Can you believe how good I am at this?

Being wrong 100% of the time is no easy feat, fam. Always short the word of @edicted.

MA(100) is your new god now!

Literally the day after I write a post saying "the 100-day moving average is your new GOD" does Hive breakdown below the MA(100). Damn I'm good. Works every time. You can always tell by how much manic energy I put into these things that the market will do exactly the opposite of what I say shortly after.

Like cockwork

We find ourselves at another critical juncture.

We are at the exact point in time where we would expect the market to bounce, making a higher low, or for it to just collapse into itself like a dying star and head down to the $35k range. It won't be long now before we find out which one is fated to happen.

In terms of volume, it's doubled since yesterday, which is a good sign, but is still middling at best, because it doubled from near all time lows. Very hard to tell if this is the bounce we recover from or a massive capitulation phase.

Full moon saving grace.

The full moon was yesterday, which is nice, and signals a relatively bullish period for the next two weeks. The problem is, if the market doesn't break higher than $45k within those two weeks, we are probably done fucked come February. Again, I would like to be above $50k before the end of the month. That's the only way I won't be worried about crashing back down to the doubling curve at $30k.

February momentum.

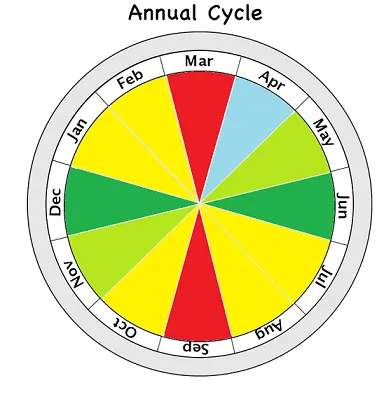

February is the most volatile unpredictable month of the year. Usually the momentum of January will bleed into Feb, so if we are trading up late January it will continue on, or if we are trading down it will also continue in that direction. However, the direction usually flips at an unpredictable time. If we are trading up in late Jan and early Feb we are due for a correction; if we are trading down during that time we're due for a massive rally.

Examples to this effect:

- 2021: Market bottomed in Jan at $30k and Feb ran up up up to $57.7k ATH untill the 21st before correcting.

- 2020: Market up until Feb 14th, COVID hit market like a ton of bricks.

- 2019: Market up until Feb 23rd, then swatted down till the real really started in April.

- 2018: Market deflated from ATH, but then massive dead cat bounce until Feb 20th.

- 2017: The entire month of Feb was bullish but then predictably crashed into the mountain during March.

- 2016: Market doesn't crash till Feb 28th.

- 2015: Again, entire month is bullish, doesn't crash till March.

We traders have a super messed up relationship with February.

It always FEELS bearish in retrospect, but if you actually look at the charts it's almost always bullish right until the end of the month. We tend to blame these negative feelings on "China" (Chinese New Year) or "taxes", but really the price is just naturally deflating from its bubbled state.

Trading scared.

I told myself a few day ago that if BNB crashed to this level I was going to buy more... but now I'm like... BUT WHAT IF IT CRASHES EVEN MORE FAM?!? These are the psychological traps we lay for ourselves, and we need to recognize them if we are going to make any kind of progress. The market has a way of separating us from our money; never forget it.

If we look back to the history of Feburary, it's been bullish every single year until at least February 20th. The only time this was not the case was the COVID crash, which doesn't really count, and the 2018 mega-bubble deflation, which also doesn't really count. We aren't in a weird position like that at the moment.

The current fear/greed index is also quite nice.

The chance that huge long positions get liquidated here is basically zero. Traders are running scared. That doesn't mean the market won't crash, but it does mean that people aren't running around doing stupid shit like leveraging debt up to their ears.

Conclusion

As far as Hive is concerned, ultimate support is still sitting around 90 cents. Hard to tell if we will touch that level in the next month or the next year. Apparently Bitcoin has already bounced up a bit since I started writing this, so that's a good sign... I guess. Or no wait it's not a good sign... The curse of always being wrong continues.

Again, I don't think we have to worry about breaking below $40k unless the next two weeks end up being a big nothing burger. $45k is the ultimate unit-bias to get past, but $50k+ puts us in the clear. At least that's what I tell myself at night.

Posted Using LeoFinance Beta

Return from Market Watch: I still got it! (+February) to edicted's Web3 Blog