Dependability is an incredibly important asset that many take for granted. As this pertains to crypto: stability is so important that we've made several deals with the Devil (dirty dirty fiat) in the form of "stablecoins". Even though a token pegged to USD is guaranteed to lose value every year, it still has value do to extremely low volatility compared to pretty much every other asset on the planet. The proof is in the pudding: we've seen Tether ascend all the way to top three on the market cap before alts woke up.

Do you want _______ to go x100?

You shouldn't! Volatility can be seen as an attack on the network. The only way to stop centralized agencies from buying out communities is to stop selling (or fork away). This moons the price and creates massive volatility. Many people cheer when their bags go x10 or even x100.

But what happens after that?

Once a project goes x100 and all of the "weak hands" have sold, what do we have left? A network with a bad distribution and new users can't buy in at a fair price. Many users buy in at the unfair price and then get wrecked, swearing off crypto forever like someone swearing they'll never drink again while hovering over the toilet.

This is a bad outcome for everyone.

It makes bear markets last much longer than they need to.

It becomes obvious that it is much more ideal for a network to simply make gains gradually over time. This way anyone can buy in at any time and be guaranteed to make gains depending on how long they hold.

The irony of this development is that it leads to its own destruction. When a network can be counted on to deliver good ROI, more users will enter the network, thus eventually mooning the price and forcing volatility all over again.

Personally I believe that Bitcoin will eventually get so big that these volatile up and down swings will actually be impossible. If Bitcoin keeps doubling in value every year the market cap will get to a quadrillion dollars in no time: less than a decade. Once the total cap is this high it's hard to imagine volatile up and down swings because no one has that much money (except the central banks themselves of course: brrrrrrrrr).

However, at a certain point I think Bitcoin is almost guaranteed to become less volatile than fiat. That's the beginning of the end of the legacy financial system if you ask me. Maybe even just the end end. Perhaps one of Bitcoin's killer dapps will end up simple being unit-of-account. The ability to price goods/services in the native currency is important, as it brings even more stability.

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| $12.8k | $25.6k | $51k | $102k | $205k | $410k | $819k |

Just a friendly reminder that if the doubling curve is still in play, Bitcoin is currently trading a full two years in front of it. Once this mega bull run finally takes off, there is a good chance we will crash back to where we are now when it's all over. Now might be one of the last good opportunities to buy into the market.

There be dragons here.

Bitcoin is trading x3.7 higher than the doubling curve, but the market does not seem to care. We've seemingly never been in more bullish territory. Considering everything going on with the world right now, the next run might be crypto's biggest bubble yet.

Not only did we begin this run early (6 months after halving instead of a full year) but also the price feels perfectly stable. In January I was flipping out because this bull run came so early, thinking there was no way we would float this long and continue the bull run. However, bullish scenario after bullish scenario just kept playing out over and over again.

The market was more volatile and unstable on January 3rd at $28k then it is now at exactly double that. On January 9th at the end of the day I called it perfectly:

Corporate Sharks try to Bait Bears into Trap...

It was so obvious to me at that exact moment: bears were being baited into a big dump. Of course I then proceeded to make all the wrong conclusions from that divination. I assumed that the bears were "smarter than that" and they wouldn't fall for it, and after the market dumped a most predictable 30% I was panicking hard for the entire month wondering if the bull run was over for a quarter or two.

Rather my gut feeling was right from the start. This was really just a big ass bear trap that fleeced tons of weak hands from their money. As panicked as I was: I still didn't sell. Now that we are trading at $56k, the market hasn't shown any signs of weakness.

Strong hands are strong.

Obviously Tesla buying in was a huge deal. Michael Saylor is out there putting in work: showcasing the true killer dapp that is crypto. Michael Saylor is working his ass off and we are ALL going to benefit; not just Saylor or his company MicroStrategy: everyone holding Bitcoin, and most likely anyone holding any crypto whatsoever. A tidal wave of fiat is about to be injected into this market over the next year.

That is crypto's killer dapp: cooperation.

One person can provide value to the network and everyone in the network benefits. It's a business model that corrupt centralized agents won't be able to emulate no matter how hard they try. We are going places that they absolutely can not follow. Not only that: they will not even understand how it works or why they can't follow.

Cooperation is a foreign concept to diehard capitalists who have been in the meat grinder their entire lives: chewing up and spitting out the lower class for profit. This new paradigm is superior in every way.

$60k is too low.

Now that we are at $56k with zero signs of weakness, the chance of bouncing off $60k and crashing all the way to $42k is pretty low in my opinion. I believe the market has to get scary and unstable again before we see another dump. I'm now targeting $70k minimum on that front. A 30% retrace from there would be $49k, so I expect $50k unit-bias to hold strong over the next few months.

Again, that is the bare minimum. If the market doesn't become unstable, we can just keep going up until it does. Again, most of the people buying here are strong hands that might not sell for years. Some of them will never sell, simply using their Bitcoin as collateral to get what they want until they can repay the loan.

There is no comparison.

We are in completely uncharted territory during a mega-bubble pocket of a halving event. This market is wholly unpredictable. At this point, I wouldn't even be surprised if the peak of the next bull run was something insane like $1M per BTC. It would pretty much be forced to spike that high should every tech company and big business buy in. That doesn't even count possible banks and entire governments dipping their toes.

These are not bullish statements.

Again, we shouldn't want prices to spike: we should want gradual sustainable gains that provide the security of fiat while having the gains of a unicorn asset. That is the superior product, not something that goes x1000 and then loses 99% of its value. Everyone cheers when the x1000 happens and then acts like the inevitable dump was totally unrelated to the pump they were celebrating. One forces the other, they are connected.

So the next time you see your bags x10, sure, you can be happy about it, but we need to realize that what's good for us isn't necessarily good for the network. There's always a price to be paid, and when these networks get attacked (even when that attack is a money pump) we'll all suffer for it eventually.

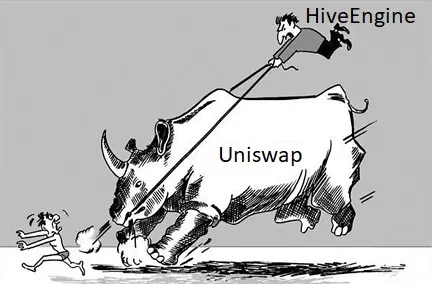

Until such times, let's enjoy these pumps. At the end of the day there is nothing we can do to control these wild beasts anyway.

Posted Using LeoFinance Beta

Return from Market Stability to edicted's Web3 Blog