I'm seeing... red!

Stock market got a bit wrecked today, took Bitcoin with it as per usual. Until we get back to the doubling curve at $35k this will continue to happen pretty consistently. That being said we are only a 7% drop away from that level at this point, which really is nothing in terms of crypto movements.

My gut feeling says we are hovering into incredibly bearish territory. The only solace is that my gut feeling is wrong like 80% of the time and betting against it is always a good bet on the average. Still, that leaves another 20% chance that we just continue to get wrecked as we head into the summer, despite a pattern of 18 months between bull runs. If you get dealt pocket AA in poker and you lose, you didn't do anything wrong, you just got unlucky. That's just how gambling works. Plan accordingly and never bet the farm on a single outcome.

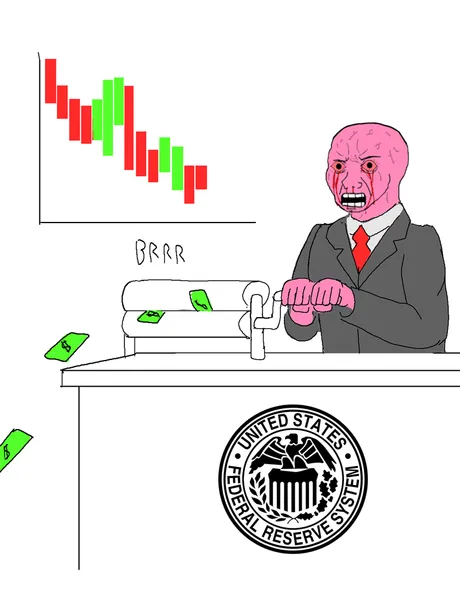

At this point the FED really has their hand on the lever of recession. Inverted bond yields are also a terrible omen. Increasing interest rates to "mitigate inflation" seems like a really terrible idea, but they just keep signaling higher and higher rates.

For me it's comical that people call this "inflation". The prices are going up, so that's automatically "inflation"... right? But the prices are going up because the supply lines are jacked. This is literally deflation of goods and it's being spun as inflation and an increased money supply which is somehow magically going to be fixed with increased interest rates. This kind of magical thinking can only lead one place eventually: recession.

To be fair we've been on borrowed time and due for a recession for years. It's been 14 years since 2008; quite a long time indeed. Many people have been talking about the "everything bubble" for quite some time. An economy with crippled supply lines is the perfect catalyst for such an event.

I find myself in pretty awkward positioning for all of this. Truly very few people are mentally prepared for another crypto winter, and even less are financially prepared.

The actions of the FED lead me to believe that despite all the "inflation" and "printer go brrr" memes... we are actually heading into a period where the dollar is legitimately strong and many entities worldwide owe the debts back via USD, which only makes it stronger. This is all a very weird combination and sequence of variables. Time will tell how accurate this prediction becomes.

Bitcoin still king.

Bitcoin has something that stocks don't have: an entire alt-market that is known to retreat back into Bitcoin when shit really hits the fan. I guarantee if a recession occurs everything will flash crash, but it's very possible many assets will not recover as the alt-market gets used to prop up Bitcoin just like we saw in 2018/2019. Again, dominance levels can and will go back up to 60% if the entire economy goes down the crapper. And maybe that's a good thing.

With so much adoption and development going on, crypto has already proven that it's here to stay. That doesn't mean it won't take a year or two in order to recover from such things, but as we all know: bear markets are great for building. A recession at this stage of the game could actually be the best thing that ever happened to the cryptosphere as a whole in the long-term.

Conclusion

These things take time, so hopefully this alarmism comes a bit early. That being said, I really have no faith in the world economy as a whole over the next year or two. All the variables are adding up to a situation most dire. Longing the market at this juncture should be the last thing on anyone's mind.

Maintain balanced positions that are acceptable no matter what happens. Be ready to buy the dip, because a COVID-level flash-crash could take BTC down to $20k for the last time ever. That kind of panic is easy to capitalize on. Keep a level head during periods of massive volatility and you'll find you do quite well on the trading field.

Posted Using LeoFinance Beta

Return from Market Watch: Ew! to edicted's Web3 Blog