a hack.

The dev team called this a bank run, but they are shady as hell and ended up scooping a bunch of liquidity for themselves during the chaos. Who knows maybe they were responsible for the exploit as well. This was not a bank run. It was an obvious arbitrage hack executed over and over again. Claiming anything else is suspicious.

Titan implemented a stable coin called IRON whose redemption method was exploited in classic arbitrage-hack fashion. The hacker was able to constantly turn a 1% profit back to back to back and crashed the entire network to zero over the course of a few hours.

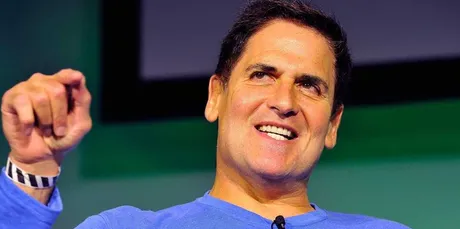

On January 14th 2021 I wrote this article blasting Cuban for comparing crypto to the Dot Com bubble. He's taken this opportunity after getting wrecked to spew more of his bullshit.

Mark Cuban Calls for DeFi Regulation After Crypto Investment Goes to Zero

“There should be regulation to define what a stable coin is and what collateralization is acceptable. Should we require $1 in us currency for every dollar or define acceptable collateralization options, like us treasuries or? [sic]”

Oh no!

Poor Marky got wrecked and now he want's the regulators to come in and save the day. God, what a jackass. These flippin billionaires just don't get it. IT CAN'T BE REGULATED. THAT'S THE ENTIRE POINT!

get over it

Okay, so even if you impose regulations to define what a stable coin is, then what? You can't stop these networks from creating collateralized assets using the underlying token. I feel like that should be obvious. It doesn't matter if it's called a stable-coin or not. Users are going to buy collateralized derivative assets no matter what they are called or classified as. No law is going to prevent that from happening.

The shear incompetence rendered by this statement triggers me so badly. The implication that stable-coins collateralized by dollars in a fractional reserve bank is better than algorithmic solutions is laughable. As if fractional reserve banking doesn't have any attack vectors? Really? What happens when the stable-coin in question needs to liquidate dollars but the bank in question loaned that money out to someone and it is no longer liquid? That's literally the definition of fractional reserve banking. The ignorance is astounding.

These networks are a worldwide breeding ground for hackers and exploits. To assume that experimental prototyped new technology is safe to park your money in because it has the label "stable coin" is completely asinine. Mark Cuban: pull your head out of your ass! Please and Thank You.

Conclusion

It's so hilarious to see a long-term crypto bear turn bullish only to get wrecked in some experimental defi scam. Stick to Bitcoin, kid. These sharks don't fuck around. Next thing you know Coinbase will get hacked and he'll complain that it's not FDIC insured. Secure the money yourself, dumb dumb. That's the whole point. We are the central banks now.

Misery loves company. Everyone likes to see a billionaire get wrecked. Knock them off their pedestal and laugh at their misfortunes. Better luck next time, Cuban.

This is the Wild West of an emergent cooperative economy. There will be no regulations. There will be no refunds. These GOVERNMENTS (because that's what crypto is) don't need to be governed from the outside. They are self-regulating by design, and Mark Cuban has no idea of what kind of shit he just stepped in. He only knows that it stinks.

All this being said, we have to take the bad with the good. What is the benefit to all this risk? Massive rewards and potential freedom. Abundance technology is coming for the monetary system, and not a moment too soon. I'll see you all on the other side. Financial freedom is on the horizon.

Soon™

Posted Using LeoFinance Beta

Return from Mark Cuban is Still a Dumbass to edicted's Web3 Blog