The market is up in arms today over rumors regarding DOUBLING capital gains taxes for the rich ($1M+ per year). Many speculative day-traders have dumped some stacks across the entire market.

https://www.marketwatch.com/story/biden-to-propose-nearly-doubling-capital-gains-tax-for-wealthy-report-2021-04-22

https://www.businessinsider.com/biden-plan-tax-rich-investors-fund-education-nyt-reports-2021-4

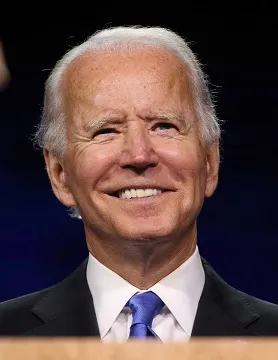

President Joe Biden will propose nearly doubling the capital gains tax rate for wealthy Americans to 39.6%, Bloomberg News reported Thursday. Combined with an existing surtax on investment income, Bloomberg said, that means federal tax rates for investors could be as high as 43.4%.

Most of the market took a bit of a speculative dive over this news, which is obviously ridiculous because again, the time it takes for these laws to go into effect can't be priced in this early. Just like with the XRP lawsuit and the "threat" of the US Treasury going after "crypto money launderers". It's quite the: sell rumor, buy the dip, moment.

Taking a look at Big-Dawg Bitcoin

We see that we once again triple-bottomed at this $51k level. Only nine more days before we finally get out of this boring month of April. By the time May rolls around the market will forgotten about all this silly FUD as we rampage to new all time highs.

How do I know a bear market isn't starting?

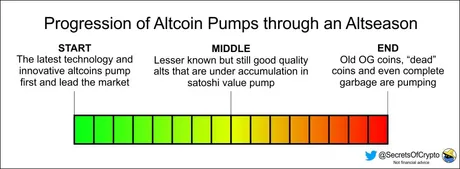

Just wanted to share this finally. Saved it on my computer April 9th. Saw it on Twitter from my fellow black-mage. I very much agree with the assessment. For me personally, the idea that we might be approaching bubble territory is absurd. I don't even think we've reached the "middle" ground yet. The mega run has only just started... maybe 25% completed seeing as most of the top coins are trading at all time highs. I'm not worried till XRP hits #2 or ETH flips BTC. Keep an eye out on pointless ICOs that shouldn't pump but do anyway: that's when you should be worried.

Biden is set to reveal the American Family Plan — part of Biden's $4 trillion overhaul on the US economy — before addressing Congress next week. But the Times reports that Biden's proposal will not tackle health care reform.

It's called the American Family Plan, but it doesn't address healthcare. That's cute, last I checked families don't have to worry about silly things like healthcare anyways. Have we noticed how casually they throw out numbers in the trillions now? I swear I never used to see that number before 2020.

President Joe Biden is planning to raise taxes on millionaire investors to fund child care and education programs

It's true, we do need more money for schools so they can add body scanners, facial recognition, and overall further the police/surveillance state agenda.

According to the Times, the proposal would also look at getting rid of an aspect of the tax code that reduces taxes paid on assets that people inherit. That could be the stepped-up basis, where inheritors of an asset that's become worth more over the time it was held — like a house that's increased in value — pay taxes only on the value of the asset when it's inherited, not the gains it saw over time.

Gonna tax dead people more?

Again, adorable.

Love that.

In addition to tax raises, the plan will reportedly seek to extend through 2025 the expanded child tax credit, which gives American parents recurring cash payments and stands to substantially cut child poverty. This four-year extension is not quite the permanent measure Democrats had been pushing for.

It's funny how everyone harps on the idea that the world is overpopulated, but then we give all these financial incentives to people who have kids. If we want less kids being popped out then where's my tax break for being a responsible citizen and having no kids? Food for thought, even though the logic kinda breaks down when we look at actual scientific correlations between poverty, education, family-size, etc. Still though.

Also reportedly under consideration are hikes to the estate tax, as well as a cap on deductions that wealthy taxpayers can take. All told, the increases will still only target those making $400,000 and above, according to the Times.

Biden is also looking to beef up the Internal Revenue Service (IRS), which could bring in more revenue through increased enforcement of wealthy taxpayers. A recent study by IRS researchers and economists, which looked at the top 1% of taxpayers, found that "collecting all unpaid federal income tax from this group would increase federal revenues by about $175 billion annually."

WOW! $175 BILLION A YEAR?!

He said as he printed out trillions. Because the IRS is so known to target wealthy people and not the middle/lower classes...

IRS Commissioner Charles Rettig recently said in a Senate Finance Committee hearing that the amount of taxes going uncollected every year could be over $1 trillion. Rettig also said increased funding — like the $1.2 billion increase in Biden's "skinny budget" — could help the IRS increase its enforcement. Over the last decade, their number of enforcement personnel have decreased by 17,000.

Hey guys don't get me wrong:

The authoritarian leftist inside me is cheering. Yeah! Tax those greedy rich assholes! But honestly, there are a lot of red flags here.

First of all, central banks have already tipped their hands. Taxes were only relevant when they couldn't print more out of thin air (aka the gold and silver standard). So the question becomes: Why tax the rich when you can just print new money?

Now logically, the answer to this question is that if we print new money everybody suffers, but if we tax the rich they can afford it. That sounds like a smart answer, but we already know the reason why tax laws are so complicated and full of loopholed swiss-cheese. The answer is that so the rich can loophole out of them, so the entire idea that we would tax the rich instead of just printing the money is absolutely absurd.

Upper class under attack

The middle class has already been under attack for a year. Looks like they are running out of blood to squeeze from this turnip. Now they are going after millionaires. Will the billionaires actually be affected much? Somehow I highly doubt it. The tippy top always finds a way to avoid these things, and Biden works for them.

At least that idiot isn't still trying to talk about unrealized capital gains tax.

https://peakd.com/hive-167922/@nealmcspadden/the-biden-wyden-tax-plan-worst-of-all-possible-worlds

@nealmcspadden was already talking about this bullshit back in November, but on top of all the other garbage they wanted to force UNREALIZED tax gains... meaning you have to pay taxes on assets even if you didn't sell them. In essence you'd be forced to realize your gains at the end of every year. Very dumb and bad idea... so at least I haven't heard anything about this again... yet.

Monero

I think it's more than obvious that privacy coins like Monero are insanely undervalued. At this rate we'll all be forced to hide our money as these dinosauric institutions lash out and try to steal everyone's value before they die a slow violent death. The Titanic is sinking.

Again, I have nothing wrong with taxes.

The ability to redistribute wealth is key for a healthy society. But as we've seen time and time again, corrupt government agencies can not be trusted to reallocate the wealth properly.

At the end of the day all I see with these tax increases is a direct attack on crypto. I read something the other day that shocked me: did you know what if Bitcoin hits $200k, more than half of the world's billionaires will be Bitcoin billionaires? How fucking insane is that?

We are over here building the new world, and the old-guard vampires are trying to sink their teeth in to survive because they are becoming completely irrelevant.

Archaic

At the end of the day, I'm no longer the authoritarian leftist that I used to be, and find myself in extreme libertarian waters above all else. The future is all about opt-in governance. We no longer have to force people to act a certain way in order to scale up.

In that same vein, taxes have become 100% irrelevant. Everyone is a central bank and money will be minted on every street corner. There's going to be a lot of strife and conflict with the old legacy systems that seem to believe that they are owed a piece of everything we are building here when they have done none of the work and caused massive damages to the world. Many people on both sides are in for some rude awakenings.

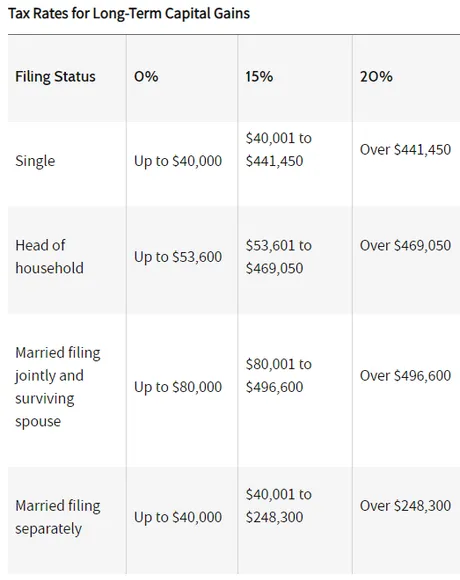

https://peakd.com/taxes/@edicted/investopedia-capital-gains-tax-101

So how can we fight against these new taxes?

How about we do it in a decentralized way? First of all: don't sell your crypto and you won't have to pay taxes on "gains" (assuming unrealized taxes aren't a thing). Always maintain your privacy and never talk to police or the IRS: that's what lawyers are for should it come to that.

When it really comes down to it I know that crypto can run circles around the legacy economy. How hard is it to build value in other ways? We can start businesses and pay "employees" and write that off as an expense. We can wash trade our losses to offset taxes. We can funnel $40k income through individuals and still pay 0% capital gains.

Some of the things people do will be illegal, many of them will be made illegal after the fact. When it really comes down to it we are building borderless governments, and sooner or later these digital borders will collide with physical ones. If there's one thing I've learned over the last 30 years it's this: digital wins.

Conclusion

Again, I have nothing against taxes. If I knew that billionaires and megacorps were going to actually pay these absurd taxes I'd support them. If I knew that government would distribute the wealth generated correctly I'd support them.

At the end of the day the government is the Titanic, and this ship it is a sinkin. Not only that, it's trying to drag us down with it, and call us traitors and terrorists if we don't help bail out the most corrupt individuals of the planet. Truly, the pure desperation phase hasn't even started yet. Steel yourselves.

They are being forced to show their hand more and more. The evilness is showing through: and it is damn ugly. Every year that goes by it will become more obvious that being a citizen is a liability rather than an asset. Citizens are literally owned by their government. We are the servants and pawns in their little game of chess. It's time to flip the board.

Posted Using LeoFinance Beta

Return from Market Watch: Capital Gains Gouging to edicted's Web3 Blog