So today was pretty weird.

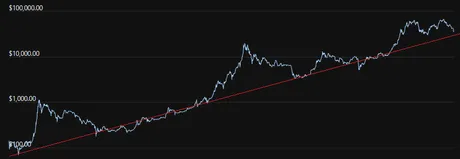

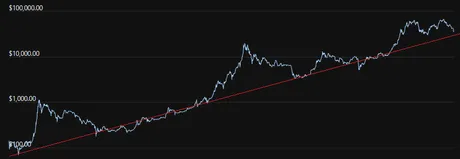

I wake up and Bitcoin is crashing to $33k. Was feeling pretty good about that. Because the day before I stopped myself from buying a potential bull trap. Then hours later Bitcoin spikes up to $37k. I swear this market just likes to psychologically mess with us. It's like a constant test of patience and willpower. In any case... look at the trendline.

Bitcoin has the most obvious trendline ever ever.

I can not believe how many people I've seen recently talk about the price dropping to zero when it hasn't even returned to the doubling curve yet. Like seriously, these investors have such thin skin and such a lack of patience that it simply blows my mind. Grow, up.

Seriously though I just want to shake people and be like...

WHAT IS THE MATTER WITH YOU IT'S DOUBLING EVERY YEAR!

Doubling.

Double.

Every year.

But somehow that doesn't matter.

Somehow it is NEVER enough.

If it's not obvious by now that society, as a whole, is guaranteed to always have insatiable infinite greed, then I don't know what to say. It's painfully clear at this juncture that it truly doesn't matter how well crypto performs. Every time the price goes down for literally any reason, people are going to complain and cry like a child that dropped their ice-cream cone. It wouldn't matter if the token just went x100 and they were still up x50, if the price goes down, it is the end of the world and it's all a scam and going to zero. Every time, without fail, this is not my first rodeo.

This psychology is actually very interesting.

Because it tells us exactly where this is all going. Which coin is going to be at the top of the market cap in twenty years? It sure as hell won't be Bitcoin, and it won't be Ethereum either, or XRP... nope. In fact, it is more than likely that the coin at the top of the market cap in two decades doesn't even exist yet. We don't know what it will be, but we know what properties it needs to have.

Top coin properties:

- It's a unit-of-account with a stable price.

- It is extremely inflationary.

- Yield/inflation/interest-rates expand and contract with the market, allowing the community to command a stable price point.

- It has massive interoperability with other chains.

- Value pours out of it into every other network.

- Likely has various incentives to get communities to work together.

If I'm being honest, RUNE / ThorChain could pull it off if they play their cards right. It is possible (however unlikely) that Hive could as well. Not that anyone needs to be number one, just that it's fun to speculate.

In all likelihood dominance will become a thing of the past and many of the coins in the top ten will have similar stacks. It's not going to matter much if one network is worth $100T and another is worth $120T. In crypto, that's close enough to be practically the same market cap. 20% difference is nothing.

The point here is that people HATE to lose money, so the first "only up" coin to pop into existence is going to be the one that everyone adopts, especially during any kind of bear market (or even fear of bear market). In fact, I'd be willing to bet that even if you could 'only' earn 50% consistent yield on this token it would still get more adoption and long-term growth rate than Bitcoin's 100% average yearly gains. That is how much people HATE red markets. They'd sooner take a 50% pay-cut than have to deal with the psychological ramifications of a bear market.

But the complaining doesn't stop there.

The tribalism complaints are constant. Remember when everyone complained that Doge mooned? Then they complained that Elon Musk was shilling it on Twitter. Then they complained that Shiba Inu mooned. Before that they complained that Ethereum mooned (BTC maxi), and before that they complained about Litecoin going up while the rest of the market dragged.

If it's not my bag then I'm going to complain about it filling up.

Market sentiment is flipping.

Remember how hard the maximalist cried when Bitcoin dominance dropped to basically all time lows and all the altcoins were going wild? Did we really think the script wasn't going to get flipped back into their favor? It's already happening right now. Dominance has already risen 3% to 40% in a matter of days. How much longer before it gets back up to 60%?

To be fair I don't think it will actually get all the way back up to 60%, but 50% is certainly still on the table. Bitcoin performs really well during uncertain times and bear markets. Bitcoin has a nasty habit of propping itself up by stomping on alts constantly during any kind of bear market. This is how it maintains the doubling curve so easily. It sucks liquidity out of the alts when we return back to the trendline and BTC becomes a good deal once again.

So yeah, if we get back to $30k, you sure as hell better think about getting some BTC, because we all know what it's like to watch Bitcoin double or triple in price while the rest of the market does nothing. If you don't have any BTC during those times, it is not a fun feeling. I know from experience

Getting flashbacks of 2018.

Back then I thought I could "diversify" my money into a bunch of ICOs and that was sure to keep my value protected! We all know how that turned out. During uncertain times, you buy more Bitcoin. End of story. There really is no argument. Bitcoin is the ultimate store of security. Do not fade the grizzled granddaddy of crypto.

Conclusion

Bitcoin dominance is moving up, just like we would expect during uncertain times like these. I can all but guarantee the doubling curve trendline for Bitcoin, but as for the alts? Not so much. Should we enter a "scraping the bottom" "bear market" Bitcoin will continue to gain dominance and suck liquidity from the alts into itself to maintain the trendline.

Luckily, we never had a mega-bubble. This means we will also not have a mega-bust. We really don't have to worry unless Bitcoin is trading under the trendline, which currently sits at $27k.

2022 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $27733 | $29867 | $32,000 | $34133 | $36267 | $38400 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $40533 | $42667 | $44800 | $46933 | $49067 | $51200 |

Fade the doubling curve at your own risk.

I personally will never make that mistake again.

Posted Using LeoFinance Beta

Return from Market Watch: Dominance. to edicted's Web3 Blog