Market sentiment has changed.

All we had to do was break $35k again and all of a sudden everyone is bullish and not talking about a bear market. Just goes to show you how ridiculously fickle people are and how their opinions mean nothing. If we're going to remember something, we should remember one thing:

The mob is never right.

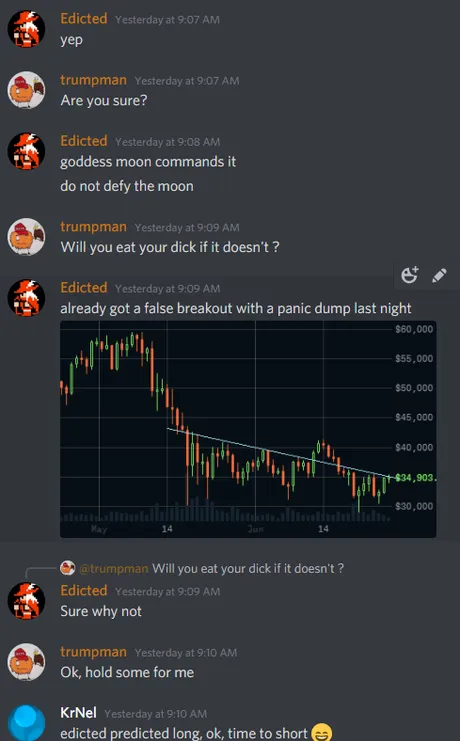

I was actually talking about this breakout yesterday.

I saw it coming in advance for once and actually made a good trade.

We finally broke out of this damn wedge.

As soon as the declining wedge converged with unit-bias resistance at $35k we broke out of it, as predicted. If Bitcoin keeps trading on this pattern of moon cycles we should have around ten more days of good fortune before we hit resistance. I'm hoping we spike up to the scary $45k double resistance by that time, where we will almost certainly get rejected for at least another 2 week moon cycle.

Resistance at $40k seems pretty weak and perhaps even non-existent, as there have been several false breakouts already. Best-case bullish scenario for me is up to $45k in ten days and then support holding at $40k. If $40k can't hold (most likely) then we probably have to retest $35k all over again. This seems likely considering that $30k has been tested so many times and fear is still quite high. There are a lot less diamond hands out there than claim to be, even with revolutionary fundamental adoption on every front and a removal of Chinese mining centralization.

ZOOM THE F OUT!

There's been a lot of chatter out there claiming that this is the beginning of a multi-year bear market. This is obviously ridiculous, as Bitcoin bear-markets only last one year, and they only happen after a mega-bubble (which never happened). A mega-bubble must go at least x10 higher than the doubling curve, which means I'm not worried about a bear market today unless Bitcoin gets close to $200k.

When it really comes down to it: look at the market. In retrospect, these 10 days of markdown that everyone is calling a multi-year bear market... yeah it's only going to look like a bear market if Bitcoin goes down more. If we recover from here everyone will just magically forget they were talking about a bear market and it will simply turn into a "correction". A very very short correction at that. Seriously though: ten days. That's nothing.

Multi-year bear markets only happen with alts, because Bitcoin sucks up all the liquidity from alts during the year after the bear market, increasing dominance while largely trading flat during that time and simply maintaining price. That will be a great time (2023) to stack more Bitcoin as a hedge and use the Bitcoin to buy back into alts later. Stacking sats is a great way to become a whale on smaller networks if you time it right.

No reason to "diversify".

In my opinion, no one should even attempt to do technical analysis or any kind of gambling on alts. Alts are for holding moonbags, farming unsustainable yields, participating in governance, and other cool stuff. If you want to trade the market, you trade Bitcoin. And if you want to increase your risk (why?), you don't move to a riskier asset, you just trade on margin with Bitcoin. IMO this is the safest way to go, as Bitcoin is far more predictable than the rest.

Conclusion

Yeah, there's a lot of uncertainty in the market, but apparently this 5% gain has given a lot of people hope. Clearly this is bad behavior in both directions. It shouldn't be so easy to flip-flop around like that.

The reason I've maintained bullishness this entire time is because I'm not looking at the alt-market even though that's where most of my value is parked. You don't do TA on the alt-market, that's a fool's errand. Bitcoin is already hard enough to predict, but the doubling curve provides us with a solid baseline.

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| $12.8k | $25.6k | $51.2k | $102.4k | $204.8k | $409.6k | $819.2k |

Looking forward to $4M BTC bubble in 2025, lol.

Imagine 1 sat worth 4 cents... wow.

The sharks are playing games.

We only got this double dip because the 2017 pattern of longing 30%-40% retracements was attacked. Fundamental adoption rates have never been more bullish. Seriously, think about it. If you could go back a year and tell yourself that all the corporations and banks are starting to dip their toes and even small governments are talking about making it a legitimate foreign currency... you would have been overcome with bullishness. So why are so many people so scared? Because number go down? Yikes.

This short-term dip means nothing in terms of the mega-bubble. $250k BTC is still firmly on the table, and is confirmed by multiple metrics like Plan B's Stock to flow, Willy Woo's analysis, and a couple others as well in addition to the doubling curve. No reason to get cold feet now so close to the finish line.

Volatility in the market is increasing. This is the exact opposite of what we would expect during a market cooldown and a return to the doubling curve (currently $20k). There are false breakouts in every direction and the sharks are doing what the sharks do best: funnel value from weak hands. Don't fall into the trap (be it bearish or bullish). Stay the course.

Posted Using LeoFinance Beta

Return from Market Watch: A New Hope to edicted's Web3 Blog