Whenever Bitcoin maintains any sense of stability, that stability breaks out into volatility. We see it time and time again. I was going to mention this yesterday and it seems like today we've broken out in a somewhat upward direction.

We seem to be stuck in this ascending channel.

For now.

However, I'd like to make a case for extreme volatility in May/June. There is a very small chance that the market will trade sideways in the near future.

Up or Down?

No idea! On one hand, when Bitcoin flash-crashed from $8000 to $4000, many people (me included) thought there was going to be a massive pump and dump in front of the halving. Yeah, that never happened, so everyone like me was extremely over-leveraged and had their longs liquidated by the flash crash.

This can't happen again. The market hasn't had a chance to get cocky again and everyone is trading in fear. There will be no massive longs liquidation even if the stock market crashes again.

Correlation to the stock market.

I expect the stock market to perform very poorly over the next two years. Right now everyone is hyped up on this dead-cat bounce, thinking the bear market is over after 5 weeks. That is ridiculous. Bitcoin's strong correlation to the legacy economy could send it tanking next month.

Halving is a bearish event in the short term.

Another case for the Bitcoin market crashing is the halving itself. The Supply Pool will not be drained on day one, but miner income will be cut in half on day one. This puts extreme short-term bearish pressure on the market.

2020 Bitcoin baseline values.

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $6933 | $7467 | $8000 | $8533 | $9067 | $9600 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $10133 | $10667 | $11200 | $11733 | $12267 | $12800 |

However...

I still believe in these numbers. On average, Bitcoin is doubling in value every year. We are below this doubling curve for the first time in 7 years due to this dire situation we find ourselves in. Is it really smart to bet against Bitcoin at a time when its fundamentals are fully maxed out and being put to the test?

Infinite QE is a dream come true for Bitcoin. If you had told people in 2017 that in 2020 the Fed would declare infinite QE, giving themselves permission to print unlimited money and giving banks the green light to hold 0% reserves, do we realize how bullish people would have been on that back then? We need to take off the fear goggles and realize that this very well might be our time to shine.

When will the economy open?

This is the million dollar question. I get the feeling that as soon as it opens a lot of people that were afraid to enter the market will lose that fear. If it happens right along side the halving event things could get really crazy, because we never got that halving pump/dump we were expecting.

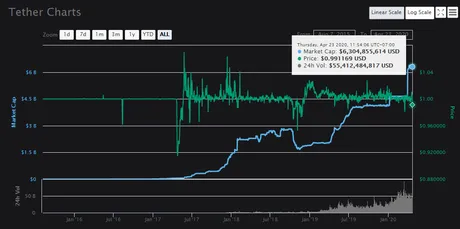

What about Tether?

The market cap for Tether is going apeshit. We've seen in the past, that when Tether gets printed the price of Bitcoin often goes up. Many in the space use their distrust of Tether and Bitfinex to assume that funny money is being printed and they are manipulating the market.

In my mind, this is obviously false, especially now considering how much investigation and scrutiny they fell under. These BILLIONS of coins are actual demand, and support the notion that investors are afraid to enter at the moment.

Investors/traders are loading up on Tether and waiting for a good time to enter the market. Don't be surprised if that time happens to coincide with the economy opening in conjunction with the halving event. This could be the perfect storm we were looking for.

Bitcoin conclusion

Variables to summarize:

- Overextended longs have been liquidated (bullish)

- Correlation to stock market (bearish)

- Halving in the short-term (bearish)

- Halving in the long-term (bullish)

- Speculative halving pump/dump possibly delayed instead of killed (bullish)

- Trading below the doubling curve (bullish)

- Likelihood of economy being reopened in May/June (bullish)

- Infinite QE & 0% reserves (extremely bullish)

- My $1200 stimulus check is going straight into Coinbase (bullish)

- May/June are traditionally high volatile months for Bitcoin (neutral)

Therefore, when we take a step back and look at the facts, the only thing bearish about the market is the correlation to the stock market (obviously a very big fear). However, when we think about it, has this correlation ever stopped Bitcoin from going x10? No. Why would now be any different? Everything points to long-term bullish action.

However, again, the short-term points to nothing but volatility. No matter what happens, Bitcoin will not trade sideways in May/June. Huge movements are coming. I'm going to be trading according to which way we fall from that ascending channel. Obviously dipping under the channel would be bearish and breaking out to the upside would be bullish.

I'm not going to be surprised if my original prediction comes true (just delayed). This would be a spike up to $20k with a crash back down to $10k after summer is over.

I also won't be surprised if we crash to $4k.

No fucks given.

Hive!

Hive has caught a bid to the extreme upside. Not only has the value of Bitcoin increased, but also the value of Hive has gone from 1700 sats per coin to 2400 overnight. I assume this is due to the announcement of Huobi listing the coin.

I can almost guarantee that this is a false pump, and have sold all my liquid coins into Bitcoin and/or stable coins. My experience with exchange listings like this is that they always generate a ton of false hype that doesn't actually bring any real value. The price normally crashes back down in a couple days.

Another reason to bet against Hive right now is the fact that Hive's market cap is higher than Steem's. This is going to set Justin off, and Binance still hasn't opened their doors to the public. Selling Hive here almost feels like free money to me. Of course I'm not looking to turn a USD profit, simply to acquire more Hive. Gonna buy back in when we inevitably crash in a couple days. As you can see I have some deep limit buy orders at the 1110, 751, and 508 sat levels.

As expected, what's happening with Steem during all this?

It's lost value because the support is 100% artificial and based on the USD value. The market continues to be fully propped up at the 15-17 cent level, so when Bitcoin gains value, the BTC/Steem pairing drops. Thanks again for gifting me more money than I could have possibly imagined while I exit. Gonna get a full Bitcoin out of this madness at this rate. 7 weeks to go.

LEO!

Now that Leo has migrated to Hive, confidence in the project seems to be making a huge comeback. I've never seen a buy wall this big (50k). I've even been making a little bit of money by providing liquidity via wash trading. I'm buying and selling at the same time, narrowing the gap in liquidity. Orders on both sides are going through. Selling at 0.09-0.1 and buying at 0.07-0.08 is pretty fun and proves once again that providing liquidity to markets is a paying job (even if it's not a lot).

Conclusion

The market is looking pretty sexy today.

I can almost guarantee with absolute certainty that May will have epic volatility.

Not sure in which direction but as always I'm personally bullish.

Return from Market Watch April 23, 2020 to edicted's Web3 Blog