This is something I've never seen before.

So FED chair Powell gives a speech basically saying, "We're going to do the thing we talked about doing months ago," and the markets respond positively to that. Really, shouldn't that have already been priced in?

I think this shows us how the market starts making up its own stories and making trades off of the rumors they create. People get it in their minds that the rate hikes will never end, and then when they begin to taper at the exact time they were told the tapering would begin, they get all surprised by the news. Very weird.

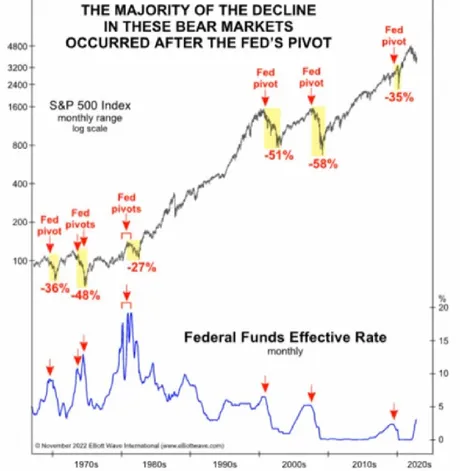

More than a few people are now looking at charts like this, which show that the worst losses in the stock market occur right AFTER a FED pivot. However, nobody is asking WHY this would be. Are they assuming that the pivot actually causes the markets to crash?

We already know this is not the case.

For example, we know exactly why the markets tanked in 2008. The housing market imploded. Why did the FED ease financial conditions? Because the housing market imploded. In theory, the FED cushioned the blow to the markets by easing the fund rate and initiation QE. In theory, if they did not respond the result would have been much worse.

The economy is also a slow lumbering beast. By the time the FED actually changes rates in one way or the other, it could take 6 months for that change to actually cycle throughout the economy. At this point I act under the assumption that the corruption rooted within this system is so bad that insider trading happens without these people even trying to hide it. I'll assume the bottom is in when central banks are like, "Okay we're going to trade stocks again; it's no longer a conflict of interest." That's exactly what they said at the top that they created. "We can't trade stocks because of a conflict of interest." They seriously aren't even trying to hide it anymore.

At this point we must assume that something big is going to break in the economy that forces everyone (including POTUS) to admit that we are actually in a recession. The bottom for the stock market likely won't be in until the fund rate is back at 0% and they turn QE back on... or at least that's what I assume. Unfortunately this analysis isn't going to work so well for crypto.

Bitcoin has already seen a 78% dip from the peak and continues to show more and more evidence of legacy market decoupling. Looking at the charts, the stock market could EASILY sustain another 25% loss (especially if the bottom is v-shaped), but the chance that Bitcoin dips another 25%+ seems increasingly unlikely given its current positioning. It would actually make more sense for us to get a bull trap up to $20k and then get slapped back down to $15k-$16k during the stock-market implosion.

Too big to fail zombies.

Another problem with all of this is simply the fact of how our debt-based economy works. Look at how many bailouts there have been. Bankers constantly get bailed out. The airlines get bailed out. Any critical piece of infrastructure that fails will simply get bailed out.

The theory behind these bailouts is that we as a society can not afford to let these failed businesses die. Too many people rely on airlines (especially the upper class). Too many people rely on banks (especially the upper class). Everyone relies on a consistent food supply (which is why factory farms are endlessly subsidized).

The problem with all this is that it creates stagnation over long periods of time. The same players can continue making the same mistakes and just get rewarded for it with a bailout. Failing up has never been more prevalent than it is now. Meanwhile, in crypto land, we find ourselves in a hostile jungle full of deadly animals (the biggest and meanest of which is the overleverage python).

Over 100 companies thought they were getting bailed out by FTX when in reality FTX was leveraging those companies in a Hail-Mary to avoid bankruptcy themselves. Now all of the garbage has been completely and utterly flushed down the toilet. There's no such thing as too-big-to-fail in crypto. There's no such thing as a zombie crypto that can survive even a single bear market. Anything that survives a single bear market comes out of it ten times stronger into the next season.

This is ultimately why we can't assume crypto will keep tumbling given a poor performing stock market. We already flushed all the BS (they absolutely haven't; too many zombies). All that's left are the grizzled survivors. Hive has been here before; in fact we are VERY comfortable within this position; perhaps even more comfortable than any other community out there. We survived a 3 year crypto winter of unrelenting attack. There's a very good chance the current bear market won't be nearly as bad. Even if we crash to 20 cents that still increases the floor by x2.

At this point gold has a market cap that's x36 times bigger than Bitcoin, which I find extremely comical. Bitcoin is so so so much better than gold. I'm fairly certain Bitcoin will overtake gold during the next bull run, and if not the next one I guarantee the one after that for sure. Seven years is a long time.

2% inflation target

Powell is always talking about this magical target. 2% 2% 2%. Well if 2% is the target they are doing a piss-poor job. Not because the CPI is 7.7% but because actual inflation has been BELOW 2% for like a decade or longer. That's right: the actual liquid supply of USD has not been inflating at the 2% target for a very long long time.

Many will point to the M2 money supply and be like "we printed out 25% of all USD in existence in a single year". Yeah, we didn't though. The M2 money supply is meaningless. The FED prints a bunch of notes that can only be traded between banks and people lose their minds. None of that money ever entered the actual USD supply. This is confirmed a thousand times over when we look at the much-more-comprehensive Z1 money supply.

Given these fund rate increases and the crippling of demand for debt, it's very safe to assume that we are firmly within a deflationary economy right now and that USD is actually being sucked out of the system rather than expanding by the traditional 1% that we've seen for over a decade (which is supported by DXY spikes). Again, the legacy economy is a lumbering beast, and the effects of this are not going to be felt for perhaps another 3-6 months.

Ultimately what appears to be happening here is stagflation.

- The layoffs will continue.

- CPI may or may not get any better.

- The pyramid scheme of debt doesn't work without growth.

Stagflation Is Just What the Economy Needs

The Federal Reserve should be — and appears to be — aiming for a period of elevated unemployment and inflation.

Lookout! The Bloomberg bootlickers are at it again!

And again, we need to frame this all within the proper context. Recessions like this don't affect everyone. I personally didn't even notice the housing crisis (those with dry powder profited heavily from extremely cheap real estate). Within an environment of stagflation, anyone that doesn't lose their job is doing just fine. Luckily I can't lose my job because I don't have a boss, eh? Others will not be so lucky.

And again, look at the banking sector; look at the stock market. Stonks can be "printed out of thin air" just like fiat can. How many companies will just print stock and dump it on their shareholders to stay afloat? Hell, that's been the Coinbase business model ever since they went public. This simply can not happen in crypto, which is why conflating legacy markets with crypto is a mistake in very niche situations such as this one. The markets move in lockstep, until they don't. Bitcoin could go x2 while the stock market moves up 1% and people would still call this "correlated". The correlation is completely meaningless.

Conclusion

It should be obvious by now that the FED is not actually reacting to the signals that the economy is sending it. They are simply following the playbook that they wrote back at the beginning of the year. Despite red flags everywhere they have not deviated from the plan, and the market actually applauds them for not even getting more hawkish during the tapering period we find ourselves in today. Such a bizaro scenario.

My brain keeps telling me that February is going to be a terrible month. After the whole Christmas rush is over and everyone is broke, how could the aftermath of January be any good for this market. Of course my gut feeling is wrong 90% of the time so it will certainly be worth the laugh if the psychic vampire that is the market decides that February is amazing. Roll the bones one more time.

Let's be honest: it would be weird if the stock market had bottomed already (-25%). None of society's problems have been fixed; they've only gotten worse since the last financial crisis. The FED is powerless and apparently all they can do is cripple demand without even fixing the CPI. Such is the outcome of supply-line disruption. Unfortunately, none of this analysis can safely be applied to crypto because we've never seen crypto operate within a recession before. If anything, it's time to take note and learn something for next time, even if next time is 15 years down the road.

Posted Using LeoFinance Beta

Return from Market Reacts to Old News to edicted's Web3 Blog