Number is about to go up.

The stock market recovered a bit today (2%) after a 10%-15% downtrend that had everyone panicking about the impending bear market. Make no mistake, a recession is coming. However, I know it, you know it, and the market knows it. That means the market is going to try and price it in early as the FED continues to signal increased interest rate hikes. With inverted yield curves... things are not looking good in the long term (1-2 years out).

But that's the thing about pricing these things in, eh?

You can't. The market always fails when it comes to this kind of speculation. Panic cascades into more panic, and before you know it the market is oversold and nothing has even happened yet. Combine that with a summertime earning season where money is flowing around and people are wondering where to put that surplus... gee maybe put it into the oversold markets that might recover for some easy money.

Don't fight the FED

This market is fully controlled by the FED right now, and we already know for a fact that these people are blatantly insider trading the market. The rest of us have to guess at what they are doing. These people know that raising interest rates to stop 'inflation' is a stupid idea, because this 'inflation' is actually deflation. The supply chains are jacked.

I haven't been able to buy prescription treats for my cat for over a year. The computer chip and silicone shortage is expected to last another year. The just-in-time business model has completely failed companies that were incorrectly employing it by not stockpiling critical resources. How the actual fuck are increased interest rates going to fix the problem of low supply?

So on a very real level we have to assume that the FED is controlling the demolition of this collapse on purpose. Again, we already know that they inside trade it directly, which means that the indirect insider trading is even more blatant (feeding information to friends and family and network contacts). Meanwhile us plebs have to simply guess what's going on. Yeah, it's not a great strategy, but it's fun to try.

Will the FED back off?

Will they finally publicly announce that obviously increasing rates was a really stupid idea and stop? I mean... I think they will, but honestly I also didn't think they'd raise it this far this fast. The markets are having a damn tempter tantrum, and them rich people hate losing money. There may be some very real pressure for them to chill out in the near future.

Do you prefer rock or hard place?

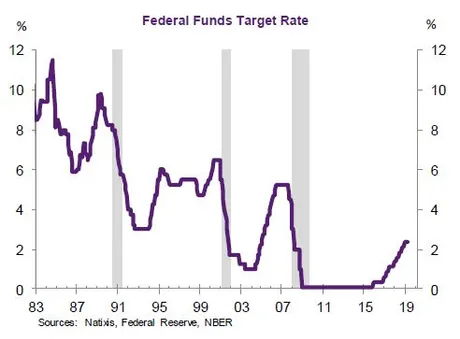

Looking at the interest rates going back to the 80's, we see that the FED is basically just totally fucked and completely out of wiggle room. The economy is so jacked that there's simply no buffer left. Can't raise interest rates... can't lower them either. The next recession is going to be really really bad. It's obvious. You will own nothing and you will be happy. Rejoice!

Luckily for those of us in cryptoland everything should be fine as long as we aren't forced to sell the bottom. Anyone who can ride out a potential bear market for say two years will be fine, but there will be a lot of psychological pain that arises from not trading the market perfectly (as this is always the case).

coulda, woulda, shoulda

Take my polycub gamble for example. I could have cashed out $140k on day 3 and then bought Hive at 40 cents and instantly been a whale already. Ouch. I didn't even think such a thing would have been possible so soon. But it was. Oh well, it's not really possible to time the market like that so just gotta make safer plays.

As far as Bitcoin is concerned we've been trading in this wedge at a perfect $30k average for two weeks now. That's really not a coincidence. This is the inflection point of max pain, where every time the price jumps higher than $30k bulls FOMO and buy more, while every time the price drops lower than $30k bears flip out and short more. It's the perfect level to extract maximum value from weak hands.

Zooming out

We see that these really aren't big price movements and that we've been in a hardcore consolidation for 11 days. However, volume and volatility are picking up today. The market is threatening a violent breakout... probably tomorrow or the next day. Considering that the doubling curve is all the way up at $33k, and $30k has been support for two years, I assume we'll be moving up pretty quickly over the next week or so during this bloodmoon transition.

Mercury Retrograde

On the crystals girl side of the equation mercury retrograde has always signaled trouble for technology and communications, and crypto is both. I was hoping that 'this time would be different', but alas, it was not. I think this market is due for a big pump in early June when it ends (June 2nd) for various reasons. That's when I'll be unwinding this ridiculous long position that I set up at $30500. I impatiently await that time so I can rebalance my bags in a way that's not going to leave me high and dry during the summer. Sticking to the plan is not easy. Stick to the plan.

Unfortunately I was going to write this post when Bitcoin was trading at $30500 today. I was gonna say: "I bet we crash down one last time for max pain before bouncing back up out of this wedge." I guess you'll have to take my word for it considering we are now trading at $29k just hours later. Again, volatility is increasing at the tip end of the wedge. We are going to see some fireworks very soon. The whole bloodmoon situation combined with retrograde ending would lead me to believe that we have that one more psych-out to get past before testing $33k in like a week. Looks like the psych-out is happening right now... so that's fun :D

Is Bitcoin correlated to the stock market?

Eh well the stock market did well today and Bitcoin is grinding at the bottom of the range, so you tell me? Truly the only correlation is that money and value are connected worldwide through all markets... and that's it. That's the extent of any correlation.

I really hope that Bitcoin completely decuples during a full-blown recession, but that is yet to be seen. My guess would be a pretty painful flash-crash at the start of a recession followed by a very slow grind up (even has stocks are grinding down). This would be the best way for Bitcoin to get the attention that it needs to continue grinding up to maintain the doubling trendline. Again, the doubling curve is going to be above $50k at the end of the year, which is hard to even imagine considering how bad this market is right now. Wouldn't that be a sight to behold? Dream Big!

I feel like a full blown recession is exactly the thing required to prove that Bitcoin is not correlated to the market at all. Sure, we might crash to $20k. But then again, are you really not buying Bitcoin at $20k? Seriously, that's just free money. If you're worried about the dip make sure you have fiat to buy it when the opportunity presents itself. It's not the market's fault that we're all degens and constantly overinvest way beyond our means. Balance your positions, fam.

Conclusion

Macro trends tell us that Bitcoin is going to $20k, but the exponential trendline tells us we are going to $50k. Honestly I think both might be true. A flash crash to $20k with a hard bounce to $50k is easily possible, and so is the opposite (spike to $50k and a crash to $20k).

This is a FED-controlled market. If they keep tightening policy and kicking the market while it's down, there's really very little we can do but bleed. However, if they back off the market will get greedy once again and realize it oversold itself trying to price in a recession that might not come around for another year or two.

Personally I don't think that the FED is done manipulating and insider trading. I think we have one more dead bounce to go before crashing into this mountain. Certainly I could be wrong and they just keep increasing rates to catalyze a recession early, but isn't that exactly what the bears want? Surely it would be more profitable for one last hurrah before the music stops... at least that's what I'm betting on.

Doesn't really matter what happens if you're in it for the long haul like me. 1 BTC = 1 BTC and all that rhetoric. That being said it would be very nice to have some stable coins to buy the dip should the dip come around. At the very least I need to unwind my long position so it's possible to ride the red wave down and reforge that position at $20k-$22k. Again, that's just free money territory if you have the dry powder laying around waiting to make a big bang on entry.

I say number's gonna go up.

Will it be one of those classic "you're wrong again" moments?

Time will tell.

Posted Using LeoFinance Beta

Return from Market Watch: Breakout Incoming to edicted's Web3 Blog