We've all seen the insanity over the last few days.

The entire world is in an obvious state of instability right now. Whether this "disruption" will be good or bad in the short-term is yet to be seen, but for every reaction there is an opposite reaction.

I think it's pretty clear that the snapback whiplash reaction to all this is inevitable, but so far it's just empty threats.

SEC vows to punish ‘abusive activity’ amid GameStop, Robinhood drama

Oh, is that so, Securities Exchange Commission?

Do you "vow"?

Because the SEC is such an honorable and trustworthy organization?

Please.

Seriously, think about it.

What are they going to do?

What can they do?

This is like trying to stop file-sharing all over again. All they can do is take the top 0.01% offenders to trial. Going after everyone is downright expensive, and logistically impossible given time constraints. More likely they simply impose more draconian measures for retail investors and allow institutions more financial privacy than ever before. These hedge funds usually keep their shorts a secret for a reason.

This entire situation really shows just how fragile the system really is. The 2008 housing crisis was created on accident with overextended loans. After seeing this, the next economic crisis very well may be incited on purpose. The people are over it.

There's also a conspiracy theory going around that it was crypto whales who organized this whole thing in the first place to point out the cracks in the system and get people headed over to the new open-source economy. Not much evidence (if any) on that front so I do not subscribe (yet), and at the same time crypto is getting blamed for a lot lately. It's very clear that blockchain tech will be facing serious resistance in the years ahead.

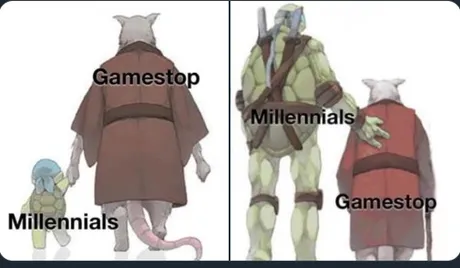

Now here's a meme I can identify with. When I was a kid Gamestop was a thriving business. I remember if I was bored at the mall I'd walk over to Gamestop just to see what was going on at the time and window shop.

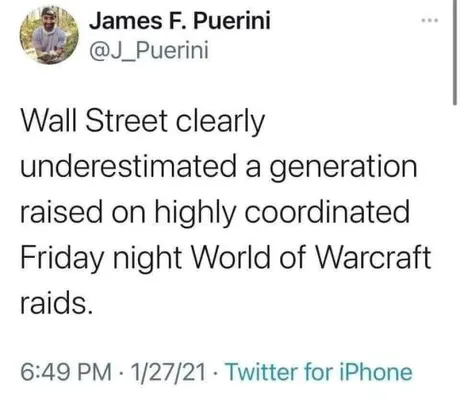

I can only imagine the ease of which to get like-minded individuals to pool resources in order to squeeze a 138% short sell on a company whose roots are embedded into the memory of an entire generation. Old habits die hard.

How Redditors Beat Hedge Funds at Their Own Game(Stop)

But the value of a company can’t be reduced to its expected future earnings. One must also consider a wide range of other factors. Among them: How much nostalgia does the firm inspire in users of the Reddit forum r/wallstreetbets? And would a rally in GameStop shares be funny? Which is to say, has the firm crossed the “so bad it’s good” threshold, as inadvertent comedic masterpieces like The Room or Troll 2 had done before it?

Reminder on short selling:

In order to short a stock, you must borrow shares of said stock at interest. You owe the stocks back at a later date, with interest, so the more time that goes by the more you owe. The guy who shorted the housing market in 2008 lost a lot of money in interest before striking gold, and he took a lot of heat for his gamble.

The important thing to note here is that shorting anything costs an overhead premium because one must borrow assets to short them.

The flagrant thing about Melvin Capital shorting Gamestop is that they "borrowed" 138% of all the stock in circulation. So not only did they borrow shares from people who weren't offering to lend them, but they borrowed shares that didn't even exist.

How were they able to do this?

https://en.wikipedia.org/wiki/GameStop_short_squeeze

On January 22, 2021, approximately 140 percent of GameStop's float (the portion of shares of a corporation that are in the hands of public investors) had been sold short, meaning some shorted shares had been re-lent and shorted again.

Yep, just like margin trading crypto. Shares were borrowed, sold, and then borrowed again. Can you imagine that? Borrowing a share like 5 times and selling it back to the person you borrowed it from just to borrow it again? Welcome to Wall Street.

Dogecoin

And let's not forget dear old Dogecoin, which is apparently the Gamestop of crypto. x10 in 24 hours? lol

Once again, my x10 Rule plays out perfectly. If an asset you hold goes x10 in a short time... you sell a good chunk, no questions asked. Funny how Dogecoin holders were able to respond to this pump much faster than Gamestop. Crypto people know the deal. Volatility is our game.

Bitcoin

As far as Bitcoin is concerned I'm still overall bearish on Q1, but in the very short term we look pretty bullish still. We've tested $30k support four times now and have really good volume. All the on-chain metrics and analysis look good.

However, on-chain analysis and whatever else mean nothing in the face of crippling regulations and increased taxes. Add to that new deadlier strains of COVID and a fresh round of lockdowns and anything could happen. I'm almost betting on some kind of Black Swan event to occur in Q1 at this point.

I've made reference to the Greatest Depression a few times, but there are some variables we need to realize. The Great Depression only happened because we were still on the gold standard. Banks couldn't print money out of thin air because there was no gold to peg it to. Now, everything has changed. Nothing is going to make sense in the face of infinite QE and negative interest rates.

Remember this 2019 fractal?

That was five days ago... so where are we now?

If we keep following the pattern we've got one spike up to around $40k before Q1 crashes into the mountain.

Conclusion

Damned if you do, damned if you don't.

The future has never been more uncertain.

However, one thing is absolutely clear.

Centralized power is being disrupted, and for good reason.

Corruption is a threat to humanity as a whole.

All we can do is stay the course and ride these waves out.

HODL on to the crypto life-boat for dear life!

Posted Using LeoFinance Beta

Return from Market Watch: Insanity. to edicted's Web3 Blog