Bitcoin still giving off a lot of mixed signals.

So I woke up this morning thinking:

"Oh shit, here we go... I was right... market gonna crash to $35k."

This was happening around 9 AM with the price of Bitcoin breaking below $40k. It did not look pretty. Not one bit.

But then some bulls put on their big-kid pants and bought all the way up to $42k. Now we are in a weird price/volatility discovery phase with really good volume. This move seems a bit pointless on the surface, as we are trading no higher than we were yesterday or the day before, but I still find it significant.

Why's that?

Well this is the first time in a long long time that Bitcoin has moved in an upward direction with really good volume. The bulls seem REALLY confident at $40k: Like they have infinite money to pump in at that level... and they do because the people pumping the market are largely institutions at this point.

Again, I think it's a good idea to wait until next weekend to refactor the situation, but I find today's bounce highly bullish, whereas just yesterday I was calling for $35k or even $30k, it looks like this bearish cycle's bottom might very well be in for the time being, and we don't have to worry about trading lower until February.

I think the price action of late January is going to be pretty significant in terms of macro analysis. In my opinion we really need to be trading higher than $45k if we want to find ourselves in bullish territory leading up to the summer time. Feb 1 is the cutoff for that metric.

Disclaimer

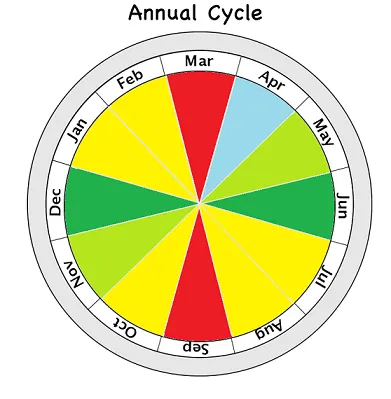

The last time I used the above cycle chart to try and speculate on the market, it was an ABYSMAL FAILURE. I was not properly reading the situation at all. Elon Musk pretty much ruined it with his little DOGE stunt (Twitter market manipulation) and Tesla putting BTC on the balance sheet and holding institutional FOMO over everyone's head. That really messed with the normal cycle we would have expected for 2021.

Hopefully this time around the market will be a little bit more predictable. It would be nice to see a local bottom in March like we often do, but this pattern of 18 months between bull markets may muck things up once again.

What about February?

February is a weird wildcard. Weird things happen in February like Chinese New Years, which can be incredibly bearish or mildly bullish depending on fate. It usually depends on what happens in January. If the market was super bullish in January we can almost always expect some kind of massive dip in either Feb or March. As we saw in both 2017 & 2021, bullish action in January bled deeply into Feb and we didn't get a pullback for quite some time. Again, February is a total wildcard and remains extremely unpredictable. Not looking forward to that.

March

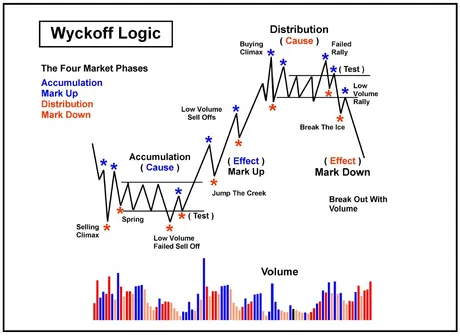

March is a VERY consistent month. It's bad. It's always been bad. Even in 2021 when we were trading at "all time highs" in March, we had pretty much already been to that level in February and this was just a sideways Wyckoff distribution.

- Gains weren't made in March 2021.

- March 2020 was the COVID bloodbath.

- March 2019 was boring and flat.

- March 2018 was a bloodbath.

- March 2017 was a boring consolidation.

- March 2016 was a boring crab-walk sideways.

- March 2015 was a bull-trap.

- March 2014 was an even bigger bull-trap.

- March 2013 was a massive bullrun that brought the market into parity with the doubling curve.

Bitcoin Doubling Curve

| 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|

| $100 | $200 | $400 | $800 | $1600 |

| 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| $3200 | $6400 | $12800 | $25600 | $51200 |

On March 1, BTC was $34, and had been in a bull market starting in January... but this doesn't seem as relevant because this was before the market even knew that the halving event was bullish, and the supply shock hit like a ton of bricks, bringing BTC up to it's true value of $100, and doubling in value every year after that.

I think we can assume that next March will again be either boring and sideways or a crash back down to the doubling curve at $32k, depending on fate.

Mega-bull run scenario?

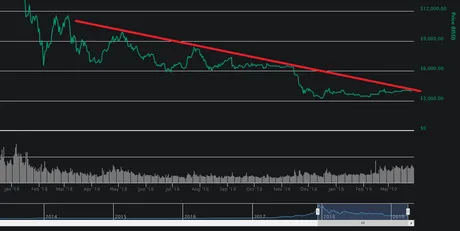

How much time must we give the market to crescendo during a full-on bull market? About three months. Looking back to 2019 (our last summer bull run) the bull run didn't start until April 1 on the dot, and the technical analysis was perfect, as the major resistance line from late-2017/early-2018 broke through to the upside. Anyone remember this? Let me go find my post on the matter.

Yeah... look at that professional analysis!

I drew that line so good.

https://peakd.com/speculation/@edicted/bitcoin-keeps-bouncing-off-moore-s-law-support

Traders are waiting for this scary-Larry resistance line to get broken. I am not. Breakout incoming.

Damn that was a good call!

https://peakd.com/analysis/@edicted/resistance-crushed-official-end-of-bear-market

In a spectacular display of self-fulfilling prophecy, technical analysis traders waited until the last second to pull the trigger and call an end to the bear market today.

Of course, when we look back in history, everyone will say the bear market ended on December 15 when Bitcoin bottomed at $3200. Hindsight 20/20 amirite?

Unfortunately my pictures in the above post were stored on Busy.org.

RIP BUSY.ORG!

It's a good reminder that images are not stored on the blockchain and most NFTs are highly centralized hammered dogshit. Looking at you, OpenSea. @threespeak fixes this. Or perhaps rather IPFS fixes this. @threespeak just adds some badass incentives that allow the network to scale... lol... 'just'...

In any case...

Even if we have a full-blown bull run in summer there's still a good chance for a local bottom in March. Be on the lookout. However, if it's more than just a regular bull run and turns out to be a MEGA-bull run... it actually might take 5 or 6 months to ramp up, just like we saw in 2017... that means the run could start as early as right now during this next bullish moon cycle in late January, which is why I'm so obsessed with this pointless speculation right now, doing multiple shitposts in a row.

Ouch

I hate to be right, but I was right, and now we are trading below the 100 day moving average. I was hoping we'd be trapped in between the MA(25) and the MA(99) for a bit longer, but no such luck. If we keep trading like this we're basically marked for a death-cross in the next month or two.

I've been saying 80 cents is still the ultimate floor, but looking at the charts once more, the entire range from 80 cents to $1 is pretty significant. We can see a weird bend in the averages at 90 cents, and the support there looks solid. I'll be looking to buy back into hive 1/3 at $1, 1/3 at 90 cents, and the last third at 80 cents. Hopefully this buy-the-dip DCA strategy ends up working out for me, because I'm ready to be a Hive whale, fam. Just need CUB and LEO to moon first :D #dreambig

Be on the lookout for the MA(7) doing a mini-death-cross over the MA(99). I'm guessing that will spark some kind of panic dip. It's very surprising how much traders use these lines to gamble on Hive and other tokens. Pay attention to them. Binance has a lot of volume and traders (obviously) and these default moving averages seem to pull a lot of weight.

Tax season

Another reason why we can expect a local bottom in March is tax season for 2021. A lot of traders took massive gains in 2021 and they will have to pay taxes on those. Many will do their taxes at the last second and realize they have to sell crypto to pay them off. We've seen this being speculated on time and time again. Don't let it catch you by surprise.

Conclusion

BTC dipped to $39700 very fast. The bears were trying to incite a panic and liquidate some longs. However, it was bought back up within the hour at tremendous speed, and now the market is being propped up by massive volume for the first time in a long time. Before now, the market was moving up on low volume supply shocks, so seeing this kind of high volume with so much overall fear is significant.

If late January ends up being super bullish (Bitcoin trading above $50k before Feb 1) I think that bullish action will carry on into February. However, March has never been a profitable month (except in 2013 when we were trading well below the doubling curve). It's safe to say that March is either going to trade sideways or down like it always does. Hedge against this "fact" when the time comes.

The full moon in February comes on the 16th, and the full moon in March comes on the 18th. I think we will see a local bottom somewhere around the Ides of March (how ominous!)... but hopefully it will be up up up up from there until summer.

And so concludes my second speculative shitpost in a row. I have a habit of doing this during very significant times in the market. I usually guess wrong where the price is gonna go, but I always guess right about the volatility. Be warned: volatility is coming very soon. I don't know what direction it will be, but I'm looking forward to seeing if the next full moon delivers. Do I sound like a hippy with healing crystals? Don't care, don't care: Send it.

Posted Using LeoFinance Beta

Return from Market was tested today once again. to edicted's Web3 Blog