Blood in the streets?

Not really. This dip is nothing like what we saw in May, where the price tanked for 10 days in a row and then traded sideways for two months. That was actually a pretty funny period in the market because it was the sideways trading that had everyone distraught. A V-shaped recovery would have stemmed a lot of the bellyaching, but having to wait a few months to get there really seemed to mess with people's heads. Oh no, a few months! What an eternity. This must be a multi-year bear market!

Bitcoin Doubling Curve

| 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|

| $100 | $200 | $400 | $800 | $1600 |

| 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| $3200 | $6400 | $12800 | $25600 | $51200 |

Need I remind everyone that Bitcoin has never been in a bear market.

Number has been going up x2 every year without fail since 2013 at the $100 baseline. The current floor for BTC is $25k, and it is very hard to imagine reaching that level without complete financial meltdown, especially considering $30k has already proven itself to be a massive support. It looks like this time around we won't even go lower than $40k.

That being said Bitcoin hovering around $49k is a really bad look. $50k is a huge unit-bias level, and the longer we hang around just under $50k the more likely it is we are to test $45k and ultimately $40k support. As far as I'm concerned we are in bearish territory until we reclaim a level above $50k. But again, this is only short-term bearishness.

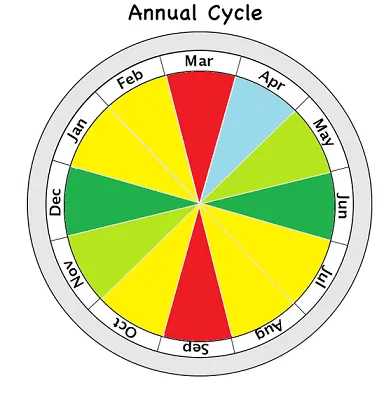

In fact, December has never acted like this before.

Show me one time that a bull market peaked in October or November. Never happened. There's a very high likelihood of this dip being extremely temporary due to macro economic fears, new covid variants, regulation, FED tightening, etc. It is still possible for this market to bounce back and have a good January, but honestly at this point I'm looking at the 18-month bull cycles and assuming that summer 2022 will be the next peak.

Is this: a multi-year bear-market?

Bear market can't come without the bubble.

No bubble; no "bear market".

Again, "bear market" in quotes because correcting back to a literal doubling curve isn't a bear market. It's a miracle unicorn asset that just keeps doubling every year no matter what. All we have to do is be trading higher than $50k in twelve months and we'll still be maintaining the curve. I'll say that again for good measure: all we have to do is trade sideways for an entire year and we are still doubling every year on average. Said it before and I'll say it again: expecting better than x2 returns every year is really greedy and dumb. Stop betting against the doubling curve.

How's Hive doin?

Hive is making the obvious moves back down to previous all time highs. $1.50 is a critical level and might be worth buying here. I personally would not recommend this strategy though. We can see that the 99 day moving average has risen to 97 cents. That makes $1 unit-bias uncrackable at this point in time. My advice for anyone looking to buy the dip on Hive is to set a big buy order somewhere around the $1.05 range to catch any potential flash-crashes that come our way. I'll definitely go long on Hive if we crash to that level within the next week or two.

Zooming into 4-hour candlesticks we can see that a death-cross has already occurred between the MA(25) and the MA(99). Because there are six four-hour candles in a day this equates to the 4.17 day moving average vs the 16.5 day MA, respectively. Of course those timeframes might be totally meaningless but I have seen many users trade based off of these default moving averages portrayed via Binance. This timely death-cross signals to me that we could get one more major dump before the market picks back up.

Don't be surprised if we get a nice dump down to the 99 day moving average ($1): I've seen it happen time and time again.

This would be the perfect buying opportunity because there's basically no way the price is going to go lower than that with a double airdrop coming down in exactly a month (Jan 6).

Best case scenario:

PolyCUB token goes live, pushing the price of LEO up. Then Hive dips down to $1. This would allow me to trade LEO back into Hive (after buying LEO 10:1) and then engage in x5 leverage on Binance/Mandala, longing Hive from the $1 mark. In fact I have my small 1000 Hive powerdown unlocking today... gonna boost that back up to 10k so I have something to gamble with when the time comes. Never underestimate the power of a double airdrop. You gotta be preemptive with Hive trading, not reactive. 1 week is too long to wait for a powerdown when it only takes three days to spike x4.

Moon cycle

Again, the new moon just happened on December 4th, so according to the short term cycles we are still bearish for another 2 weeks or so (Dec 18). Combine this with the fact that BTC seems to be getting swatted down at the critical $50k level, and it doesn't look good in the short term. As soon as BTC breaks above $50k I'll feel much better about turning bullish. Either that or it has to crash all the way down to $40k for me to go long. At this point it looks like $40k is much more likely, but then again I'm usually wrong about these things so who knows.

Conclusion

Hive is not a bad buy in this $1.40 to $1.60 range with a double airdrop coming down the pipe. However, anyone who wants a sure thing should wait for a flash-crash back to the 99-day moving average at $1. If it doesn't come, no big deal, but if it does come it's a sure thing IMO.

If this ends up happening I will margin trade Hive hard. Using 10k Hive as collateral at $1 I could borrow 40k Hive on margin. This would give me a liquidation level at 80 cents (50k * $0.80 = $40k). I would actually prefer a liquidation level of 75 cents so I could only borrow 30k Hive on margin with 10k Hive collateral at $1. Still, if Hive spikes back up to $3 right before the airdrop I'd be able to pay off the entire loan with 10k Hive and be left with an extra 20k Hive ($60000). Gamble gamble.

It also wouldn't be a bad play to short BTC on leverage as a hedge at this level. We can use the $50k resistance line to our advantage here to mitigate most losses. If BTC goes down, great, we made money. However, if BTC goes up to $51k we can just set a stop-loss and liquidate the position for minimal losses. I think I might actually use my 1000 Hive powerdown for this when it unlocks in 20 hours.

Although it is hard to part with Hive with a double airdrop coming down the pipe in one month's time. We'll see. Again, this would be a very short term play (2 weeks or less) and we'd hope for BTC to crash down to $40k before liquidating short positions and rebuying back in.

Posted Using LeoFinance Beta

Return from Market Watch: Hive Hits $1.50 Buying Level to edicted's Web3 Blog