As you can imagine, I'm pretty happy with the aggressive gamble I made on Ethereum recently. I gotta say, I was pretty nervous when I margin traded at $230 and it immediately crashed to $210 the next day, but now that fear has obviously melted away to the point of being laughable.

Normally I would take this opportunity to sell off a bit and lower my risk and subsequent volatility (just kidding, I never do that; just know that I should). However, with my initial prediction of Bitcoin hitting all time highs in as little as one month, it's really hard to sell anything. This is especially true as we head in to the final year of the 4 year cycle, with Bitcoin's halving event fading into the past and historical promises of unicorn rainbows to come.

Speaking of unicorn rainbows, apparently Uniswap DEX is starting to get more volume than traditional centralized exchanges. I find myself using it as well. The UX is great and it connects to network with ease at large. I await the day that centralized exchanges stand on their last legs and have nothing more to offer this decentralized arena. Perhaps Uniswap will become a big part of that planned obsolescence.

Another thing that makes it difficult to selloff crypto is the impending tax event that it creates. After doing a little research, I found out that holding an asset for one year or more would allow me to pay as little as 0% capital gains tax with a 15% maximum. Anything less than a year would fall under traditional income. No thanks!

The fungibility of crypto creates an interesting dynamic here, because if I want to sell off assets and not incur income tax, I could simply hold onto assets purchased less than a year old and sell the assets I've had longer than a year. Leveraged trading makes this dynamic even more complex, because I'm pretty sure you can sell off assets to pay back debt without incurring a tax event. This means I could sell off a fraction of the Ethereum I bought to pay off the debt used to buy it, which would greatly lower my volatility and risk in the market while leaving behind a big chunk of Ethereum that I can hold until capital gains tax kicks in.

Outperformance Dominance.

Surprisingly, Ethereum is currently outperforming Bitcoin's run by about x3. Traditionally the volatility of Ethereum is closer to x2 compared to Bitcoin. Perhaps we are seeing extra speculation due to the fabled Eth 2.0 upgrade.

Regardless, the fundamentals of crypto are stronger than ever before. Crypto is a hedge against the system; a beacon of truth in a sea of lies.

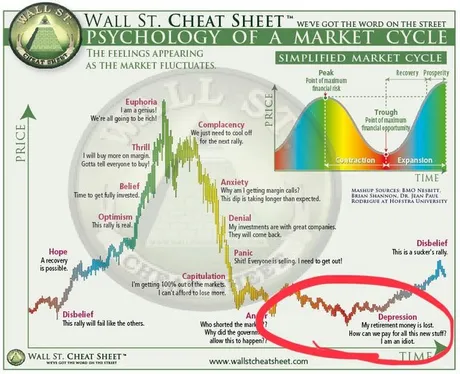

As we witness the slow-motion train wreck of the legacy economy, I can't help but feel like the run up in 2021 will vastly dwarf all others by comparison. After all, this is why the whole movement started in the first place, and what is happening today makes the housing crisis of 2008 look like a funny joke.

Ethereum development can't really be outmatched at the moment. Being second on the market cap makes it more stable than the other networks, and the static nature of Bitcoin development is seen as more of a feature than a bug. Everything seems to be working as intended.

This means Ethereum will grossly outmatch Bitcoin in terms of development over time, but also be at greater security risk due to all said changes. Luckily, both projects shield each other from the dangers of the other's shortcomings. This is a cooperative collaborative space. Competition need not apply.

I also haven't forgotten about Litecoin, although my position there isn't very large anymore. However, considering Litecoin's halving event was pretty much exactly one year ago, I have to wonder if it will somehow outperform everything this month. Liquidity could run dry at any moment.

Conclusion

August is going to be an exciting month. It won't be the big one of 2021, but it will be large enough to turn a lot of the bears bullish again. Hitting all time highs seems to have that effect on people. Currently, we're still seeing some stinker thinkers out there with the "this is a sucker's rally" attitude. It's time to Jump on the hype train, friends.

Return from Market Watch: August 1st, 2020 to edicted's Web3 Blog