You've probably all noticed the pullback today.

I'd say this was expected but it should actually pull back more. If it doesn't I'm going to interpret that as hugely bullish. There's still a futures gap at $20k that we should expect to be filled. IMO a bounce off $20k is still a very bullish pathway.

Expecting a 25 point increase.

What the FED decides to do with the fund rate over the next couple days doesn't really matter that much in my opinion. Most will be looking for the future forecast. Bulls want to hear when rates will spot being hiked. During the last meeting it was vague and multiple hikes were on the table with no promises of chilling out.

However, 25 points is less than the initial 50 points that many were expecting just a few months ago. The CPI data suggests that 'inflation' has peaked and is coming back down. Big Tech layoffs have made headlines. Bad news is good news. Higher unemployment means lower 'inflation'. Lower 'inflation' means less fund rate hikes. Everyone is waiting for the pivot.

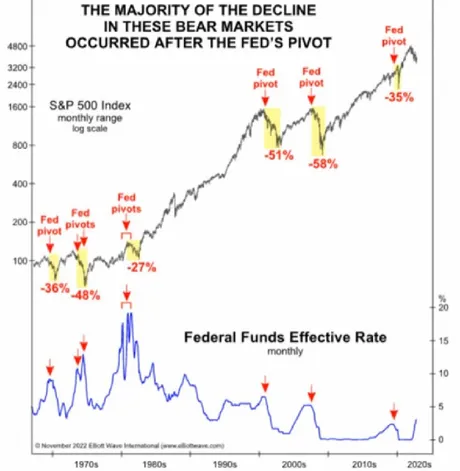

History shows us that the pivot is pretty meaningless and only signals that the market is going to get a lot worse before it gets any better. Will this time be the same? Seems likely enough, but we also have to take into account that the FED may be a big part of the problem in this particular case, whereas in previous cases they were reactively adapting to the economic climate and there was a massive delay between manipulating rates and economic recovery.

The data shows that the FED hasn't hiked this high and this fast for quite some time. It's almost a straight line up and we've already far surpassed the rate we peaked at in 2019 (2.5%) which happened over a much more gradual period of time. The second deflation kicks in they're going to have to reverse course just as fast as they got here in the first place, if not faster. The actual USD liquid money supply has not expanded, and thus doesn't need the whip. The FED has no control over supply chains and sanctions on "enemy" countries.

I'm still kind of struggling to see how the whole Ukraine/Russia proxy war has any value whatsoever, but at the same time we've got to factor in that the military industrial complex loves to make money (don't we all?). The factories are always open. Imagine you own a warehouse that makes bombs.

Wouldn't it be nice if business was... booming?

I find it comical the numbers people throw around. Everyone talking about taxpayers giving this many billions of dollars to Ukraine for the war effort and whatnot. You guys do realize that the money goes to the military industrial complex first, they take their cut, and then physical weapons go to Ukraine, right? Many like to gloss over that the middleman takes a huge profit and the burden is all on the taxpayer. Ah, whatever I wouldn't worry about it too much.

Getting back on track

Another weird thing that happened last night is that during the dip HBD spiked up to something crazy like $1.50. By the time I woke up it was back down much lower than that at $1.10-$1.15, but even that is significant due to the fact we can convert Hive to HBD for $1.05. I didn't actually check but everyone says this is a Korean pump out of UpBit as always, and I have no reason to believe otherwise. Honestly I have to wonder if whoever orchestrates these things is actually able to make any money off them considering how fast we can stabilize the price with our 'new' conversions.

I do find it interesting that this coincided with a dump, almost like there was legit demand for the HBD token and the network just couldn't keep up with that demand. But if that were actually the case that just brings up a new question: why take such a massive loss when you could just do a Hive >> HBD conversion over a couple days and only lose 5% + market volatility? Again I just find it odd that these whales keep trying. I'd say stick to SBD but SBD is still trading at $2.50. lol... nice 'stable' coin they got there. Woof.

Conclusion

FED meeting tomorrow and ending on the first of the month. Again it doesn't matter how much they hike rates at this point, only that they give some indication of when they will stop. Everyone is looking for that pivot, but history tells us that at best that can only lead to a bull trap.

Luckily Bitcoin has already suffered its traditional year long bear market, and it's pretty obvious that crypto wants to go up from here. If we get smothered by a recession I get the feeling that it's not going to be that bad, and the upward pressure of crypto combined with the downward pressure of the legacy economy may even out to a wash that provides us with some much needed stability at this point. That's the kind of consolidation and wealth transfer that leads to a massive bull run six to twelve months down the road. The crab-walking can only last so long.

Absolutely expect the futures gap to be filled at $20k. A bounce off $20k and recognition that the FTX contagion is a thing of the past is exactly what this market needs. I won't be making any bets to this effect because if the FED actually signals when they will pivot: bulls will probably lose their minds. Yada yada yada, don't fight the FED, so on and so forth.

Bitcoin is still sitting at $22700, which has been a critical level that continues to hold against all odds. I mean it's seriously weird right? Why isn't it dipping more? That being said it's only actually been 10 days. Time moves different in crypto land.

Posted Using LeoFinance Beta

Return from Market Gets Cold Feet Before FOMC to edicted's Web3 Blog