BRUTAL!

So this morning some dipshit CUB whale dumped the token like 40%. I call them a dipshit, not because they sold CUB, but because they sold it like a complete idiot; selling it all at once into a single LP pool, and gifting arbitrage bots thousands of dollars for free out of their own pocket. Use paraswap.io to avoid this, as their "MEGASWAPS" will buy/sell from all pools at once.

I've said it before and I'll say it again:

CUB has been range bound between $2M market cap and $5M market cap since inception. This sideways trading has been happening for an entire year now. If you saw the market cap at $5M like it was, you should be expecting a dump.

Of course no one was actually expecting a dump because who dumps that much CUB 5 days into a 60 day airdrop? What the hell? So crazy. Add to that the YouTube ban of LEOfinance and the fact that polycub is in hardcore bleed mode and we really have seen a perfect storm for our bags. Not fun!

I'm sure most of us I have been expecting some kind of bounce on the polycub market by now. It was at $5, then at $3.50, then at $2, then $1.50, then $1.00, and not sitting at something like 89 cents. Where does this dump end? It's kind of crazy honestly... not even CUB dumped this hard without at least getting a little upward momentum in between. No such luck apparently.

At this 90 cent level, polycub seems like a really good buy... assuming one actually has any liquidity to buy in with. That's the problem with hyperdeflationary tokens with zero elasticity. I've already told Khal this in DMs, but xpolycub should of had ZERO yield during launch. Zero. Or maybe just the 50% penalty from the other farms.

What is the benefit of single staking?

The benefit of single staking pools is that they can be used to provide elasticity. They can provide demand when the market needs demand, and they can provide supply when the market needs supply. Clearly, the incentive pendulum needs a little work to reflect this actuality.

When we need the price to go up, we increase yield to the single-staking pool. This incentivizes users to buy pcub, or better yet cannibalize their LP to shove it all into the single staking pool. This makes the token less liquid and easier to pump. If we want to bring the price back down we take away yield from the single staking-pool.

Why would we want to make the price go down.

This is a concept that crypto degens just don't seem to understand. STABILITY. Say it with me now: STABILITY; ELASTICITY; UNIT-OF-ACCOUNT. It should always be the goal of a currency to remain stable. Always. Always always always. Again, crypto bros do not understand this concept.

Only up. Diamond hands. HODL.

I'm finding the infinite greed quite tedious. And I'm not immune to the infinite greed either, which is even more frustrating! I had the chance to take $140k gains after two days of gambling, and instead I decided to let it ride instead of cashing out and having money to support these lower levels? Wow, that is so bad! What was I thinking?!! I'll tell you what I was thinking: what if pCUB spikes to $13 like CUB and I'm a millionaire. That's what I was thinking: MORE MORE MORE MORE MOAR. Look where that mindset gets you.

If you want to make money in crypto, you have to stop trying to make money. Build value from the networks you're trying to be a part of. Had I taken my own advice on this I'd have over $100k to defend the $1 support on pCUB. Instead I just have a bunch of pCUB and find myself locked in the system hoping for a pump up. Oops!

Market cap is the only metric.

We can't look at token price. We MUST look at market cap. It's the only number that means anything in DEFI with yields this high. When we look at market cap we see that POLYCUB only has like a $1M cap at the moment. That is actually absurdly low, and thus it is probably a good time to buy in considering that the token price has plummeted over 80%. It's all speculation, but a micro-cap under $1M? Wow, seems like a good deal honestly. That's less than half of CUB's lowest market cap to date, and yields on PCUB are obviously still sky high.

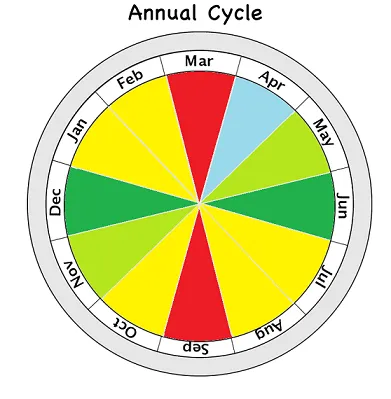

Looking at the market at large, Bitcoin and friends are on the Struggle Bus something fierce. This makes sense because, like I said, March is a trash month. Tax season is garbage. Russia just started a war and the sanctions on them clearly hurt everyone (even if they hurt Russia more).

That's because the economy and life itself is not a zero-sum game. When we sanction Russia, everyone that was doing business with them suffers. A 6% loss in crude oil creates a supply shock because corporations use a Just-In-Time business model.

Think about it: if there is a shortage of oil, who's going to stop using oil? Most people who use oil have to use oil no matter what the price is. Only a small fraction of the population can stop using oil if the price goes up, and even then that small fraction of people choose to pay the higher price because they want to drive to that dance club in the city or whatever the fuck they are doing.

Prices going up doesn't necessarily stop people from consumption, so the price goes up again, and again, and again. Before you know it, a 6% drop in crude oil creates a 30% spike in prices. This is the exact same concept that I have tried to portray in terms of market cap liquidity. Price of Bitcoin can go up without anyone buying it. The market cap of Bitcoin going up $100B doesn't mean $100B actually got pumped into it. These are facts. If you don't understand them you should figure it out because it's pretty damn important.

Full Moon March 18th.

Honestly the TA for BTC looks pretty good. We keep making higher and higher lows, and we are about to finally get past March Madness and into April which is a much safer month. Normally we would expect a local bottom in mid-late March... so hopefully it will be only up from there if it happens... At least until May/June. Again, hopefully the 18 month bull cycle is still in play.

Looking at the market... it's actually surprising that Bitcoin is holding the line at this level. Risk-on assets would have usually been abandoned at this point. We are in the middle of tax season. The economy and the stock market are suffering. The FED keeps talking about raising rates. Honestly I'm surprised that we aren't trading slightly below the doubling curve right now (something like $28k).

2022 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $27733 | $29867 | $32,000 | $34133 | $36267 | $38400 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $40533 | $42667 | $44800 | $46933 | $49067 | $51200 |

Believe it or not, we are actually in a damn good spot right now overall. If the stock market starts tanking and Bitcoin holds the line at the doubling curve, nothing could be better from an institutional adoption standpoint. That could easily create a chain-reaction domino effect that leeches more and more value from stocks and commodities into crypto. This is something that can only happen when Bitcoin is trading at or slightly below the doubling curve. When bitcoin is higher than the curve it becomes extremely correlated to legacy markets... because it is bubbled with legacy money. Traveling on the curve while stocks bleed would be a thing of legend. The bigger the bleed the more impressive Bitcoin becomes to the world. #dreambig

Conclusion

There are a lot of problems with polycub, but we are learning quickly what those problems are. We always knew it was going to be volatile... but seriously this is insane. Looking at the market cap we see that it is less than $1M (we must ignore the airdrop tokens that haven't unlocked yet but are being included in the total). The marketing campaign could kick this thing into hyperdrive... or it could be a big nothing burger... who knows. What we do know is that this has been a fantastic gambling experience, and will likely continue being so for quite some time. Don't gamble money you can't afford to lose... easier said than done I suppose when you see people around you becoming millionaires arbitrarily. Why not you?

Get rich slowly. Stop trying to extract value from networks and instead try to provide value to them. You can thank me later. Networks have a way of rewarding this kind of behavior over time.

Posted Using LeoFinance Beta

Return from Market Watch: Eat My Shorts! to edicted's Web3 Blog