Bank of England Says CBDC Could Launch by 2030

Hahahahahahahahaha... What?

Full stop! By the time 2030 rolls around crypto will have gobbled up the entire world economy within a Quadrillion Dollar market cap. LoL... 2030. You can't make this stuff up. The world in ten years isn't going to make sense for a CBDC to even exist.

This is a prime example of open source tech being able to code circles around regulators, governments, banks, and all the other red-tape of the legacy economy. The breakaway tipping-point is coming soon, and it's going to hit like a ton of bricks.

Fed Issues Market Red Alert: Warns Stocks Vulnerable To "Significant Declines"

The Federal Reserve told everyone yesterday that the economy is on the verge of imminent collapse... and then what happened? Bitcoin was trading at all time highs within hours. Is this because Bitcoin is a hedge against the economy collapsing, or because when inside traders tell you to dump we should definitely buy more?

Probably the latter.

Bitcoin is strongly tied to the legacy economy on the short term. When the legacy economy crashes, Bitcoin crashes. It is only on the macro scale that Bitcoin is able to suck liquidity from the larger system at an alarming rate of x2 per year in order to maintain the double curve. This curve creates exponential x1000 gains every ten years. 2030 will be insanely dominated by crypto and the "metaverse".

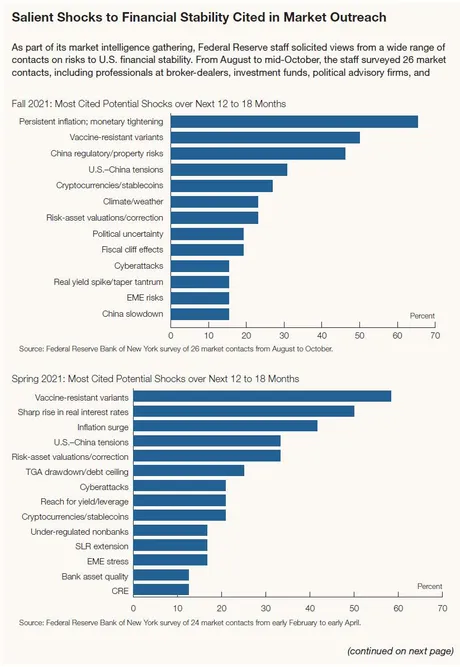

Look at this survey conducted by the New York FED...

In spring cryptocurrency was labeled as the #9 threat to the economy, and six months later we've ranked up to #5. Moving on up in the world. The chance that a big financial collapse is blamed on crypto instead of rampant corruption is very high going forward. Probably not the next one but the one after that for sure.

Who should we blame?

The powers that be certainly aren't going to blame themselves for the situation we find ourselves in. We can see that COVID is the #1 scapegoat (as predicted in March 2020).

The second rule of fight club...

Other targets of the blame-game are inflation / increased interest rates, China, China again, cyberattacks, and global climate change. Look at this assessment very carefully. They are essentially blaming China five times and cryptocurrency multiple times as well.

First China get's blamed for their real estate debacle, and "China slowdown", then they get blamed again for the toxic relationship between our two nations (which is obviously more than half our fault), then they will certainly be blamed again for cyber attacks should those pop up (evidence doesn't matter). "Political uncertainty" is also heavily tilted toward China within this context.

Guess what the Chinese government does when something goes wrong. Wanna guess who they blame? Gee, could it be the United States? Except when countries blame the Unites States for stuff it usually actually is our fault because we are in charge, control the world's reserve currency, and are sticking our noses into every other country's affairs if there's a profit to be made.

Crypto doe

Cryptocurrency also gets cited as a risk multiple times. First directly with the "crypto/stablecoin" category, then indirectly with tags like "risk-asset valuations", and EME risks. Emergent Market Economy? How much you wanna bet El Salvador gets blamed for some shit for legally adopting Bitcoin?

DEFLECT DEFLECT DEFLECT

It's pretty funny how the most powerful institution in the entire world is just constantly acting like they are a powerless child on a playground full of bullies. Laughable. But honestly looking at the dinosauric tools that the FED has at their disposal perhaps there really is nothing they can do at this point. The entire system is too far gone, and even though they are a big part of it nothing they do can turn this around. There aren't really a lot of options at this point aside from implementing UBI and just giving people money for existing. Luckily they will force everyone to be vaccinated to receive this UBI so that we're all safe and sound as we stand in the breadline.

Blaming crypto for financial collapse will be the ultimate slap in the face, and it's pretty much guaranteed to happen sooner or later. Ironic, as the only reason Bitcoin was allowed to take root stems from how broken the current system is. At the core, blockchain is nothing but a worthlessly inefficient database if centralized authority could be trusted to not abuse their power. They've already stopped trying to push the "blockchain not Bitcoin" angle, because blockchain without an underlying decentralized currency is totally worthless.

The only reason crypto exists is because centralized authority has proven countless times that they can not be trusted with their positions of power. And now those same powerful people will go on to blame China and cryptocurrency for their own abysmal failures.

This is par for the course in the world of politics.

- NEVER TAKE RESPONSIBILITY.

- NEVER ADMIT FAULT.

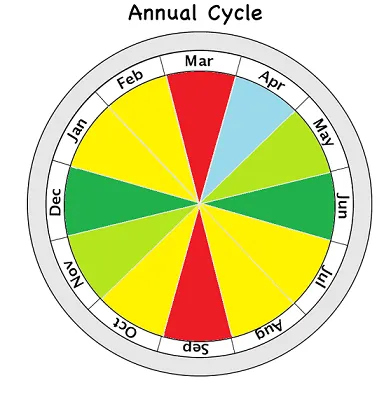

Market cycles.

As predicted, after the two week consolidation at $60k the market is ready to move back up again something fierce. Even Litecoin is catching a bid, spiking up 30% in the last week. My birthday is coming up and it's going to be a wild one!

November 14th

$16k... which could easily be signaling the times of change are upon us. I guess we'll find out soon. Personally I think the price of Bitcoin next November is going to be somewhere around $70k-$160k (10x the numbers we see today).

Wow, what a badass price prediction I gave last year, amirite?

Crazy shit always happens around my birthday in the crypto markets. I'm convinced this is due to being such a special snowflake. In 2017 the market was obviously insane. In 2018 November 14th was the exact time that Bitcoin started tanking 50% from $6k to $3k. 2019 was also mildly disappointing. But then 2020 rolled around and blew everyone out of the water. I even won a few bets that year on BTC spiking above all time highs, and I will win my bets this year when BTC spikes above $100k.

I guess that's just the nature of these four year cycles.

We get one amazing year followed by one terrible year, then a dud, then a rip upwards... now we are back to the amazing year. Get ready for it.

When it really comes down to it November has never been a bad month within the context of a bull market, and this is clearly a bull market; trading literally at all time highs as we speak. Get ready for fireworks.

Conclusion

When the FED tells you to dump all your assets, what do you do? Buy more, DUH! Literally these fuckers have been caught insider trading countless times, and they are now implying that we should dump our bags. Don't trust these toolbags: buy Bitcoin.

The market does not crash when institutions tell you it's going to crash. It crashes when no one is expecting it and everyone is riding high on infinite FOMO. Think back to 2017 if you were around during that time. It was absolutely insane. Indescribable. You can look at it on a chart but you could never capture the actual spirit and complete manic insanity of that run. Coming to a 2021 near you.

When it really comes down to it, the market can not be dumped until it gets pumped. That's how it works. That's how these manipulators make maximum profits: by convincing you to sell the bottom and buy the top of a controlled demolition. Talk to me again when a dozen more ETFs get approved and you FOMO into Shiba Inu x10 from here.

All this being said, Bitcoin is still x2.8 higher than the doubling curve right now. It's a great time to take gains if you think this is just a regular bubble and not a mega-bubble. Personally I've been waiting for Q4 2021 for four years, so I refuse to cash out anything until the end of the year. But that's just me... I can definitely afford to be wrong on this one. Can you?

Posted Using LeoFinance Beta

Return from Market Watch: Insider Incompetence. to edicted's Web3 Blog