Really?

The day after Mercury Gatorade ends Bitcoin spikes above $40k? What the hell? Looks like I'm being forced to continue reporting on astrology. What a cruel twist of fate for a scientist.

So as you can judge from my hysterics.

In my previous posts I was talking about how the market was doomed to return to the doubling curve. Wouldn't you know it, the exact opposite thing happened. So weird, right? Remember that my predictions are wrong like what, 95% of the time? That's an insane correlation. I'm like the best trader in the world at this point, minus the actual money-making part.

Lucky for me I haven't suffered any opportunity costs on this pump.

When I said I was betting heavily on the market crashing, what I really meant to say was all I did was liquidate my CUB Kingdom value into CUB/BUSD. That was over 70k CUB (now 35k CUB and however much BUSD). CUB hasn't gone up, so I'm still up on that trade at the moment because I'm farming more than twice as much yield. I should have never left the LP pools in the first place... doing so cost me quite a bit. Live and learn.

If we can hold above $40k without volume dipping and sideways trading, that puts us in temporarily wildly bullish territory. But again, this all could just be a dead-cat-bounce before tax season in March. March has always been a trash month that trades sideways at best. This was even true in 2021 when we were pushing ATH in March.

It's never been a good month.

However this is February, Fam. And February always gets one pump and one dump. History shows us that the pump usually comes early and the dump doesn't come till week 4 or even the beginning of March (dirty dirty tax season). The only times this has been reversed is when deflating from mega-bubbles in 2014 and 2018. We had no mega-bubble this time around, so it looks like the non-mega-bubble pattern is about to play out.

What does the moon say?

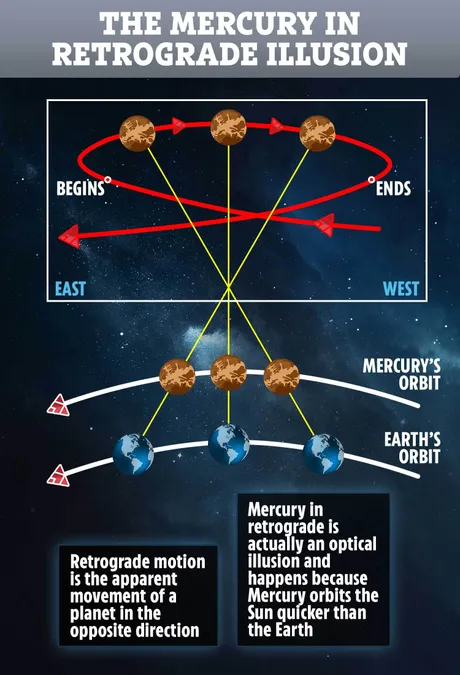

We are in a bearish new moon cycle, and the market just pumped immediately after retrograde ending. Given the history of February this seems wildly bullish in the short term. I'm tempted to buy this pump (AKA transfer value from CUB/BUSD to CUB/BNB) because a spike above $40k in combination of Feb's trading history is exactly the signal I was looking for. By the looks of it other traders have already beaten me to the punch, as the yield on CUB/BNB has already dropped dramatically from just a couple days ago. Competition is rising along with the underlying value of BNB.

BNB is still sub $400, and honestly I think the lowest it can go at this point is $300, and I would all in at $250 just like I did when CUB first launched in March last year. That being said, buying in now a little is an acceptable risk considering these numbers. I can easily make a bet at this level and mentally prepare myself for a 25% loss. That's not really a big deal.

52% loss.

The BTC drop from $69k to $33k was massive. While it makes sense that we would return to $30k to the doubling curve given the current status of the economy, February has a very strong history of dead-cat-bounces.

What if real-bounce and not dead-cat?

The hopium is real. We still could be in the middle of a super cycle considering we've been floating above the doubling curve for over a year (a decade long record considering there was no 4-year mega-bubble in play).

Given the market history of February combined with a bullish full moon coming into play on Feb 16th, we could easily see 3 or even 4 weeks (entire month of FEB) of sustained bull market before any kind of dip comes into play.

Mega-bubble scenario.

If lengthening cycle theory is to be believed, the mega-bubble hasn't been canceled, only delayed (fingers crossed summer 2022). Of course it would be better for everyone (especially builders) if the market just stayed stable for the entire year of 2022. Unfortunately that's not how free-markets work. When the FOMO gets going it doesn't let up until peak absurdity kicks in.

If a mega-bubble does come in the summer, we are basically in an "only-up" scenario for the next five to six months with a few 30% retraces along the way. I'd say we'd have to be testing $100k by April at the latest in that case, but again saying it out loud just sounds like a pipe dream at this point so I guess I'll keep my expectations more reasonable.

The reasonable expectation of a normal bull run (18 month cycle) in summer 2022 would be something like x2 to x3 the doubling curve.

This could happen even if we hit $30k in March. A bounce from there into summer is not unreasonable.

2022 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $27733 | $29867 | $32,000 | $34133 | $36267 | $38400 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $40533 | $42667 | $44800 | $46933 | $49067 | $51200 |

Given these numbers if we peaked in May (pretty common) BTC would be trading at something like $70k to $105k. This makes a lot of sense, because obviously many people in the Bitcoin community are going to take gains at six-figures in celebration of their Twitter "laser eyes" victory. I wonder what their next ridiculous trope will be.

It would be more fun if we mega-bubbled to $350k and I got to watch all the laser eyes sellers cry their tears and buy in at the peak and lose it all. That would be pretty satisfying. Someone needs to provide me with exit liquidity, amirite? #dreambig.

Conclusion

February has never been a boring month. I promised volatility, and the market has delivered. Going in the opposite direction I said is just par for the course. Let's see what happens this time around.

Obviously the market can still crash to $30k from here. Normally this would happen by volume dropping off a cliff and BTC just trading sideways at $40k for like a week before finally crumbling. However, I think the bottom might be in. A 52% correction is no joke. This pump above $40k (immediately after a mercury retrograde ending no less) was exactly the signal we were looking for when combined with the trading history of the last decade.

This is one of those very few circumstances where buying the pump might not be such a bad idea. Judging by previous market history this could mark the signal of further gains up to $50k. Like I said, February has always been a crazy and volatile month. We might not be able to guess which direction it's going but we can be sure these fireworks we're seeing now are just the beginning.

Silly retrograde.

Crystals girl wins again.

P.S.

It's also worth noting that Hive has flipped into mildly bullish territory. Not only are we trading above the 200 day moving average, but we are also trading slightly above the 25 day MA as well. Even after suffering multiple death-crosses, the price has been recovering at a legendary rate. If we start trading above the MA(100) at $1.33 we'll be in madly bullish territory and get a fresh round of golden crosses. Should be interesting to say the least, especially considering all the fundamental development going on around here.

Posted Using LeoFinance Beta

Return from Market Watch: Crystals-Girl Wins Again. to edicted's Web3 Blog